The market ended yet another consolidative session on a negative note on November 20 but remained within the broad range of 19,600-19,875. Until the index holds 19,600-19,550 as a support, the ongoing consolidation is likely to break out on the higher side with resistance at the 19,850-19,900 mark, experts said.

On November 20, the BSE Sensex dropped 140 points to 65,655, while the Nifty50 declined 38 points to 19,694 and formed a small bearish candlestick pattern with minor upper & lower shadows on the daily charts.

"On the downside, the Nifty is approaching the crucial support zone of 19,650 – 19,600 where multiple support parameters in the form of the 40-hour moving average and the lower end of the rising channel is placed," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He expects the Nifty to hold on to this support. The hourly momentum indicator has a negative crossover and has reached the equilibrium line indicating that the correction has matured and can start a new cycle on the upside, he feels. According to Gedia, "19,900-19,930 is the immediate resistance zone".

Kunal Shah, senior technical & derivative analyst at LKP Securities feels despite the consolidation, the broader picture remains bullish, with major support identified in the 19,550-19,500 zone.

The broader markets remained flat with the Nifty Midcap 100 index rising 0.11 percent and Smallcap 100 index falling 0.07 percent. The breadth was slightly in favour of bears on the NSE.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 19,674, followed by 19,654 and 19,621. On the higher side, 19,740 can be the immediate resistance followed by 19,760 and 19,793.

On November 20, the Bank Nifty also witnessed consolidated and ended with 1 point gain at 43,585. The index has formed a Doji candlestick pattern on the daily charts as the closing was near its opening levels, indicating indecisiveness among buyers and sellers about future trends.

"The index encounters formidable resistance at 44,000, where the highest open interest is concentrated on the Call side. A breakthrough above this level is anticipated to trigger sharp short-covering moves," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Conversely, he feels the lower-end support is positioned at 43,300, and a breach below this level could pave the way for further downside movement towards the 42,800 level. "This data highlights a delicate balance in market sentiment, with potential for significant moves based on key resistance and support levels."

As per the pivot point calculator, the index is expected to take support at 43,482, followed by 43,417 and 43,312. On the upside, the initial resistance is at 43,691 then at 43,756 and 43,860.

