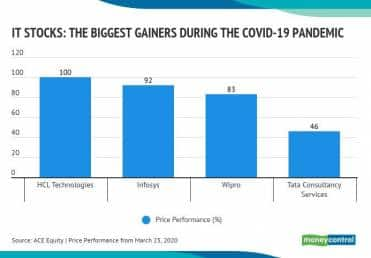

IT stocks were the biggest gainers during the COVID-19 pandemic. Stock prices of the top four Indian IT services firms – TCS, Infosys, Wipro and HCL Tech -- increased over 50 percent on an average between April and September 2020.

It is probably the highest rise IT stocks have seen over the last few years, when the digital wave began to take shape. This is driven by the momentum IT majors have seen over the last few months in terms of deal wins and tech investment from clients, according to experts.

TCS’ share price increased 42 percent from Rs 1,709 in April to Rs 2,425 and Infosys' rose 58 percent from Rs 640 to Rs 1,009.5 (Monday closing price). HCL Tech saw the highest increase of 98 percent from Rs 420 in April to Rs 834, followed by Wipro at 69 percent higher -- from Rs 184 in April to Rs 311, on September 28 closing time.

The top four IT stocks saw a 52- week high over the last couple of weeks at Rs 2,554, Rs 324, Rs 1,037 and Rs 849, respectively. A quick look at the Bombay Stock Exchange (BSE) data reveals that this is probably the highest these companies have seen in the last five years.

Factors behind the rallyThere are primarily three reasons, pointed out experts.

One: When the pandemic struck, contrary to what IT majors thought, clients stepped up their tech spending to ensure business continuity. Salil Parekh, CEO, Infosys, said in June during the company’s annual general meeting that the impact of COVID-19 was not as much they feared as clients continued to invest in tech.

Roop Singh, chief business officer, Birlasoft, in an earlier interaction with Moneycontrol, had said that after the initial jolt IT firms felt, they were able to shift to the work-from-home (WFH) environment in a matter of few weeks. Not only that, they were able to pivot their offerings to the changing consumer needs -- be it cloud, cybersecurity, or big data analytics through partnerships.

Infosys, TCS, Wipro and HCL Tech stepped up their partnerships with cloud-service providers. These companies also acquired partners of software firms like Salesforce and ServiceNow that saw significant traction at the back of the pandemic. Wipro acquired 4C, a Salesforce partner in July and Infosys acquired GuideVision, a ServiceNow partner in September.

Two: The ability to invest in technologies and gain market share. The four companies had the ability to invest since they were cash-rich. Infosys, Wipro and HCL Tech acquired two firms each. All the four firms have been investing in new-age technologies and training the workforce. For example, Infosys launched its cloud suite Cobalt recently to cater to the growing demand.

All these are aiding the firms in gaining market share through vendor consolidation. Infosys won the Vanguard deal and Wipro’s automotive software engineering deal with Marelli was also a part of vendor consolidation.

HCL Tech, during its mid-quarter update, said that it is bettering its revenue guidance it gave last quarter as it saw strong execution and momentum across service lines and this is expected to continue for the rest of the quarter.

Three: These firms were able to win more deals as much as during pre-pandemic levels as they enjoy client trust. Chirajeet Sengupta, Partner, Everest Group, pointed out: “You need to convince not just the Chief Information Officer but the board, too. Some of the tech investments companies go beyond the CIO and decisions are taken at the CEO and board levels. So they need to connect with the board.”

An external IT consultant, who works with a top IT firm on its strategies, pointed out that IT firms have increased their focus on winning large vendor consolidation deals and have set up separate teams targeting the same.

As a result, most Indian IT firms reported a significant increase in deal wins in the June quarter, on a year-on-year basis, with a majority of them in the digital space. If one goes by the US-based Accenture’s results, the momentum should continue.

Accenture reported an 8.5 percent year-on-year increase in new bookings at $14 billion, its second highest ever, for its quarter ended August. “Sustained healthy momentum in outsourcing business revenue and booking augurs well for Indian peers,” said Emkay Global Financial Services, a brokerage firm.

Will this continue?Experts seem to believe so, given the way the sector responded to the crisis.

Kotak Institutional Equities, a brokerage firm, in its recent note, said that commentary from large companies across industries provides evidence that companies are spending in innovative capabilities that will lead to the acceleration of IT services spending.

This can support close to 10 percent growth for companies, the report said. It further added that TCS and Infosys will be at the forefront of transformation even as other companies benefit.

A case in point is HCL Tech’s September quarter update on upping its revenue guidance to 3.5 percent from 1.5-2.5 percent it gave last quarter.

But winners are clearly those who are able to pivot their offerings and transform themselves along the way. The IT consultant quoted earlier said that top IT majors do use cutting-edge technology internally and such players would be able to win as they instill confidence in their clients.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.