Note to readers: Healing Space is a weekly series that helps you dive into your mental health and take charge of your wellbeing through practical DIY self-care methods.

Do you find it difficult to talk about money? Not just to your boss to ask for a raise, but to your partner, friends, colleagues? If you run a business, do you hesitate to levy your real rate or raise your consulting fee and end up charging clients a lower rate or handing out a disproportionate amount of discounts? The reluctance to address money in your closest relationships could be an indicator of how you value yourself and your relationships.

For instance, if a parent constantly rewarded you with money or an expensive gift instead of showing affection, as an adult you might think that a gift is sufficient as a token of affection instead of actually expressing affection directly. This could actually annoy a partner who does not equate affection and money in the same way. The conversations about money especially between friends and family are important to have in order to eliminate such misunderstandings. “Do you want to hang out?” can mean “do you want to go to a club and spend money on food and drinks” for a college or workplace group, while for you it might mean do you want to just meet at someone’s house, order some food in, and talk. If you haven’t understood what the terms mean to each other monetarily, you might have a problem.

For instance, if a parent constantly rewarded you with money or an expensive gift instead of showing affection, as an adult you might think that a gift is sufficient as a token of affection instead of actually expressing affection directly. This could actually annoy a partner who does not equate affection and money in the same way. The conversations about money especially between friends and family are important to have in order to eliminate such misunderstandings. “Do you want to hang out?” can mean “do you want to go to a club and spend money on food and drinks” for a college or workplace group, while for you it might mean do you want to just meet at someone’s house, order some food in, and talk. If you haven’t understood what the terms mean to each other monetarily, you might have a problem.

Why do we find it so hard to have conversations about money? Precisely because we use them as measures of self worth. If someone earns more or saves more or lives better than we do, we use it to say they are more successful, more valuable, worked harder, or are otherwise endowed with virtues that money imparts them. These become the unspoken gaps between us – if a wife earns more than a husband, the conversation becomes harder because the husband is living with the societal expectation that he should have been earning more and is therefore somehow inferior. If a son doesn’t give his salary to his parents, husband to wife, he lives with the burden of being ungrateful. We tie up virtue with money.

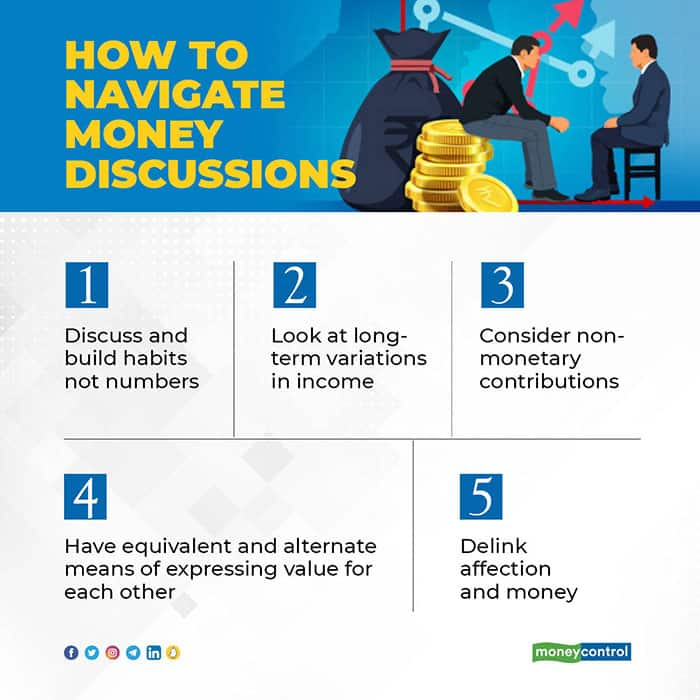

If you’re having these money conversations for the first time, one way to get around the awkwardness that they pose is to shift the focus from the quantum of money to the habits around money. Things become awkward when you say ‘I’m contributing Rs X’. People get pretty sensitive when you put numbers to a gift or a contribution. Instead, focus on the emotions behind the gift, pick sentimental value over monetary value. Discuss saving and spending habits. In most relationships over time, the amount one person earns in comparison to another will fluctuate. A parent might be earning a lot but retire just as the child begins to earn much more than he ever did. The husband might earn more now but the wife might earn more in her next job. The trick in long-term relationships is to not look at the details of the numbers, but the habits you are building as a team, couple, family or group.

If you’re having these money conversations for the first time, one way to get around the awkwardness that they pose is to shift the focus from the quantum of money to the habits around money. Things become awkward when you say ‘I’m contributing Rs X’. People get pretty sensitive when you put numbers to a gift or a contribution. Instead, focus on the emotions behind the gift, pick sentimental value over monetary value. Discuss saving and spending habits. In most relationships over time, the amount one person earns in comparison to another will fluctuate. A parent might be earning a lot but retire just as the child begins to earn much more than he ever did. The husband might earn more now but the wife might earn more in her next job. The trick in long-term relationships is to not look at the details of the numbers, but the habits you are building as a team, couple, family or group.

It’s a good idea to set the baseline for your lifestyle to what the person who earns less is comfortable with. Among friends, if you have a principle of dividing the bill equally, you might want to allow the person whom you know earns the least to pick the restaurant according to their comfort level, do a rotation, so each knows in advance when their turn is coming up, else go with each paying for what they order. If you’re dating, let the person who is still in college or in their first job, pick the dates. Perhaps treats can come out of a different contribution pool, in which you each put a set amount whenever you are able to for special occasions.

In relationships of any kind, managing the money is less about numbers and more about the respect and dignity you accord each other. Never use earnings to make a point in an argument. Keep disagreements about money, paying bills and discussing long term spending or investments as different conversations. Delink affection and money. Find equivalent ways to express the value you feel for each other.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.