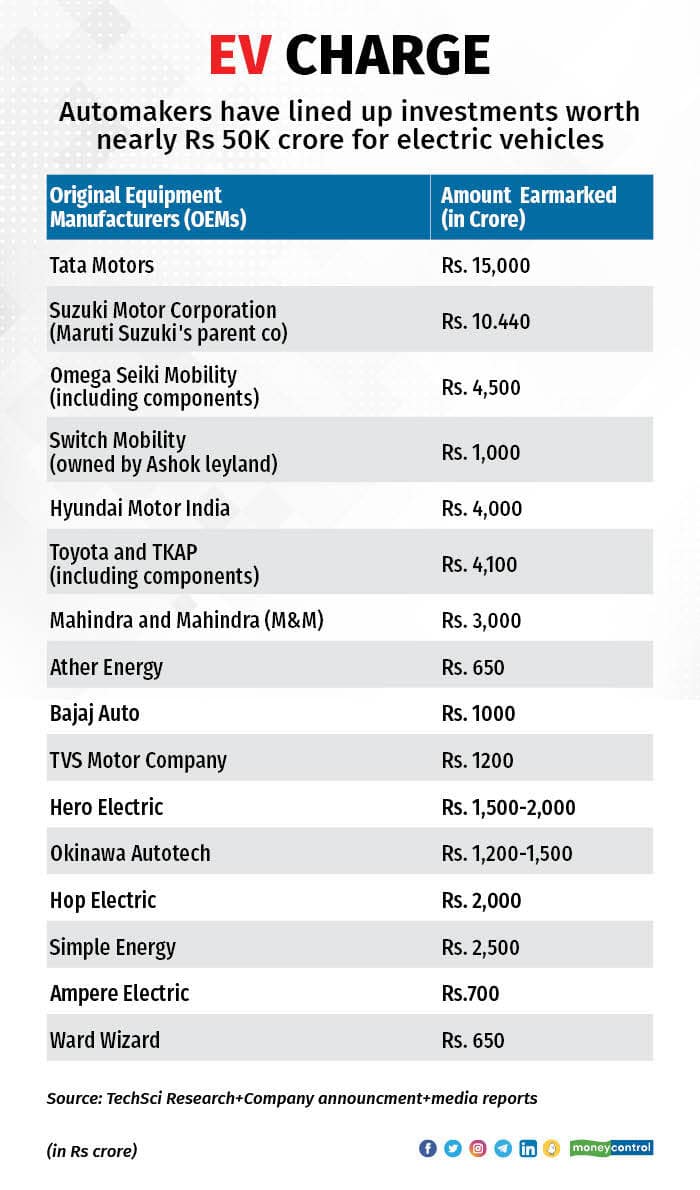

As Indian auto makers line up $5 billion of investment for manufacturing electric vehicles (EVs), auto component producers are seeking to march in step by boosting capital expenditure.