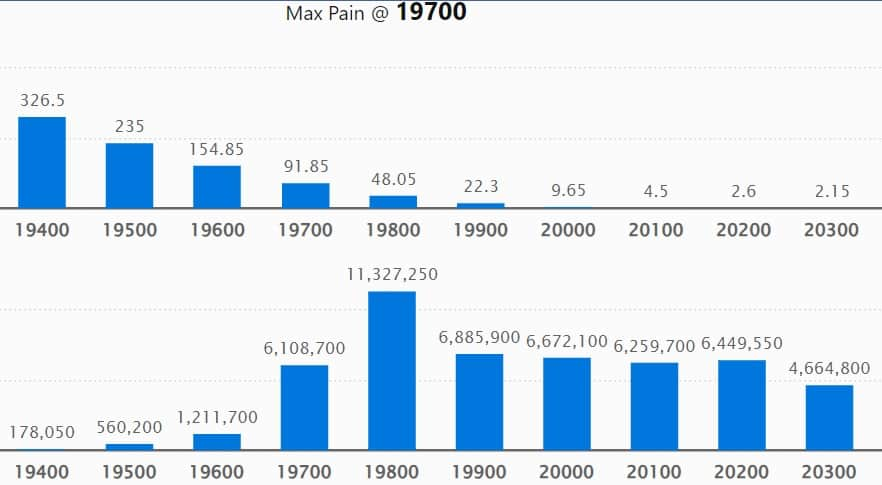

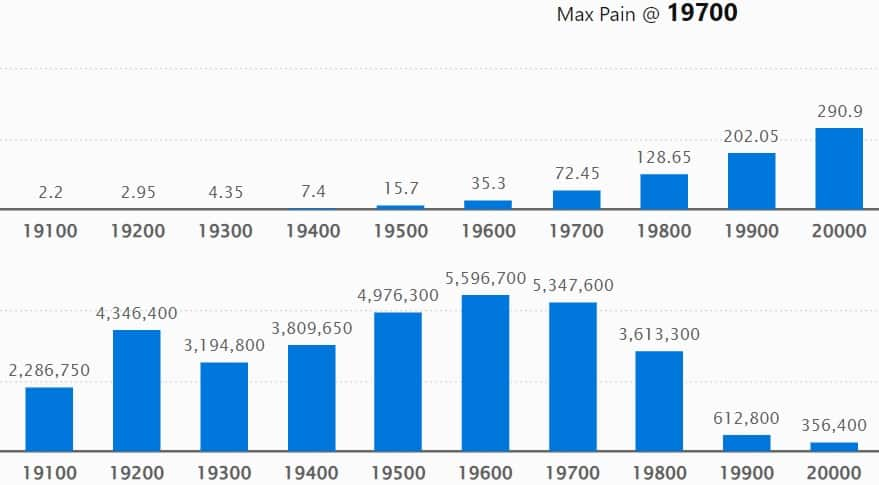

On the weekly options data front, the 19,800 strike owned the maximum Call open interest (OI), with 1.13 crore contracts, which can act as a key resistance level for the Nifty. It was followed by the 19,900 strike, which had 68.85 lakh contracts, while the 20,500 strike had 67.27 lakh contracts.

Maximum Call writing was seen at the 19,800 strike, which added 27.49 lakh contracts, followed by 19,700 and 20,000 strikes, which added 26.92 lakh and 13.3 lakh contracts.

Maximum Call unwinding was at the 19,900 strike, which shed 8.68 lakh contracts, followed by 20,800 and 19,200 strikes, which shed 86,400 and 10,000 contracts.

On the Put side, maximum open interest was at the 19,000 strike, which can act as a key support for the Nifty, with 57.69 lakh contracts. It was followed by 19,600 strike, comprising 55.96 lakh contracts, and 19,700 strike with 53.47 lakh contracts.

Meaningful Put writing was at 19,000 strike, which added 9.24 lakh contracts, followed by 19,600 strike and 19,200 strike, which added 8.95 lakh and 8.43 lakh contracts.

Put unwinding was at 19,100 strike, which shed 14.84 lakh contracts, followed by 19,800 strike, which shed 8.92 lakh contracts, and 18,700 strike that shed 2.46 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Bajaj Auto, Power Grid Corporation of India, Max Financial Services, Navin Fluorine International, and Infosys saw the highest delivery among the F&O stocks.

