Anubhav SahuMoneycontrol Research

The Centre’s ban on the sale of cows and buffaloes for slaughter is facing opposition in the courts and in the states, but if it goes through, there will be a very definite impact on the dairy sector. The dynamics of the dairy industry could weaken in such a scenario due to increased margin pressure. We think that companies having higher revenue exposure to value-added products should be in a better position to cushion the impact.

So the relevant question is what the implication could be for the dairy farm business owner if he cannot easily get rid of an unproductive cow, say by selling to a cattle trader, who in turn sells it to the slaughter house. The implied cost implication is not insignificant, in our view. Not only are producers deprived of a traditional source of income from selling non-milch and ageing cattle, they are also stuck with having to feed the cow for the rest of her life.

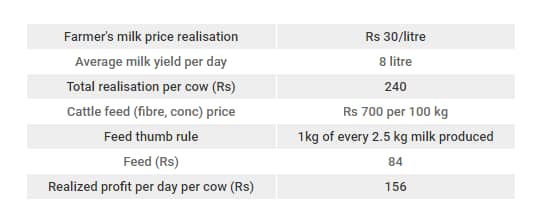

Instance on Farmer’s income from Selling Cattle Milk

Anecdotal evidence suggests that the immediate impact of a slaughter ban are the low realisations on the sale of cows. Last year, while the ban was in force in Maharashtra, realisations on cow sales fell to less than half the previous year’s level. A Holstein cow was selling at Rs 30,000 vs Rs 75,000 a year before.

Further, if the farmer continues to hold on to the cattle because he is not able to fulfill strict regulatory criteria for selling, then there is high cost to it in terms of providing maintenance to the cattle. Back-of-the-envelope calculations suggest feed cost to be at least 35 percent of the realisation the farmer makes on the milk sale.

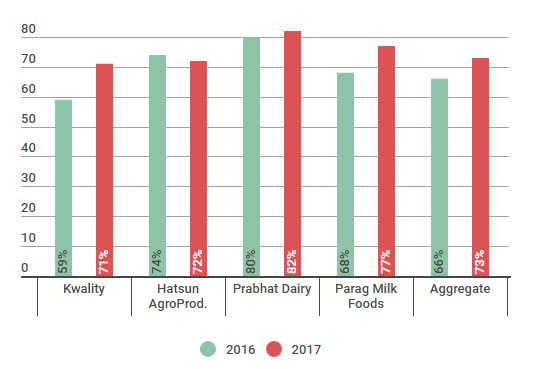

Spike in Raw Materials Prices

Source: Capitaline

Interestingly, the dairy sector has recently been impacted by the liquidity crunch, fragile farm economics and surge in raw material costs. So, not only has there been topline impact but also considerable margin pressures. For the major players in the industry, compared to 2016, there has been a surge in raw material costs. In aggregate, there has been a 715-basis-point increase in raw material costs as a percentage of sales.

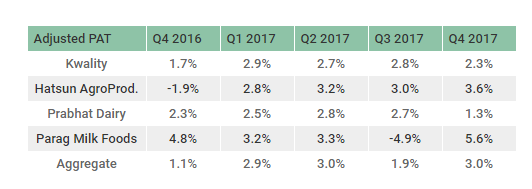

Chart: Low margin business

Source: Capitaline

Further, though companies have partially passed through raw material price increase to consumers along with improvement in product and distribution mix, it is admittedly a low margin business.

The dairy sector has a limited organized sector presence (22 percent) and this organised component is a net beneficiary of GST, but the likely disruption the tax change causes to the supply chain in the short term is undeniable.

Given this context a further disruption in farm income i.e. reduced visibility in monetisation of cattle lifecycle can have an incremental impact on margins.

The Head of Business Transformation at Kwality, Nawal Sharma, also underlined the low remunerative nature of the dairy farm business.

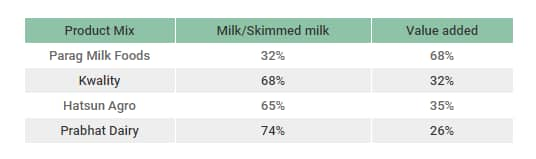

Table: Product mix

Source: Moneycontrol Research

In our view, companies which are in a better position are those where there is higher revenue exposure to value-added products. Parag Milk Foods stands out in this category. However, a huge valuation premium (trailing P/E) 100x 2017 earnings vs industry average of 50x doesn’t justify current price levels as an entry point.

Also, companies having higher B2B business (70 percent in case of Prabhat Dairy) can be relatively immune to the raw material price volatility as the model largely works on a cost-plus format.

Overall we advise investors to stay away from the sector and revisit the investment case once the dust settles on the policy front.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.