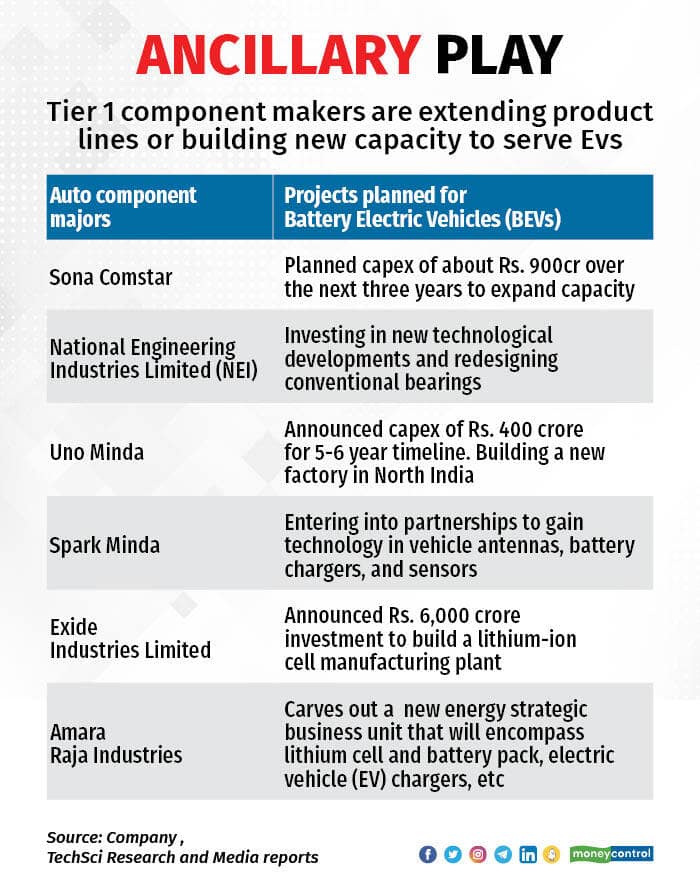

Auto parts makers such as Minda Corporation, NEI Industries, Sona Comstar, Anand Group, Lucas TVS, Rane, JBM Auto, Brakes India, Sansera, JK Fenner, and Lumax have announced plans to expand capacity and create new skill-sets to tap demand for EV parts.

ICRA's sample study of 49 large auto ancillary companies concluded that the auto component industry is expected to devote around Rs 16,700 crore in FY2023 for capital expenditure and around Rs 20,800 crore in FY2024.

Within that space, EV projects are tipped to be around 25-30 percent of total investment, said the research company.

“We expect the capex investments by larger ancillaries to be at about 6-6.2 percent of operating income in FY2023. The recently announced PLI scheme will also contribute to accelerating capex over the medium-term besides investments by new entrants in the EV segment,” said Vinutaa S., vice president & sector head-corporate ratings, at ICRA Limited.

PLI is short for a Production-Linked Incentive scheme announced by the government to boost local manufacturing.

Under the PLI scheme for auto components, 75 companies are planning to invest Rs 29,834 crore over the next five years.

Component makers charged up

Auto component makers Moneycontrol spoke to said they were looking at everything from locally built motors and controllers to battery management systems, chargers and charging systems and remote diagnostics.

Sona Comstar, which makes motor control units, among other things, said it had identified electrification as an irreversible trend as early as 2016. The company has planned capital investments of about Rs 900 crore over the next three years to expand capacity. It has an order book of Rs 18,600 crore of which 62 percent is from EV programmes.

“We are winning new EV orders now at an accelerated pace with the total count of orders doubling in the last one year from 15 to 30 programs,” said Rohit Nanda, group chief financial officer at Sona Comstar.

Uno Minda Group is spending Rs 400 crore over the next 5-6 years and will also be setting up a new plant in north India specifically for manufacturing EV-specific products.

Other such as National Engineering Industries, a bearings maker, are investing in new technology and gearing up to add separate production lines for EVs in existing and new factories.

Electronic components

Auto component makers are not only counting on increasing EV demand, but also a surge in need for electronic components in existing internal combustion engine (ICE) vehicles.

“Higher EV penetration will prove to be an opportunity for us. More the demand in the EV segment, more impetus will be laid on electronic contents owing to premiumization, like enhanced use of smart keys, digital clusters and high voltage wiring harness,” said Nikhil Kulkarni, CEO and business unit head, Spark Minda Green Mobility Pvt. Ltd, a subsidiary of Minda Corporation

Grant Thornton predicts that with gradual upskilling and latest technology adoption, domestic component manufacturers are expected to be on par with international standards and export EV components.

“It is expected that the electric two-wheeler vehicle firms and ancillary units are set to raise $1.5-2 billion from PE (private equity) firms considering that most of the electric two-wheeler companies are looking at enhancing production capacities and expanding their distribution network over the next few years,” said Saket Mehra, partner and auto sector leader, Grant Thornton Bharat.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.