In the equity market which is characterised by its ebbs and flows, it is difficult to find stocks that consistently generate wealth for investors. This is especially true in the current situation where pulls to each side are of such magnitude that more often than not, investors are left wondering on the sidelines. However, amid all the chaos there are some hidden gems that have not only managed to beat the market blues but have consistently augmented investor wealth quarter-on-quarter.

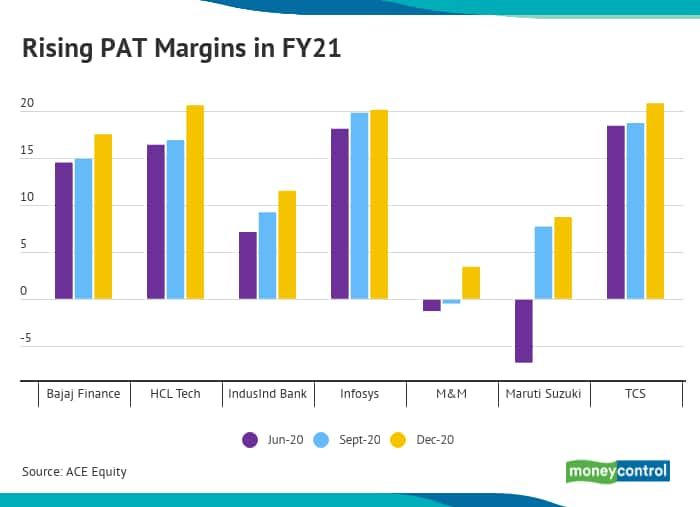

Today, we are going to talk about seven Sensex stocks that have consistently given double-digit price return in each of the last three quarters. A rising profit margin in each quarter of FY21 may have helped the stock's price performance.

The stocks that made the cut are Bajaj Finance, HCL Technologies, IndusInd Bank, Infosys, Mahindra & Mahindra, Maruti Suzuki India, and Tata Consultancy Services.

It may not be surprising to see IT names dominate the list of these seven stocks. The sector was among the least impacted by COVID-19 induced slowdown. Stocks from auto, banking and finance also found a place in the list.

Five out of seven stocks from the list have already turned multi-baggers in FY 21, data from ACE Equity. An interesting theme that emerged was that most of these companies have seen improvement in their profit margin in each quarter compared to its preceding quarter of FY21.

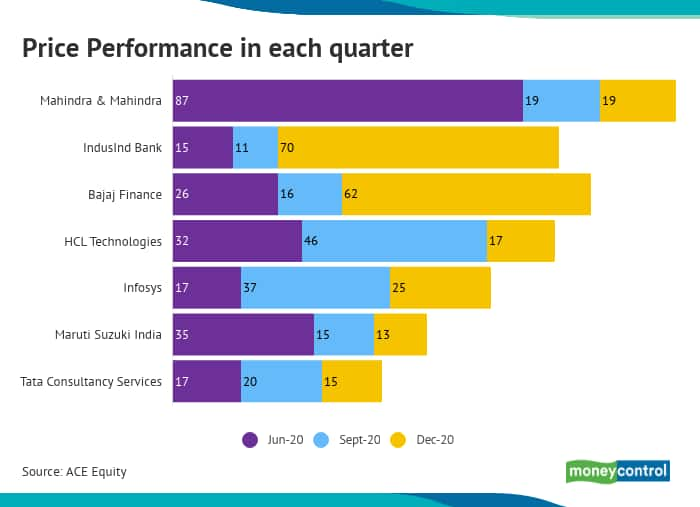

Mahindra & Mahindra| So far in FY21, the stock has gained 199 percent, rising from Rs 285 (March 31, 2020) to Rs 852 (March 09, 2021). In the June quarter, the stock rose 87 percent, and in the September and December quarter, it grew 19 percent, each.

IndusInd Bank |So far in FY21, the stock has gained 192 percent, rising from Rs 351 (March 31, 2020) to Rs 1024 (March 09, 2021). In the June quarter, the stock rose 15 percent, in the September quarter it surged 11 percent and in the December quarter, it added 70 percent.

Bajaj Finance | So far in FY21, the stock has gained 144 percent, rising from Rs 2216 (March 31, 2020) to Rs 5415 (March 09, 2021). In the June quarter, the stock rose 26 percent, in the September quarter it surged 16 percent and in the December quarter, it added 62 percent.

HCL Technologies | So far in FY21, the stock has gained 123 percent, rising from Rs 437 (March 31, 2020) to Rs 973 (March 09, 2021). In the June quarter, the stock rose 32 percent, in the September quarter it surged 46 percent and in the December quarter, it added 17 percent.

Infosys | So far in FY21, the stock has gained 11o percent, rising from Rs 640 (March 31, 2020) to Rs 1346 (March 09, 2021). In the June quarter, the stock rose 17 percent, in the September quarter it surged 37 percent and in the December quarter, it added 25 percent.

Maruti Suzuki India | So far in FY21, the stock has gained 70 percent, rising from Rs 4288 (March 31, 2020) to Rs 7310 (March 09, 2021). In the June quarter, the stock rose 35 percent, in the September quarter it surged 15 percent and in the December quarter, it added 13 percent.

Tata Consultancy Services | So far in FY21, the stock has gained 67 percent, rising from Rs 1823 (March 31, 2020) to Rs 3050 (March 09, 2021). In the June quarter, the stock rose 17 percent, in the September quarter it surged 20 percent and in the December quarter, it added 15 percent.

Recommendation: Analysts have recommended a "BUY" rating on Mahindra & Mahindra, IndusInd Bank, HCL Technologies, Infosys, Tata Consultancy Services while they have given a "HOLD" rating on Bajaj Finance, Maruti Suzuki India data from Refinitiv Eikon showed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.