Under new CEO Thierry Delaporte, Wipro is going through yet another transformation to catch up with its rivals in the top tier of India’s IT services sector. Only, this time, the CEO has overhauled the business units.

Delaporte has taken steps to simplify the company’s operational structure to fund investments and empower client-facing executives in the pursuit of growth.

Can this restructuring deliver? It looks promising and some of these changes are long overdue, point out analysts, but execution is what will make the difference in the end.

Wipro has been a laggard for long. As Chairman Rishad Premji pointed out during the analyst call on November 18, the company now has an “obsession for growth” and has chosen Delaporte to deliver it.

One of the key pillars of the strategy is to get talent.

Lagging growth

Wipro has been lagging behind other Indian IT services companies for years now. In FY20, the company grew only 1.6 percent year-on-year compared to Infosys’ 8.3 percent and TCS’ 4.7 percent. HCL Tech grew 15 percent in the same period.

In FY19, HCL Tech overtook Wipro to become the third-largest IT services provider, with revenue of $8.6 billion. Wipro’s revenue stood at $8.1 billion in FY19 and $8.25 billion in FY20.

So, Wipro really needed to step up to regain the ground it lost over the years. The question is if it can catch up this time.

Executives under Delaporte are confident that this time things will be different. For one, Delaporte has changed the company’s structure to make the organisation agile and more nimble and in line with changing market dynamics.

Agile and nimble

From the current more than 20 P&L units, the new model has brought it down to four strategic business units based on geographies and sectors, namely Americas1, Americas2, Europe, and Asia Pacific Middle East and Africa (APMEA).

While the Americas are based on sectors, Europe and APMEA are based on geographies to drive growth from these regions. The company expects 58 percent of incremental revenue from these regions.

These would be aligned with two global business lines (GBL), based on capabilities – iDEAS (Integrated Digital, Engineering & Application Services) and iCORE (Cloud Infrastructure, Digital Operations, Risk & Enterprise Cyber Security Services).

The change will come into effect from January 1.

How will all this help Wipro?

Under the new model the focus is on key markets and sectors and deprioritising ones that are not optimal. Srini Pallia, who will be heading Americas1, said during the analyst meet that the company is clear about what it does not want to focus on.

Public sector units, airlines and hospitality are not key focus areas. Banking and financial services, retail, energy and utilities and manufacturing are expected to contribute 56 percent in incremental revenue. Other areas include healthcare, and technology and software.

This is how it would work on the ground. For instance, take Switzerland, where the company caters to over 20 sectors. Here the company's priority would be banking and financial services, life sciences and heavy industry.

This might impact revenues by 2-3 percent but is unlikely to hit margins since these accounts are not optimal, pointed out analysts.

However, the clear focus on geographies and sectors and reduction to four SMUs, brokerage firm Motilal Oswal said in a note, “…should free up internal resources to invest in growth initiatives, which is positive.”

Client account mining

This will also help the company address the challenge it had in increasing its client accounts. A note by brokerage firm Emkay research said that Wipro had not been able to add to its active client base as much as cross-town rival Infosys.

Wipro’s client list has grown barely 7 percent over the last six years from 1,018 in Q2 FY15 to 1,089 in Q2 FY21, whereas Infosys’ active clients have grown by 63 percent during the same period to 1,487.

The company also fared poorly in adding client accounts. Wipro’s $100 million client list stood at 11 at the end of Q2 FY21 compared to 10 for Q2 FY15. In contrast, Infosys’ $100 million client accounts stood at 30 from 13 in Q2 FY15.

The new model should address the issue through global account executives (GAE). For Wipro, key large accounts account for about 70 percent of revenue. Under the new model each of these accounts will be assigned a GAE with significant decision making power and accountability, which is likely to drive better mining.

Delaporte has said that the company will see more GAEs, who would have one of the most important roles in helping the company grow. So, the coming weeks would see Wipro on-board more such executives.

“Our target is that GAEs should constitute 25 percent of the top 200 leaders in Wipro. That is not the case today by far. These client-focus executives will focus the majority of their time on proactive growth and relationship building,” he added.

Pareekh Jain, founder, Pareekh consulting, said the focus will help mine its existing accounts beyond IT services. Recently the company closed a multi-year engineering services deal with existing client Marelli for automotive software engineering. The idea would be to get more deals in areas such as consulting as well, he added.

Large deal engine

In this context, the appointment of Chief Growth Officer (CGO), a new role, will be highly important and strategic. These executives would work with the CGO to drive large deal momentum, which has been missing in Wipro.

“Look at large deals. Why is it that we had less large deals in the past? I know the answer. Because we did not have the large-deal engine. We do win large deals but it is relying on someone in the account and making him the hero. We want an engine that goes after large deals,” he said during the analyst call.

Analysts pointed that just as Infosys built a large deal team to pursue deals, Wipro will have a team to drive the deal momentum.

So, will this time be any different?

It’s too early to say. In Q2 FY21, the company's revenue declined 2.7 percent year-on-year to $1,992.4 million. Infosys, on the other hand, posted 3.2 percent growth in revenue at $3,312 million. TCS’ revenue growth declined 1.7 percent for the same period.

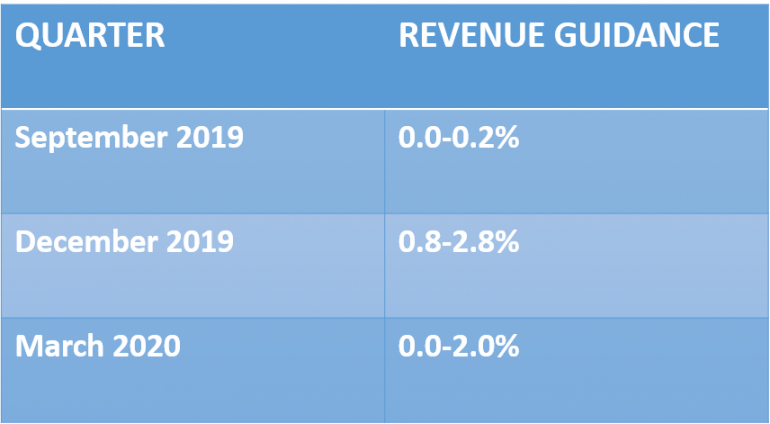

However the company’s outlook for Q3 FY21 is much better than the ones projected in the previous quarters. Wipro projected a revenue growth of 1.5-3.5 percent quarter-on-quarter for Q3FY21 at $2.02-2.06 billion.

However the company did not share a clear timeline on when it expects to see the changes reflect in its revenues.

In a note, Sudheer Guntupalli and Hardik Sangani, research analysts at brokerage firm ICICI Securities, said that even earlier there were multiple instances where the street thought a turnaround was imminent. “…it just turned false positives in hindsight”, they wrote.

So, investors will be more cautious this time around and will wait for execution evidence. Brokerage firm Emkay Research pointed out that execution remains key though the strategy is well-crafted.

“The increased focus on large deals, while simultaneously maintaining margins, will be a challenge in our view. Given these considerations, we believe, growth acceleration to industry levels in the near term may be an uphill task,” Guntupalli and Sangani said in their note.

“Limited precedence of such a major turnaround in the Tier-I space makes us more cautious. We await execution evidence before turning constructive on the stock,” they added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.