The landscape of financial markets has witnessed a remarkable surge in the number of Futures and Options (F&O) traders, particularly among retail investors. With a staggering 500 percent increase in unique individual traders in FY22 from 7.1 lakh in FY19 as individual investors flocked to the F&O segment. The SEBI chairperson recently said that retail investors need to be cautious about their participation in this market.

Rise In Retail Investors Cause For Worry?The exponential growth in the number of retail investors engaging in derivatives trading raises concerns about their preparedness and knowledge for the associated risks. While increased participation can contribute to market liquidity, it also highlights the need for caution among individual investors. The SEBI chairperson's concern underscores the importance of understanding the complexities of the derivatives market before venturing into it. A Sebi study suggests 89 percent retail traders in equity F&O (Futures and Options) suffered losses in FY22. On the other hand, there is a need for investors to look at the long term so that chances of making inflation-beating returns are much brighter through this strategy rather than losing money daily in the F&O segment.

Portfolio HedgingExperienced investors employ Futures products not just for speculation but also as strategic tools. Hedging portfolios is a common practice among seasoned investors to mitigate risks. For instance, using Futures contracts to offset potential losses in the equity market during turbulent times can be a prudent strategy. Additionally, investors can leverage Futures to generate consistent income by capitalising on their existing equity holdings.

F&O Trading RisksDerivatives trading, while offering lucrative opportunities, demands a keen awareness of market conditions. Investors should exercise caution during heightened volatility, as this can amplify risks. In turbulent market environments or uncertain economic conditions, it might be advisable for investors to temporarily avoid F&O trading to safeguard their capital.

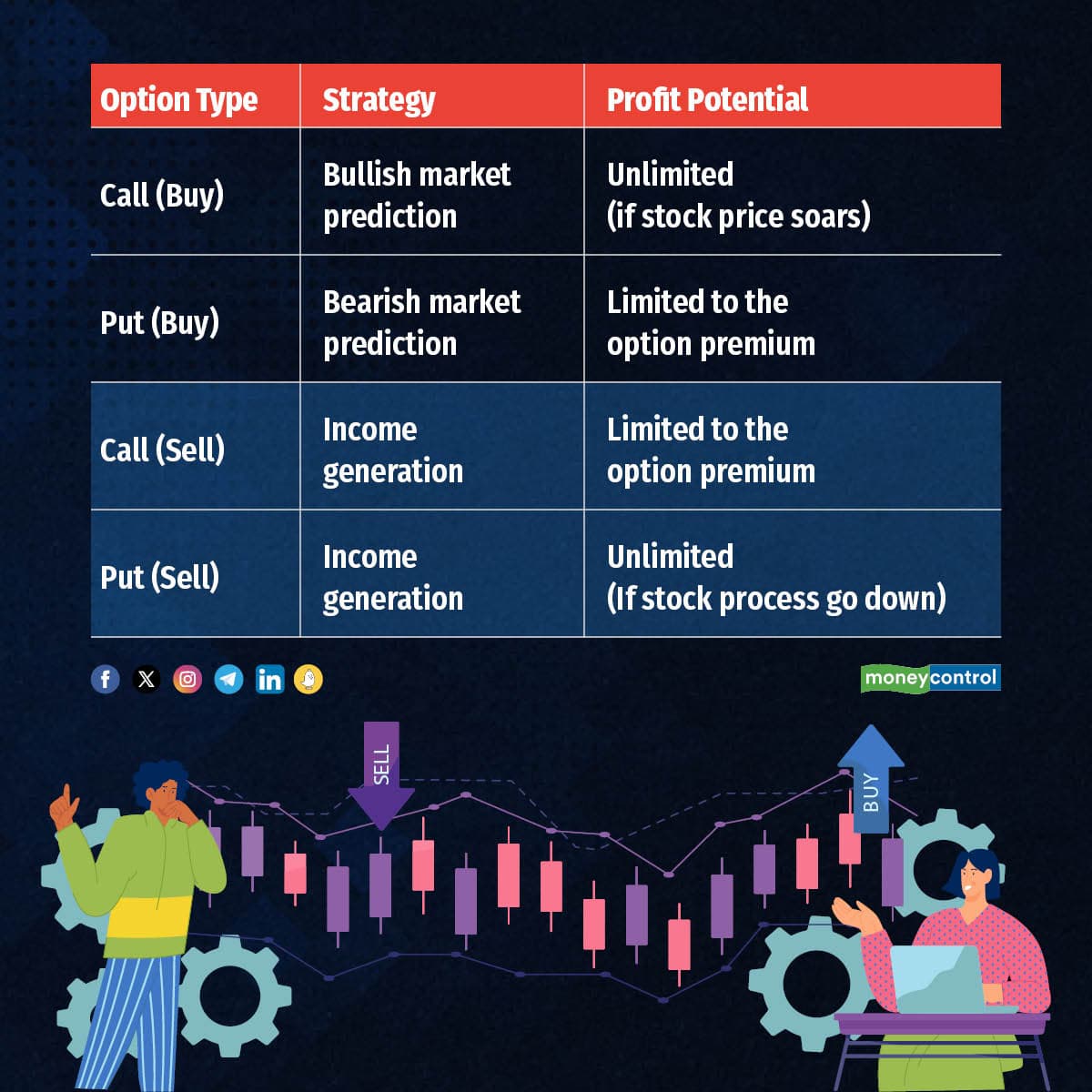

Options trading provides a spectrum of opportunities, whether one is an option buyer or seller. For option buyers, understanding the art of timing and price movements is crucial. On the flip side, option sellers can capitalize on consistent income through strategies like covered calls or cash-secured puts. The table below illustrates examples of profit potential for both option buyers and sellers:

Options markets offer a variety of strategies, some of which are easily accessible to retail investors. The ABC wave theory, or Elliott Wave Theory, describes a three-wave counter-trend movement in prices: This strategy, for instance, involves using a combination of call and put options to create a risk-defined and potentially profitable position.

- Wave A: The initial price wave moving against the overall market trend.

- Wave B: A corrective wave following wave A.

- Wave C: The concluding price movement that completes the counter-trend pattern.

High Net Worth Individuals (HNIs) can explore this sophisticated ABC strategy tailored to their risk tolerance and financial goals.

READ | MC Explains: Once profitable out-of-money options now a trap for F&O traders on expiry day

Myths Surrounding Options MarketsThere are common myths surrounding options markets, such as the perception that it's a quick and easy way to make money. However, the reality is that options trading requires a thorough understanding of market dynamics, risk management, and strategic decision-making. Educating oneself about these aspects is crucial for debunking myths and making informed investment decisions.

The derivatives market presents both opportunities and pitfalls. More than 90 percent of retail investors end up losing money, emphasising the need for thorough education and certification. Aspiring participants should consider obtaining NISM certifications to gain a comprehensive understanding of the risk and reward dynamics in derivatives trading. Armed with knowledge, investors can navigate this complex market with prudence and increase their chances of making informed and profitable decisions.

Suresh Shukla is CBO of SBI Securities. Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.