Generals always fight the last war, they say, and it seems right now that lots of people are looking for the next Bear Stearns or Lehman Brothers. They’re only half right.

The 2008 crisis that killed these investment banks started with subprime mortgages and complex credit products, but became an epic rolling disaster due to a rapid loss of funding for large parts of the banking system.

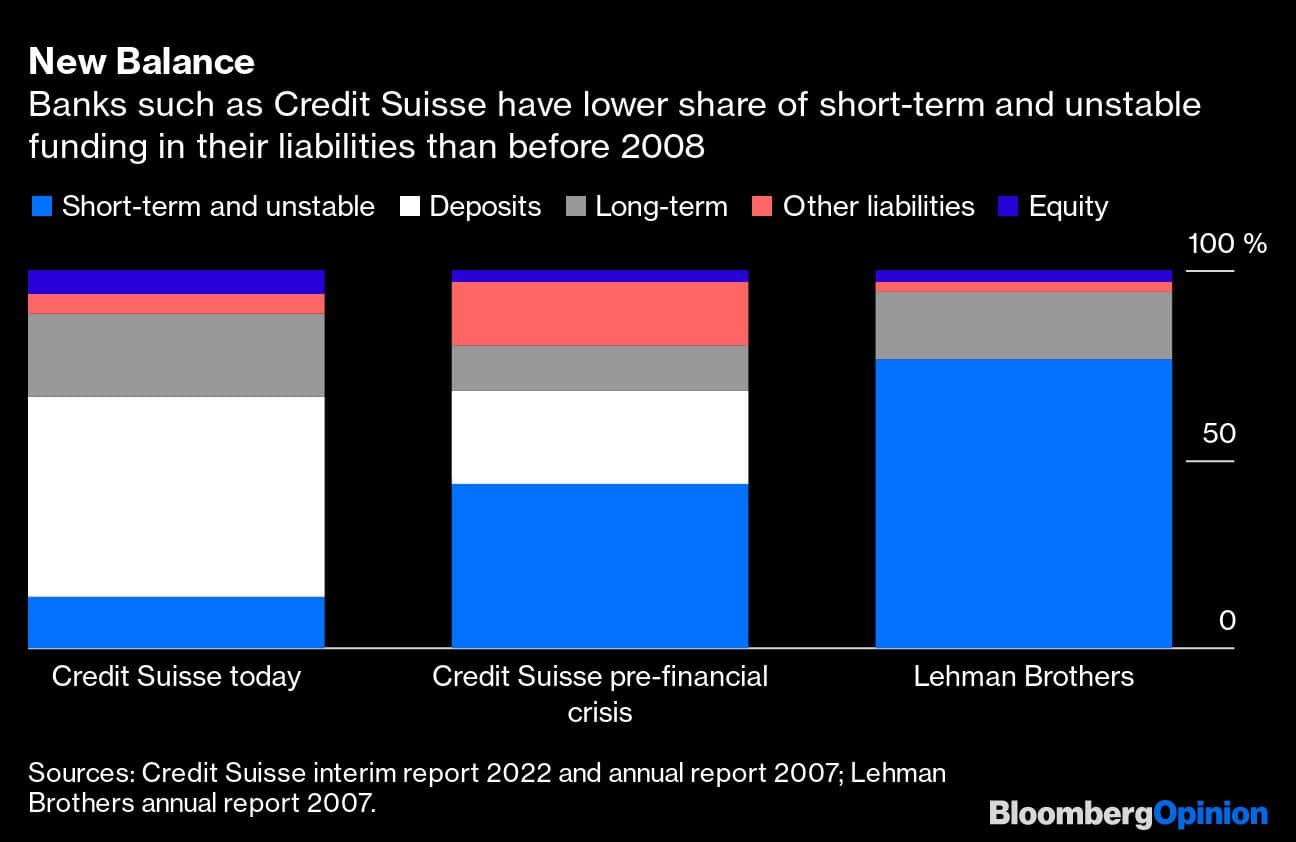

This liquidity drain was so deadly because too many banks (and their semi-detached investment vehicles) were too reliant on short-term financing. Today, corporate treasurers and money managers can still pull their ready cash from many places quickly if they get skittish — but not from banks to the same degree as 14 years ago.

