One important thing: The much-awaited amendment to Information Technology Rules 2021 has been notified this evening. Now, the Indian government will appoint grievance committees to hear users’ appeals against content moderation decisions taken by social media intermediaries like Meta, Twitter and others

Ironically, it is being brought out on a day when the world's richest man, Elon Musk, has acquired Twitter in a bid to free up the ‘digital town square’.

In today’s newsletter:

- Musk’s freed bird

- Nervous November for new-age stocks

- Apple shines, Amazon sinks

Top 3 stories

Top 3 stories

Musk’s freed bird

Billionaire memelord Elon Musk finally owns Twitter. Considering the various twists and turns this chaotic saga has seen, usually reserved for thriller movies, we never thought we would see this day but here we are (thanks to a deadline from the US court)!

Driving the news

Elon Musk has completed the $44 billion buyout of Twitter to take the company private, six months after his initial offer.

- The closing of the deal caps the months-long drama which saw legal challenges, public spats, disparaging memes and an almost courtroom trial.

Clean slate

Following the completion of the deal, several top executives at Twitter, including CEO Parag Agrawal, CFO Ned Segal, policy head Vijaya Gadde, and general counsel Sean Edgett, were fired.

These executives are entitled to severance pay of a total $204 million, since they are covered by a "golden parachute" clause, with Gadde walking away with $74 million, and Agrawal and Segal not far behind at roughly $65 million and $66 million, respectively, according to Marketwatch.

India reaction

The Indian government's initial reaction to this deal has been lukewarm. Rajeev Chandrasekhar, the minister of state for electronics and information technology, said he expects Twitter to comply with the country's local rules.

"Our rules and laws for Intermediaries remain the same regardless of who owns the platforms. So, the expectation of compliance with Indian laws and rules remains" he said.

What's next?

Musk must now figure out how to turn around Twitter by revving up its revenues while walking the tricky path of content moderation and hate speech, which are not necessarily engineering problems.

Now let that sink in!

More reading:

Nervous November for new-age stocks

Shareholders of Nykaa, Paytm, Policybazaar, and Delhivery have reason to be worried, and it's not just that these stocks have dropped by an average of 19% in the last month.

With 159.67 crore shares of these four companies due for lock-in expiry in November, analysts are of the view that retail investors should exercise caution while trading in these stocks.

Why it matters

According to a Moneycontrol estimate, the new-age shares for which lock-in would expire in November are cumulatively worth over Rs 87,000 crore at current prices, while the combined size of their public issues was around Rs 34,600 crore.

- Although PE/VC shareholders may look to exit a part of their holdings in the four stocks, they are expected to largely stay put for the time being

- When the Zomato lock-in expired in the last week of July, it triggered a sell-off, and the stock tanked 41 percent within a week

In the hot seat

Several experts believe that these new-age stocks will continue to suffer as they struggle to show profits. As such, pre-IPO shareholders would be looking for a way out as soon as possible

- SoftBank has the biggest skin in the game as it owns more than 10 percent of Policybazaar, 17.5 percent of Paytm and 18.5 percent of Delhivery

- Next on the watch-list is Tiger Global, which holds a 7.1 percent stake in Policybazaar and 5.2 percent stake in Delhivery.

- Similarly, Tencent (8.4 percent stake in Policybazaar), Ant Financial (25 percent stake in Paytm) and Nexus (9.1 percent stake in Delhivery) will also be closely followed.

Apple shines, Amazon sinks

Apple is in a league of its own. It seems to be the only tech giant that is weathering the economic downturn in an otherwise bruising earnings season for tech companies. The company said it has set a new revenue record across nearly all geographies this quarter.

India shining

Apple CEO Tim Cook said they saw a strong double-digit revenue growth in India for the September-ended quarter.

- India set a new all-time revenue record in terms of iPhone sales during the quarter, CFO Luca Maestri said.

$4 billion milestone

Apple executives didn't disclose any further details but the company's local filings indicate that the iPhone maker crossed the $4 billion annual revenue mark for the first time in FY22. Net profit rose 3 percent to $150 million.

