As per ancient Greek mythology, a phoenix is a long-lived bird that cyclically regenerates or is otherwise born again, and in terms of the stock market there are several stocks with historical precedents, that have corrected very sharply during times of panics but have, thereafter, rebounded very strongly once things improve or mend, Dharmesh Shah, Head – Technical, ICICI direct said in a podcast ‘D-Street Talk’ with Moneycontrol.

“We believe that there are several such phoenixes (stocks that have corrected significantly from their life-time highs and are out of favour) available at huge bargains relative to their business fundamentals,” he said.

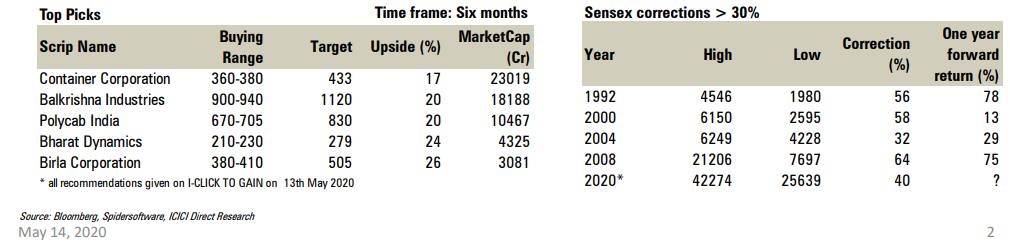

ICICIdirect’s study of three major bear markets (classic empirical evidence) of 1992, 2000, 2008 has produced interesting revelations. Stocks that are likely to bounce back include names like Container Corp, Balkrishna Industries, Polycab India, Bharat Dynamics, and Birla Corporations.

Buying good companies (credible business history over business cycles, a reasonable business model with decent management pedigree, robust balance sheet and inexpensive valuations on a historical basis) post significant (minimum 50%) correction from their all-time highs and holding them for a period of one year generates super normal returns of at least 60 percent for such stocks.

Though the near-term outlook may be hazy for such companies, the risk-reward turns extremely favourable for investors as the market has already priced in extreme pessimistic scenarios.

“Also, as the anxiety around the event settles down and a new bull phase eventually commences, these companies return abnormally high alpha for investors,” he said.

There have been three major bear markets (1992, 2000, 2008) over the past three decades where the benchmark itself corrected over 40-50% from its respective highs

ICICIdirect has run our thesis across these three bear phases, of buying decent names post >70% correction from life-time highs

In all three instances, one year forward returns for such fallen gems have generated disproportionate returns. Going by history, the current bear market offers one such rare opportunity to hunt for good bargains.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.