Madhuchanda Dey Moneycontrol Research

Another quarter of 20 percent growth in net profit underscores HDFC Bank’s reputation as a consistent performer. But is it good enough to justify the tag of being one of costliest banking stocks in the world? A deep dive into the numbers reveal tailwinds that should help overcome the drag from the agricultural portfolio.

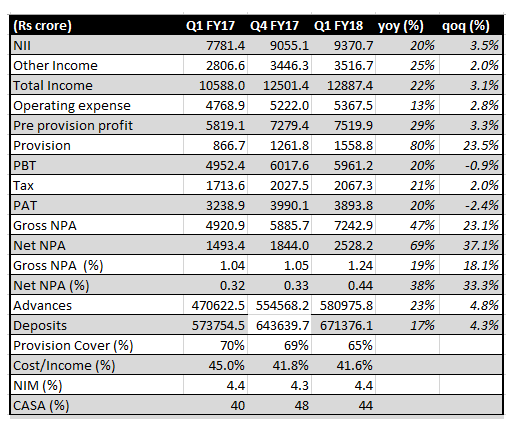

Numbers at a glance

The 20 percent growth in bottomline was driven by a similar growth in net interest income (difference between interest income and interest expenses) and a faster growth in non-interest earnings. Income before provisions rose 29 percent, partly because operating expenses were kept in check.

Still, as a prudent measure, the bank made higher provisions towards stress in the farm loan portfolio.

Casualty of “loan waiver”?

The moral hazard of the farm loan waiver is now becoming evident, with a well-run bank like HDFC Bank feeling the pinch.

Gross NPAs as a percentage of the loan book rose from 1.05 percent to 1.24 percent, with close to 60 percent of the slippage being in farm loans. Although it would be premature to comment on the quality of the bank’s farm loan book of close to Rs 28,000 crore, the management feels that such delinquency is more common initially when farmers are expecting a waiver (not sure about the quantum) and hence they withhold all payments. However, once clarity emerges, farmers usually service the un-waived loan as they seldom like to jeopardise the chance of availing of a crop loan in the future.

The bank saw gross slippages of Rs 3100 crore in the quarter.

Why turn incrementally positive?

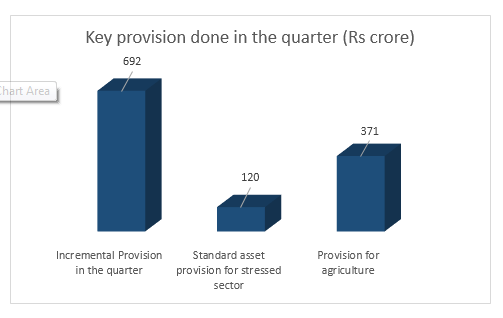

Prudent provisioning: The bank mentioned that of the incremental provision of Rs 692 crore, it has made a general provision of Rs 205 crore that included prudent provisioning on stressed sectors like iron & steel and telecom. In addition, 72 percent of the provision for non-performing loans were towards farm loans. The provision coverage on the new crop loan slippages are of the order of 50 percent which is much higher than the requirement stipulated by the RBI. Consequently, the net NPA of the bank still stands at a respectable 0.44 percent.

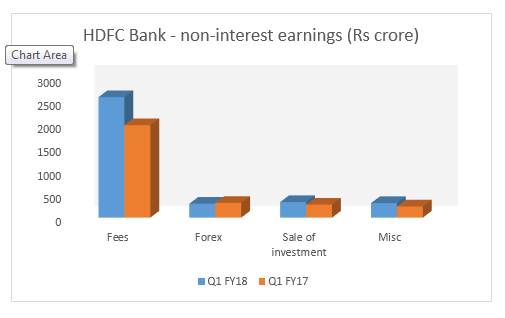

Strong traction in fee income: While growth in fees has been a forte of private sector banks, the 30 percent surge in core fees was a positive surprise. Management highlighted certain one offs like payment from oil marketing companies that contributed close to 4.5 percent of this growth. The growth was also aided by very strong performance from third-party sales owing to distribution of equity mutual funds. The management indicated that a large part of this growth is sustainable. The non-interest earnings is also benefitting from strong loan growth.

The biggest beneficiary from the inefficiency of public sector banks: HDFC Bank has capitalised on the opportunity resulting from the distress in public sector banks. The bank has been able to wrest market share both on the credit as well as in deposits. While advances grew by 23 percent in the quarter, with robust growth in corporate as well as retail, the growth in deposits stood at 17 percent.

The bank’s performance in incremental market share is particularly impressive. HDFC Bank now has a 7.6 percent share in system’s credit, up from 6.5 percent last year, with a 25 percent share in incremental credit. What it means is that HDFC Bank lends Rs 25 of every incremental Rs 100 lending in the economy.

While the NPL burden of public sector banks and hence their loss of market share is partially aiding this gain, a part of it is also due to the strong low-cost liability franchise that the bank has carefully built over the years,which is making it competitive even with highly rated corporates. The bank seems to be gaining market share in working capital financing of large corporates as well as in the business banking segment.

On the deposits front, with an incremental market share of 9.2 percent, the bank has improved its share in the system’s deposits from 6 percent to 6.3 percent.

Stable and strong interest margin: HDFC Bank has succeeded in improving its already strong interest margin by 10 basis points sequentially to 4.4 percent, thanks to the improvement in credit to deposit ratio and stability in low cost deposits at 44 percent.

The consistency of HDFC Bank, at times, has left investors unenthused especially in the context of the premium valuation. However, we are seeing the bank in a different avatar now, one which even on such a large base is smartly gaining market share without compromising on margin and inherent asset quality. Hence, at 4.3X FY18 price to adjusted book, it will still deserve a place in the core portfolio of investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.