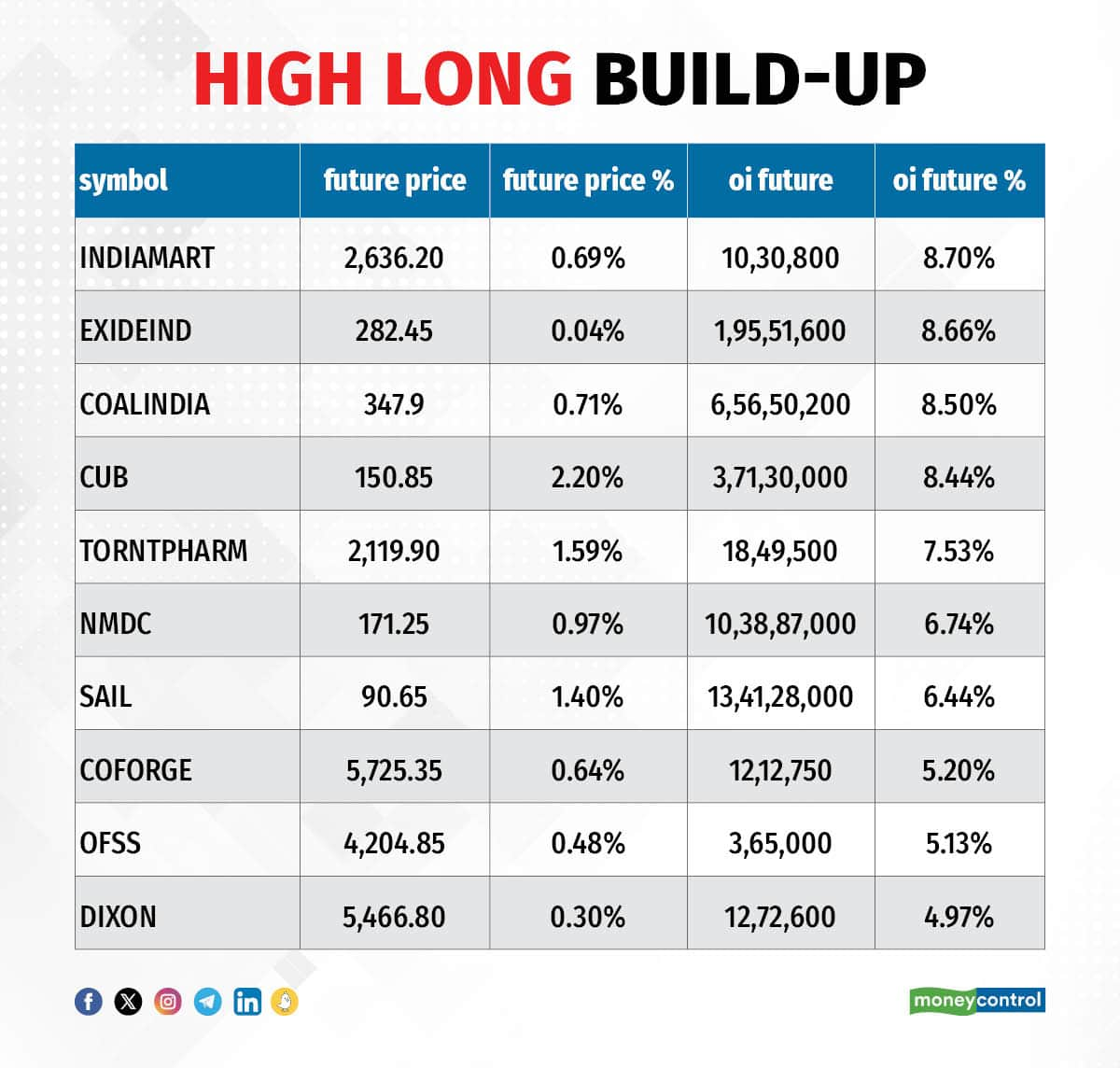

A long build-up was seen in 38 stocks, including IndiaMART InterMESH, Exide Industries, Coal India, City Union Bank, and Torrent Pharma. An increase in open interest (OI) and price indicates a build-up of long positions.

