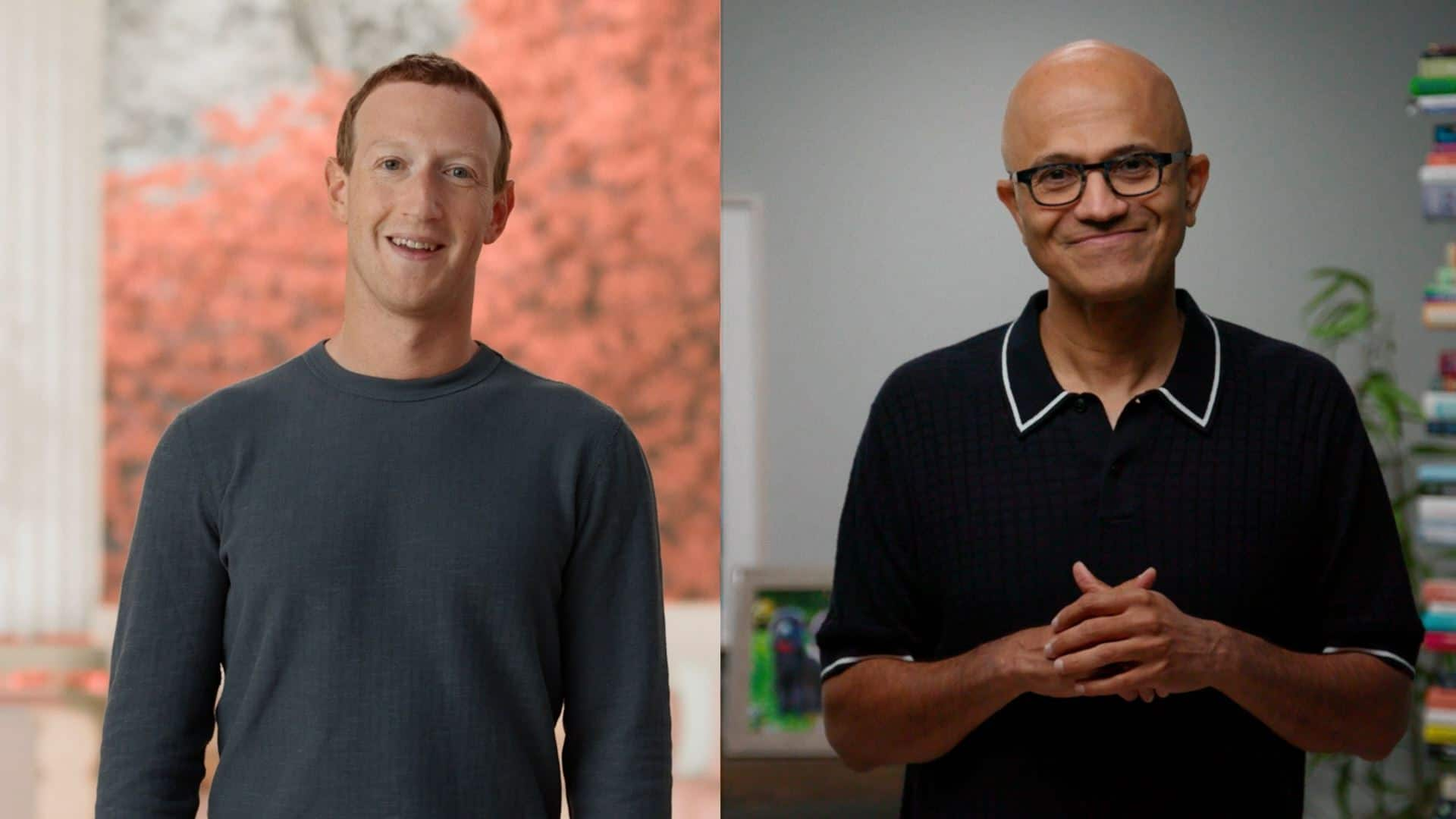

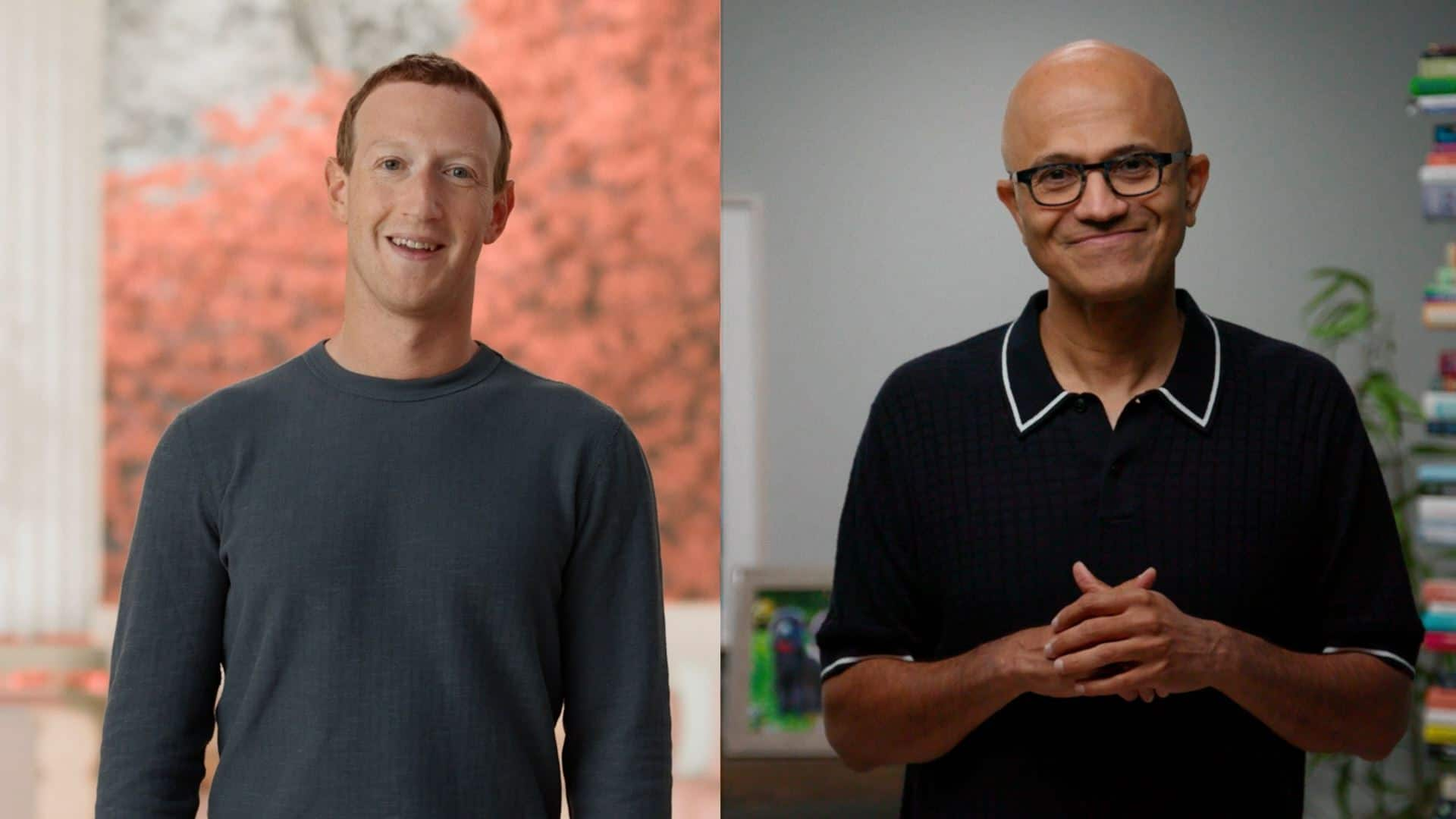

One quick thing: Meta has found a powerful ally as the tech giant tries to make its ambitious vision for the metaverse a reality.

Meta also debuted its first high-end VR headset and bought three game studios, Camouflaj, Twisted Pixel, and Armature Studio, to help its Oculus Studio unit.

In today's newsletter:

- Massive job cuts at Byju’s

- Wipro, HCLTech Q2 report card

- Fireside ammo for Indian startups

Top 3 stories

Top 3 stories

Massive job cuts at Byju’s

Just when we thought layoffs were becoming a thing of the past, the world's most valued edtech startup has announced more job cuts and a massive reorganisation.

Driving the news

Byju's is laying off 2,500 employees as it looks to cut costs amid mounting losses and a global funding crunch. This represents about 5% of the company's 50,000-strong workforce. We first reported this development in July.