- Apple is currently among the leading players in India's premium smartphone market (above Rs 30,000) and the top-selling brand in the ultra-premium class (above Rs 45,000), according to market research firm Counterpoint Research.

Making iPhone 14 in India

Last month, Apple stated that it has started manufacturing the iPhone 14 in India, a move that could provide a huge boost to the country's ambitions to become a global manufacturing hub. This came just weeks after the device was launched on September 7.

The move is part of the Cupertino-based tech giant’s strategy to diversify its manufacturing capabilities beyond China amid rising geopolitical tensions between the two countries.

- According to a recent JPMorgan report, Apple may move 5 percent of its global iPhone 14 production to India by late 2022 and later expand its capacity to make one out of every four iPhones in India by 2025.

Amazon’s cost control

Meanwhile, Amazon is pausing hiring in certain businesses amid moderating sales and recessionary fears, besides the challenge of increased foreign currency headwinds.

- The company would continue to fund earlier-stage businesses like its lucrative cloud-computing and advertising divisions, it would question costs elsewhere and proceed carefully on hiring, CFO Brian Olsavsky said.

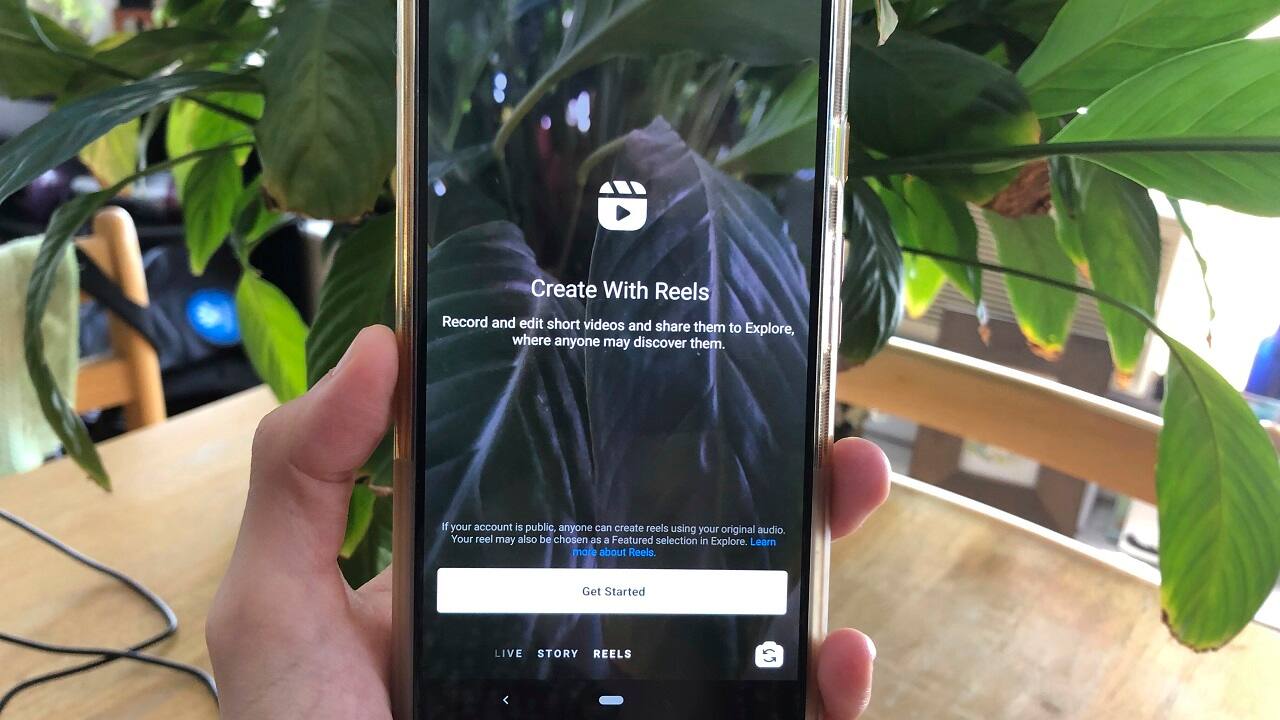

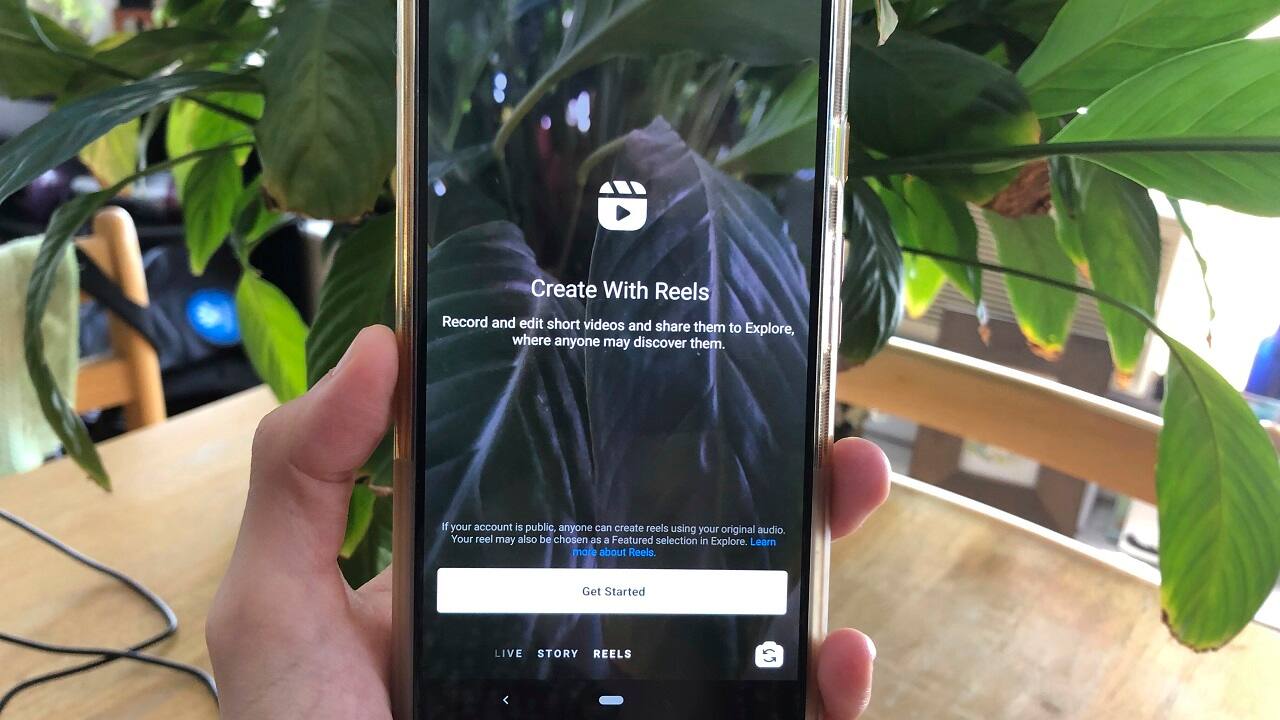

MC Special: Instagram 'Reels' out small product sellers

Do you also find it hard to find cool and trendy products on Instagram? Well, you're not alone.

Over the last year, things have started to change. While it is challenging for buyers to find things, sellers are also unable to expand their reach.

Wonder why? Now, products get lost in the huge maze of Instagram's most popular "Reels," which takes precedence on the feed.

What’s happening

Well-funded brands spend Rs 30-40 lakhs per month on marketing, however, small businesses cannot afford such expenditures.

"Taking videos then editing them out, posting them with trending music and proper lighting easily takes a few hours. And if I do not post these videos, my products will not show on the feed so I will miss out on being visible in the customers’ feeds," said Guwahati-based seller Barsha Sharma.

Many sellers say it's hard for them to keep up with trends or that they aren't getting as much traction as they used to.

What now

As a way to expand their business, sellers are now looking at alternative platforms including offline exhibitions and their own websites.

FYI: Reels has hit a $3 billion annual revenue run rate across Instagram and Facebook.

Go deeper