The flood of post-crisis reforms has given banks far greater protection against runs on their funding. Many in finance and markets might not yet fully get this, but that is at least partly because these safety measures were dressed up in the impenetrable language of deep specialists and are expressed in ratios devoid of obvious meaning.

Credit Suisse Group AG can tell the world it has a liquidity coverage ratio of 191 percent, and the vast majority of listeners will be left bemused. An analyst could explain further that this means the bank has high-quality liquid assets that are nearly double its forecast 30-day net cash outflows in a stress scenario — hat tip to Simon Adamson, a long-time banking specialist at CreditSights. But for many, this probably still raises more questions than it answers.

The fact that financially savvy people aren’t all banking specialists makes discussing liquidity dangerous if it’s done badly. Right before Christmas in 2018, then-Treasury Secretary Steve Mnuchin answered a question no one had been asking by suddenly tweeting that he’d called in all the big US banks to see him and they all confirmed they had ample liquidity! Cue another leg down in the stock market and a leveraged-loan selloff that had been going on throughout December.

Ulrich Koerner, Credit Suisse’s recently appointed chief executive officer, would have done better to remember this episode when he affirmed the bank’s “strong capital and liquidity position” in the same breath as the phrase “critical moment” in a September 30 memo to staff and investors.

But there’s a far simpler way to look at all this, not just for Credit Suisse but for any lender. Liquidity coverage ratios and net stable funding ratios are sophisticated tools that are useful (I hope) to banking regulators. Most investors, though, can reassure themselves about the differences between 2008 and today by reviewing a single page in banks’ annual reports: their ordinary balance sheets and specifically their liabilities.

Just compare the proportion of long-term debt and deposit funding currently with 2007, for example: At Credit Suisse, long-term debt— the name tells you it can’t be quickly pulled — accounted for 22 percent of its funding, versus 12 percent in 2007. Deposits now make up 53 percent of its funding versus 25 percent in 2007. Deposits, of course, can be withdrawn in the worst-case scenarios; however, guarantee programs protect ordinary consumer deposits of up to 100,000 Swiss francs ($100,000) in Switzerland, which really should guard against panic. Also, Credit Suisse’s demand deposits — the kind that can be most easily taken back — are just 26 percent of its funding presently.

At the other end of the scale, less stable funding such as short-term borrowing from banks and markets, plus trading liabilities, account for 13.5 percent of Credit Suisse’s funding today compared with 44 percent in 2007.

Now, look at Lehman Brothers’ balance sheet in its 2007 annual report. It didn’t have deposits because it wasn’t a US Federal Reserve-regulated bank or member of the Federal Deposit Insurance Corporation. Its customers did have cash balances in trading accounts and these did disappear rapidly over 2008 — but they were small as a share of its balance sheet to begin with. However, Lehman did have a lot of short-term borrowings from other banks and markets, plus trading liabilities and other money it owed clients, and these added up to 77 percent of its funding base. Long-term debt was just 18 percent.

Lehman Brothers was more vulnerable to liquidity losses than Credit Suisse was in 2007 — let alone than Credit Suisse is today.

To be absolutely clear, really bad managers could still blow up a bank today — and that’s as it should be; regulation isn’t meant to make private enterprise completely foolproof. Poor executives could choose terrible assets, fail to understand or manage risks, or lose the faith of their staff and their clients. Yet the industry— and especially the biggest banks — have been forced to change their balance sheets and funding sources in ways that make it much harder for a bank to blow up in a really fast and chaotic fashion.

Banks’ direct exposure to each other through lending is significantly lower than before 2008 and their funding is longer term. They have to own a much higher proportion of easily saleable assets — particularly government bonds and central bank reserves. Both things reduce the risks that any bank could be forced to rapidly sell other kinds of corporate loans or bonds in a way that causes losses across the financial system.

If there is a next Lehman moment, it is much more likely to have its epicentre elsewhere in financial markets.

Paul J Davies is a Bloomberg Opinion columnist covering banking and finance. Views are personal, and do not represent the stand of this publication.Credit: BloombergDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.