It’s Byju’s results day! This is probably one of the most discussed topics in the Indian startup ecosystem in recent months.

- Join us at 9pm as we try to decode the edtech giant’s financial performance for FY21 and what the future holds. Tune in (Also, available on-demand later!)

In today's newsletter:

- Byju's discloses its FY21 revenues

- Twitter-Elon Musk saga continues

- Lift-off for India’s space sector?

Top 3 Stories

Top 3 Stories

Much to everyone’s surprise, Byju’s revenue in FY21

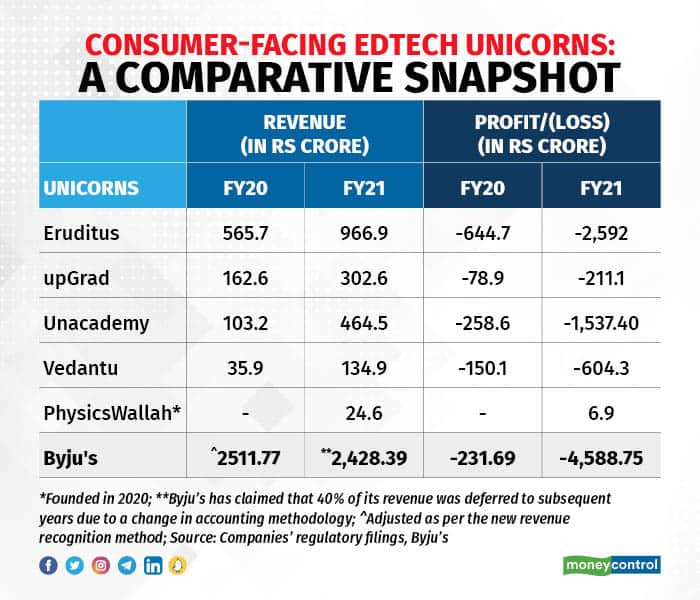

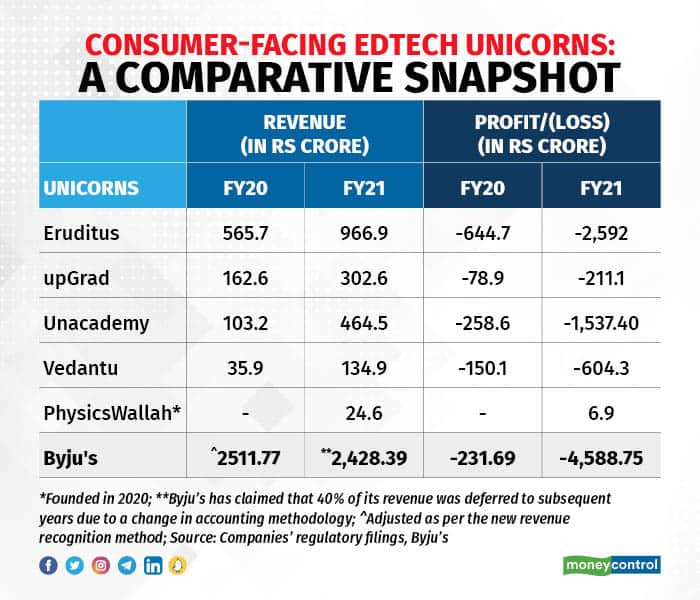

The cat is out of the bag! The FY21 (2020-21) results of the edtech giant Byju’s are finally out after a year-long delay and to everyone’s surprise, it posted a marginal decline in its revenue in FY21, a year that saw the internet sector booming, thanks to Covid-led restrictions.

- This is particularly strange since almost all consumer-facing edtech companies (including the now-bankrupt company like Lido Learning) saw their revenues swelling manifold in FY21, the first year of the Covid-19 pandemic.

Deloitte, Byju's auditor, claims that the company has adjusted its FY21 revenue after months of scrutiny. According to Byju's, nearly 40% of revenue was deferred to subsequent years due to a change in accounting practises.

Going by the numbers

- Byju’s reported a consolidated revenue of Rs 2,428 crore for FY21, down marginally from Rs 2,511 crore in FY20 (2019-20)

- Byju's reported a Rs 4,589 crore loss in FY21, nearly 20 times the adjusted loss of Rs 231.69 crore loss in FY20 (2019-20).

- During the year, Byju’s spent Rs 2,250 crore on advertising and marketing, a 2.5X jump from its promotional expenses in FY20

- The company’s total expenses jumped almost two times to a little over Rs 7,000 crore from just under Rs 2,900 crore in FY20

What does Byju say?