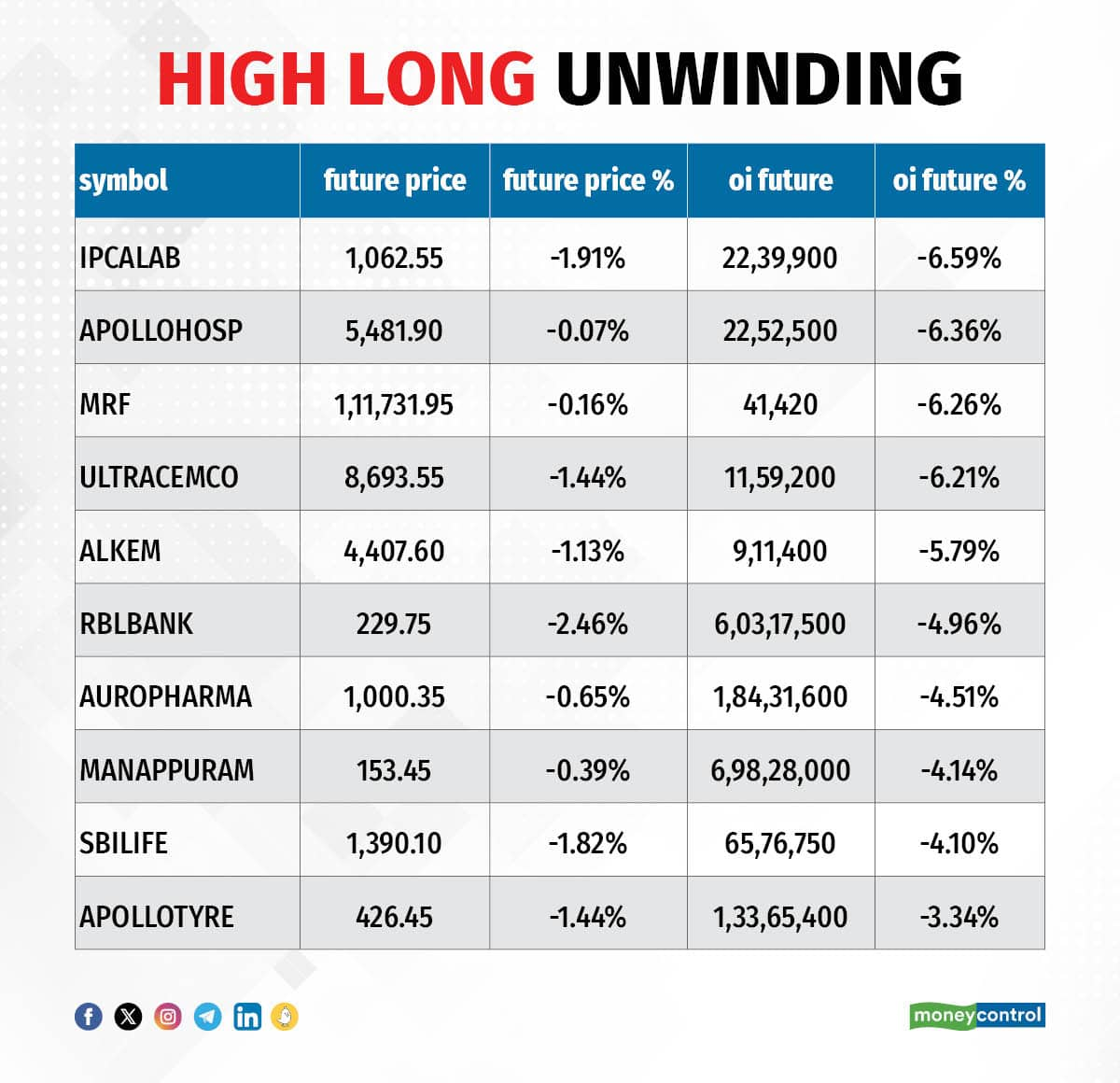

Based on the OI percentage, 43 stocks saw long unwinding, including Ipca Laboratories, Apollo Hospitals Enterprise, MRF, UltraTech Cement, and Alkem Laboratories. A decline in OI and price indicates long unwinding.

70 stocks see a short build-up

A short build-up was seen in 70 stocks, including Balkrishna Industries, Bajaj Finance, Aditya Birla Fashion & Retail, Bandhan Bank, and L&T Finance Holdings. An increase in OI along with a fall in price points to a build-up of short positions.

