Ruchi AgarwalMoneycontrol Research

Godrej Agrovet (GAVL), a quality player present across the agri value chain, will be a long-term beneficiary of the improvement in the fortunes of the sector. A strong management, and reputed brands are added positives. Long-term investors should keep an eye on this stock in the current phase of market consolidation.

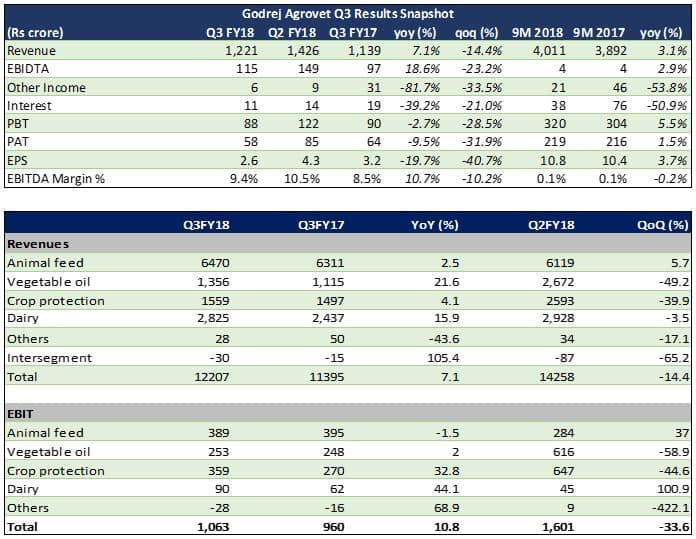

Quarter at a glance

Godrej Agrovet reported a 7 percent year-on-year (YoY) increase in revenue, mostly on the back of robust volume growth in the palm oil and dairy businesses. With stable margins at 9.4 percent, EBITDA (earnings before interest tax and depreciation) grew 18 percent YoY. However, pricing weakness in the animal feed and slow growth in the domestic crop protection segments partially neutralized the growth. With higher other expenses, low other income and higher tax rate, net profits dipped 9.5 percent YoY.

Animal feed – pricing weakness

After remaining subdued for past consecutive quarters, volumes in the animal feed segment (which accounts for more than 50 percent of total revenues) were up 10 percent YoY mostly on account of improved performance in the broiler volumes, push for new products with aggressive promotions and a favorable demonetisation base from last year. Cattle feed volumes remained strong. Revenues grew 2.5 percent, however, weakness in prices led to a near flattish EBIT growth.

Palm oil business saw healthy growth

The palm oil business saw a healthy 22 percent topline growth with a healthy volume uptick, though with a change in the pricing formula the margins got toned-down to around 19 percent. The oil palm segment is positioned to benefit from the recent increase in the import duty on imported palm oil.

Crop protection segment

The crop protection segment saw a subdued performance with a 4 percent increase in revenues, particularly due to a weak performance in domestic business where revenues declined 7 percent. According to the management the lineup of new products is expected to drive segment growth in the coming quarters.

Dairy Business

Post a difficult quarter, the dairy business saw a strong revenue growth of 16 percent. With the moderation of milk procurement prices, margins improved sequentially. Value added products continued to report strong growth and is viewed as the major driver for the segment in coming quarters. The management expects milk prices to remain stable in coming quarters which would stabilize the margins for the dairy business.

Outlook

We believe the stock is positioned for growth given that milk prices are expected to remain moderately controlled, which would help stabilize margins in the Dairy segment. High margin value added dairy products are seen to contribute significantly in driving segment growth which would help improve dairy margins.

Import duty on palm oil will make the domestic palm oil business more competitive. New product launched in crop protection segment are expected to drive volumes. Finally, volume recovery in the broiler feed segment would continue.

Post its October listing, the stock has run up around 27 percent, which includes a small correction of 2.5 percent in the last one month on account of market volatility. It is now trading at a 2019E PE of 32x and an EV/EBITDA of 22x.

With an operationally diverse yet synergistic verticals, the company has consistently generated strong returns over the past years which is expected to continue in coming quarters. Given the company’s exposure to the Agri and animal husbandry sectors which were at the core of budgetary allocations and development objectives, the company is positioned to benefit. We see GAVL as a quality stock positioned to give healthy long term gains and definitely a stock to include in the portfolio.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!