- Byju's said it will rationalise jobs across product, content, media and technology teams "in a phased manner"

Impact on business

Byju's K-10 business which includes Toppr, Meritnation, TutorVista, Scholar, and HashLearn will be consolidated as one business unit.

- Aakash and Greater Learning, however, will continue to function as separate organisations.

Edtech sector woes

Meanwhile, Byju’s underwhelming FY21 results that were released last month have made investors re-evaluate growth potential for consumer-facing edtech companies in India.

Byju’s revenue dropped during the year, albeit marginally, but at a time when almost every internet company grew manifold thanks to stay-at-home Covid-19 restrictions.

As a result, investors are turning to startups, questioning their growth projections, despite the fact that these companies have raised millions of dollars at exorbitant valuations in the last two years, projecting strong growth.

Thus, it may be difficult for startups to raise capital in the current environment at higher or comparable valuations.

Why it matters?

Education is a very sensitive sector, especially in a young country like India, and the fight for survival for edtechs will have an impact on innovation.

Thus, the 'tech' in edtech may not see further innovation.

Investors believe that as the pandemic subsides, edtech startups will be forced to improve their quality or tech capabilities in order to retain students.

But if startups can't raise money, it will be hard for them to invest heavily in growth and innovation, which means they might not be able to grow. It's a vicious circle!

How did Wipro, HCLTech fare in Q2

CEO speak

Chief executive Thierry Delaporte said there has been no slowdown in demand so far, but there is uncertainty due to macroeconomic concerns. He stated that the projection of bookings for the coming quarter is strong, but it is too early to tell if there is a decision-making lag.

Report card

On moonlighting

Wipro reaffirmed its stance on moonlighting, which has been a hot topic since Chairman Rishad Premji's comments and the company's termination of 300 employees. However, Delaporte emphasises that the main issue is a conflict of interest, not anyone taking on any side gig.

HCLTech, which also reported its earnings today, made it clear that it does not approve of employees moonlighting. The company expects employees to honour exclusivity and non-compete clauses in contracts.

HCL’s profits rise

The consolidated net profit of India's third-largest IT services firm increased 7.05 percent to Rs 3,489 crore for the quarter from Rs 3,259 crore in the same quarter last year.

- Operational revenue was Rs 24,686 crore, up 19.5 percent from Rs 20,655 crore the previous year.

- Operating margin increased significantly to 18 percent, exceeding analyst expectations of 17.5 percent.

Deal wins

In Q2FY23, the firm won new deals with a total contract value (TCV) of $2.38 billion. The company won 11 large deals, eight of which were for services and three for products.

The IT services major added 8,359 employees during the quarter, taking the total headcount to 219,325. The attrition rate remained flat sequentially at 23.8 percent on the last twelve months (LTM) basis. HCLTech also added its highest-ever number of freshers historically in Q2 coming in at 10,339.

Fireside ammo for Indian startups

Fireside Ventures, a venture capital firm focused on direct-to-consumer brands, has raised $225 million in its largest-ever India-focused fund, joining the ranks of Sequoia Capital, Accel, and others.

What’s the plan?

- The Fireside Fund III will be deployed into new companies and the firm plans to invest in 25-30 startups over the next three years.

- So far, the firm has closed three funds, with the VC managing assets totalling $395 million (Rs 3,000 crore).

- The revenue of its portfolio companies from its first fund was up 21 times, while its second-fund portfolio companies were up by 4-5 times.

The VC firm intends to double down in the D2C (direct-to-customer) space, looking into areas such as wellness and other niche areas where such brands can excel.

By the numbers

Data shows that 12 India-focused PE/VC firms raised more than $6.5 billion in limited partners in 2022. However, while these investors made more bets in the 2021-22 period, the cheque sizes seem to have gotten smaller.

MC Investigation: Celebrity traders are the latest target of scammers

Scamsters are creating fraudulent or catfishing accounts in the name of celebrity traders to steal money and securities from demat accounts.

- What’s staggering is the effort that is going into creating these accounts, tracking the most vulnerable targets and mimicking the celebrity trader’s real account.

These incidents have an impact on both the people who lose their money and assets and the celebrity traders who are constantly defending themselves against unfair charges.

Do read our special story