After the recent sell-off in broader markets, several small cap stocks are seen stabilising with few outperforming the markets by a good margin. BSE Smallcap index is up by 4.13 percent since March 13 lows while the benchmark BSE Sensex is trading flat in the similar timeframe.

The market sell-off in March has ensured that even high dividend paying small cap stocks have fallen sharply. These dividend paying small-cap stocks are seen stabilising and gaining ground in line with the broader market sentiment.

Accumulation is seen in select small cap stocks with high dividend yields according to Darpan Patil, of Rupic Consultancy. He adds that the BSE Smallcap Index is testing the demand zone and a minor reversal in trend can be expected.

BSE Smallcap index

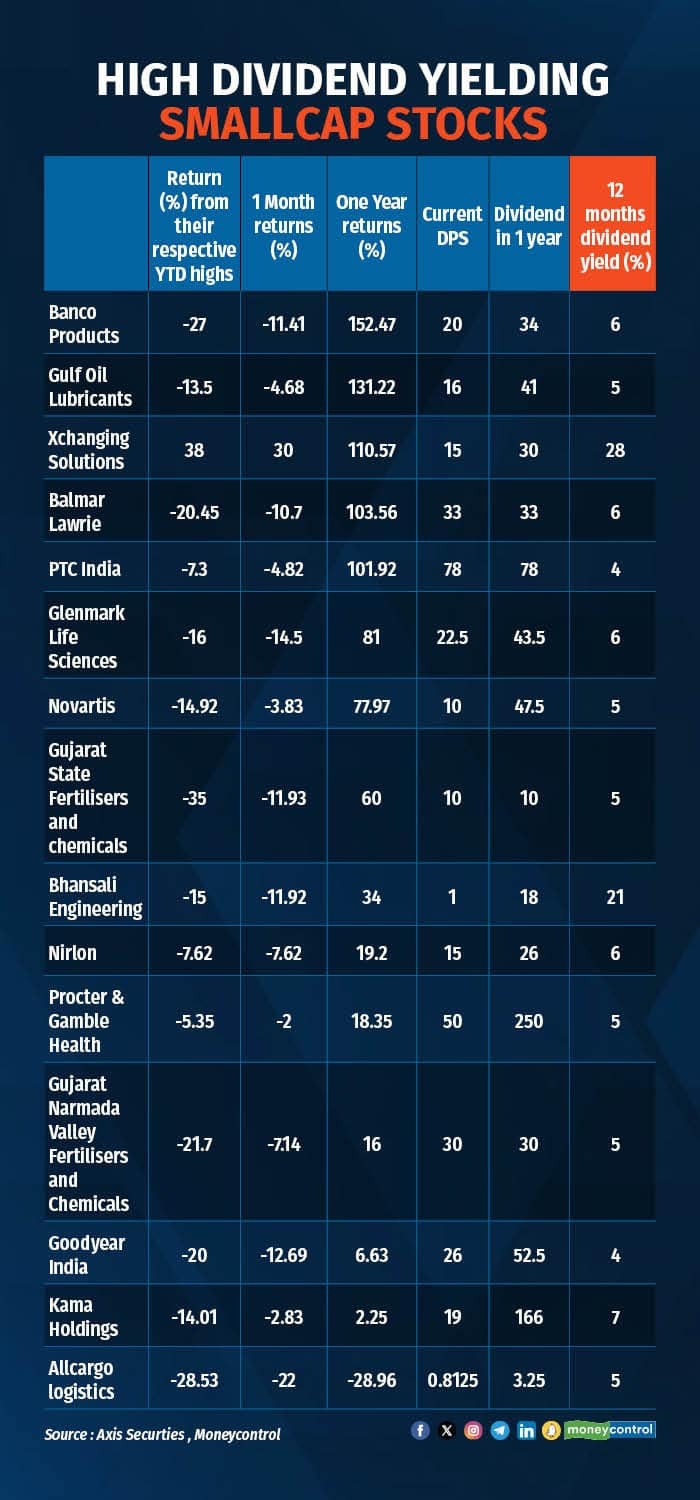

BSE Smallcap indexGulf Oil Lubricant shares were up by more than five percent, Allcargo Logistics shares gained by more than two percent while Banco Products shares strengthened by more than one percent on March 21 trading session. All these smallcap stocks are high dividend yielding stocks.

Purvesh Shelatkar, head of institutional broking at Monarch Networth Capital, says: “Every deep market correction invites smart opportunistic buyers in a bull market. Such deep cuts should be used to add stocks with positive cash flows and dividend paying companies. Same logic can be applied to high quality smallcap companies.”

We find several high dividend paying stocks have corrected up to 13 percent in the past one month. The recent correction has improved the dividend yield and hence can be on radar of long-term investors seeking value in dividends as the intrinsic value increases post correction.

Purvesh points out that the earnings growth for FY25-26 is expected to be better for smallcaps than for large caps and hence the interest in small caps, especially on corrections, will remain high. PE levels for the broader indices haven’t moved much due to earnings growth in the past two years, he adds.

Recent strategy report by ICICI Securities highlighted how relatively higher weightage to capex-related sectors and engineering sector of the broader market indices places it better in terms of expected earnings growth when compared to Nifty.

Also read: PAT to GDP ratio of smallcaps at 0.7% of GDP has more room for expansion: ICICI Securities

Darpan believes in such market situation, where the broader markets are cheaper today than they were at the beginning of the year, investors may find value in dividend paying high quality small cap stocks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.