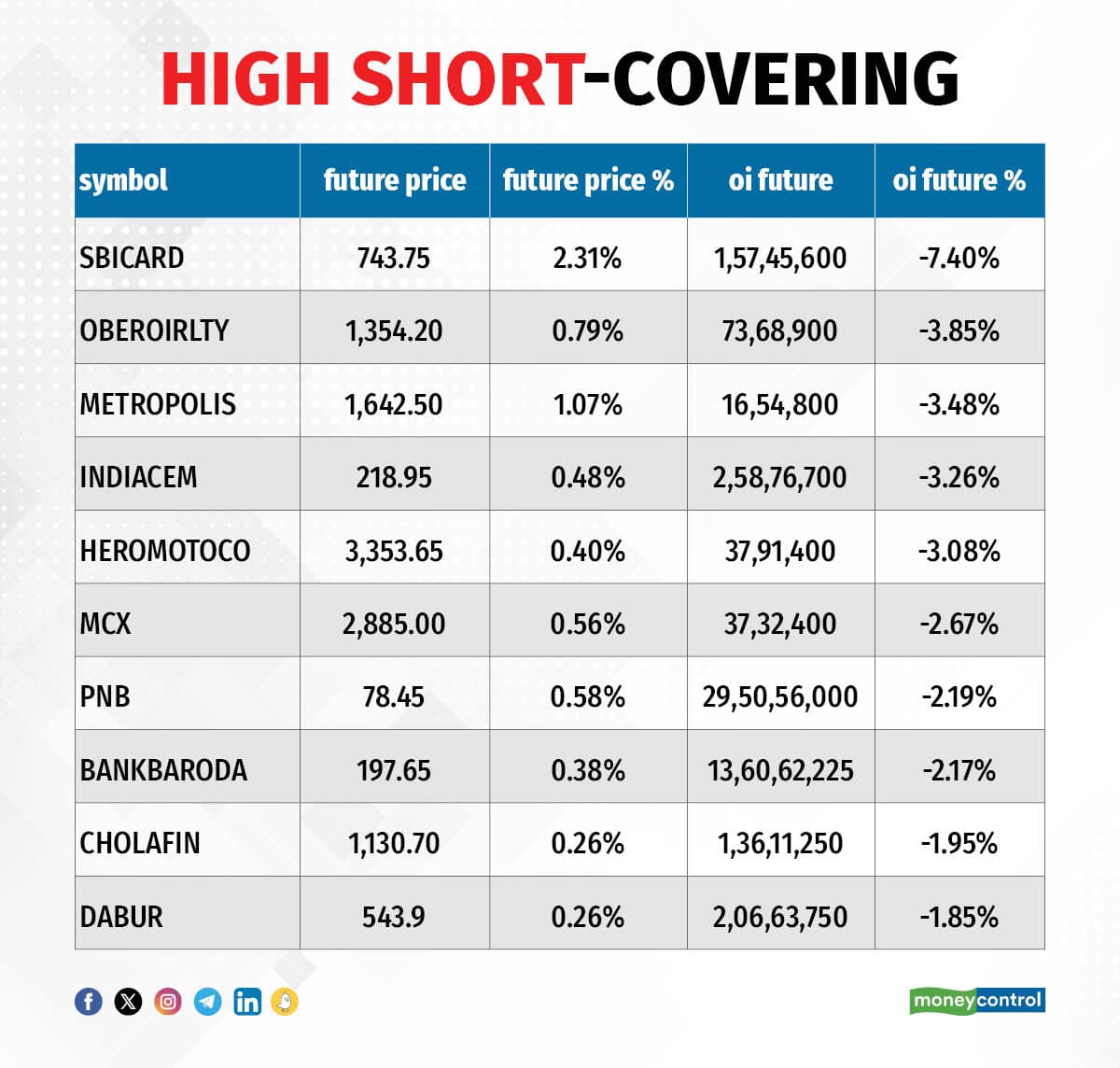

Based on the OI percentage, 34 stocks were on the short-covering list. These include SBI Card, Oberoi Realty, Metropolis Healthcare, India Cements, and Hero MotoCorp. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped further, to 0.91 on November 20, from 1.02 in the previous session. A below 1 PCR suggests that the traders are buying more Call than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Stocks in the news

ABB India: ABB and Titagarh Rail Systems have formed a strategic partnership to supply propulsion systems for metro rolling stock projects in India.

HDFC Life Insurance Company: Karnataka Bank has entered into a strategic corporate tie-up with HDFC Life Insurance to offer life insurance products to its customers.

RateGain Travel Technologies: The company that provides hospitality software has announced the closure of the qualified institutions' placement (QIP) issue and approved the issue of 93.31 lakh equity shares at a price of Rs 643 per share, which is at a discount of 4.97 percent to the floor price.

Tata Power Company: Subsidiary Tata Power Renewable Energy (TPREL) has crossed the 1.4 GW capacity of group captive projects in the last seven months. With these group captive projects, TPREL's overall renewables capacity as of October 2023 has reached 7,961 MW.

Oberoi Realty: Oberoi Realty has launched Forestville by Oberoi Realty, the first luxury residential project in Kolshet, Thane. The company has launched the first phase of this development consisting of 3 towers.

Kirloskar Electric Company: The company said the management has withdrawn the lockout at the company’s unit No. 15 situated at Bhudihal, Nelamangala taluk, Bengaluru Rural District with effect from November 20. Further, the management has requested all workmen to report to work.

HCKK Ventures: The software and services provider has announced the merger of Softlink Global, a global leader in logistics technology solutions, with HCKK, subject to the market regulator's approval. HCKK is acquiring Softlink at an approximate valuation of Rs 430 crore.

Funds Flow (Rs Crore)

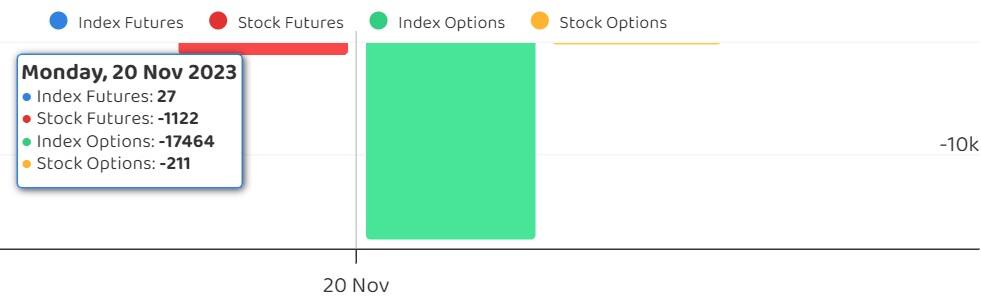

Foreign institutional investors net sold shares worth Rs 645.72 crore, while domestic institutional investors bought Rs 77.77 crore worth of stocks on November 20, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has added BHEL, Indiabulls Housing Finance, and NMDC to its F&O ban list for November 21, while retaining Chambal Fertilisers and Chemicals, Delta Corp, Hindustan Copper, India Cements, Manappuram Finance, MCX India, RBL Bank, and Zee Entertainment Enterprises in the list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!