In a 35-minute candid chat with us, Byju Raveendran, Byju’s Founder and CEO, talked about how the last six months were difficult for him and his company, and the way ahead for Byju’s.

Here are some key takeaways from the interview:

- "I'm an eternal optimist and it's been a very good learning experience. It can't be tougher than this. And if this can't break us, I can tell you nothing else will."

- "There has never been a fraud. Even public companies don't go through this level of scrutiny."

- "Now, the $300 million from Sumeru and Oxshott is not coming, but that is not our mistake. But who cares about $300 million? I can raise $300 million in a week"

- "We have not decided when to file FY22 yet. Investors and lenders don't care. Not a single investor has sold their shares in the last six months"

Why are Byju’s results important?

Byju’s is India’s most-valued startup and the world’s most-valued edtech startup. The company has raised billions from investors over the years and sky-high valuations, projecting big revenue numbers.

- A drop in Byju’s revenue, albeit marginally, will raise eyebrows on growth projections of a number of startups in the country.

India currently houses close to 70,000 startups and is the third-largest startup ecosystem in the world. The scrutiny around Byju’s valuation and accounting practices will only dent the prospects of high-growth companies in India.

Read our full interview

What’s next in the Elon Musk-Twitter saga?

Has there been a stranger deal than Elon Musk's proposed $44 billion buyout? The mercurial billionaire initially expressed interest and even contemplated a hostile takeover but then got cold feet and terminated the deal (thrice!). Meanwhile, Twitter wasn't interested in the beginning but is now keen on enforcing the deal through a lawsuit.

What happened now?

Twitter said that about 98.6% of Twitter shareholders voted in favour of the acquisition deal yesterday, based on a preliminary tabulation of the stockholder vote. Musk, Twitter's largest individual shareholder, didn't vote at all, according to Bloomberg.

- Shareholder approval was the final condition required to close the deal, although as things stand today, its consummation is far from over.

What next?

This approval now sets the stage for the October 17 trial in the Delaware Court of Chancery, which will decide the fate of this buyout.

- Twitter has sued Musk for terminating the agreement, while the Tesla chief executive countersued, accusing Twitter of misrepresenting the number of false and spam accounts on its service.

Whistleblower hearing

Following the recent revelations by Twitter's former security chief turned whistleblower Peiter Zatko, Musk had sought to delay the trial last week, but was denied. Although he can include Zatko's claims in his case.

Yesterday, Zatko also told the US Congress at a hearing that the social media platform is plagued by weak cyber defences that make it vulnerable to exploitation by “teenagers, thieves and spies” and put the privacy of its users at risk.

"Twitter's security failures threaten national security, compromise the privacy and security of users, and at times threaten the very continued existence of the Company...Twitter leadership has refused to make the tough but necessary changes to create a secure platform. Instead, Twitter leadership has repeatedly covered up its security failures by duping regulators and lying to users and investors" he said in a prepared testimony.

Twitter has previously termed Zatko's complaint as a "false narrative" about the company and its privacy and data security practices that is "riddled with inconsistencies and inaccuracies and lacks important context".

Also read: Elon Musk and Twitter fight over India's importance and standoff with govt

Lift-off for India’s space sector?

What happened?

As a result, the industry is pitching for 74 percent foreign direct investment (FDI) for the space sector, with the government currently formulating a policy in this regard, sources told us.

- At a recent meeting of space industry stakeholders with the Department of Space, officials were informed that a 74 percent FDI cap, similar to the cap for the defence sector, would help the nascent private space industry.

Current status

Currently, only the establishment and operation of satellites are considered to be a part of the space sector under the present FDI regulations.

- According to a legal expert, the government route allows 100 percent FDI for the space sector, with government clearance needed for any private sector engagement.

- To help the sector, earlier this year, Minister of State for Science and Technology Jitendra Singh announced that the government planned to allow FDI in the space sector.

MC Interview

Kotak Mahindra Bank recently appointed Milind Nagnur as its first-ever Chief Technology Officer at a time when Indian banks are facing growing consumer backlash, coupled with increased regulatory scrutiny when it comes to their digital offerings.

In many ways, Nagnur stands apart from his peers. For one, his last stint was at Early Warning, a US-based fintech company that was owned by seven banks. In over 20 years, Nagnur has held leadership roles in Citi, Wells Fargo and JPMorgan and combines the expertise of traditional large banks with the technology-first approach of fintechs.

In his maiden interview since taking over, Nagnur speaks of an important shift – that of viewing the bank as a software engineering-focused organisation.

Read the full interview