India’s top three paint companies—Asian Paints, Berger Paints, and Kansai Nerolac—have been consistent wealth- creators for several years now.

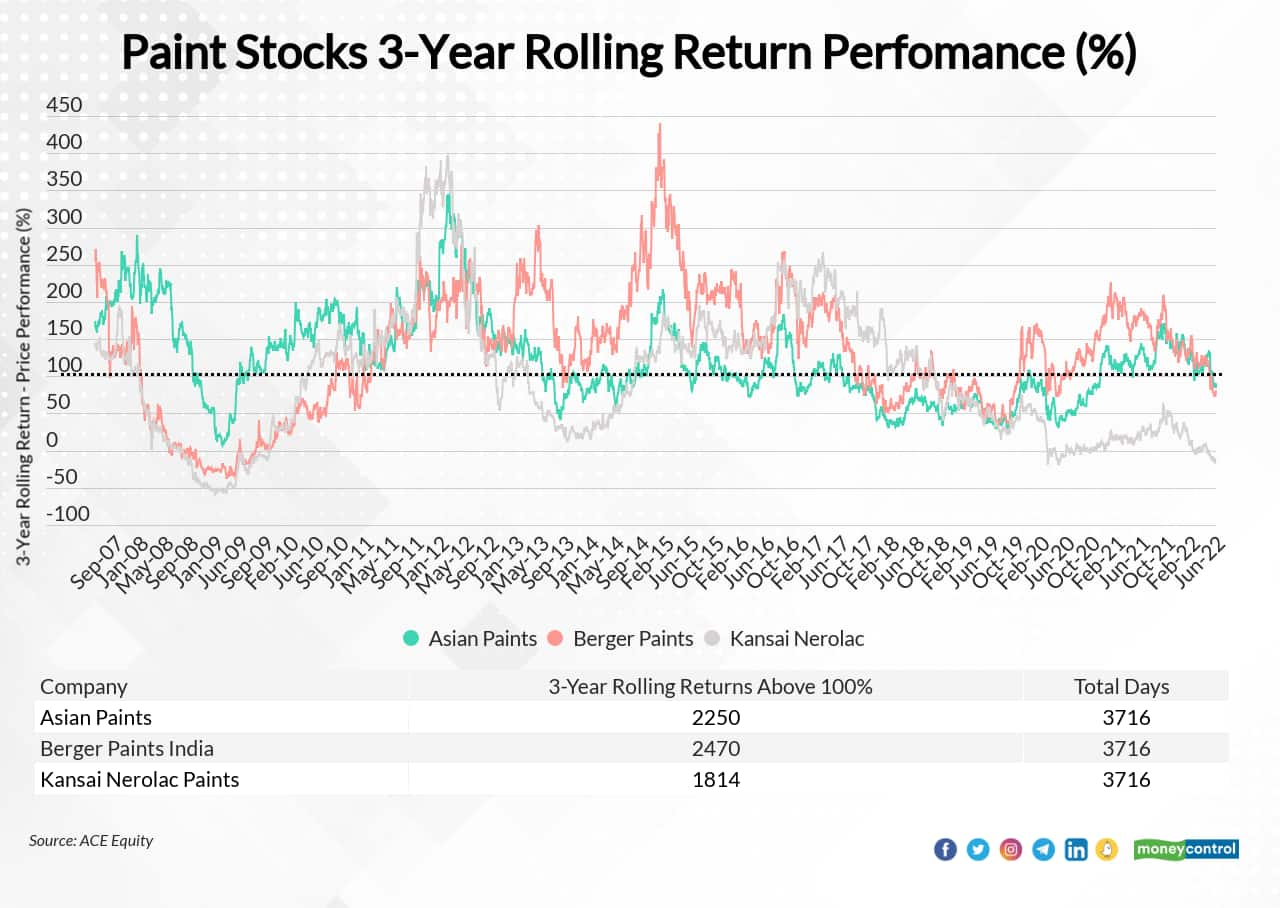

A Moneycontrol analysis found that an investor who stayed with any of these companies for a three-year period in the past 15 years (June 2007-June 2022) saw their investment double most of the time.

We calculated and analysed three-year rolling returns for these firms over the last 15 years. Rolling returns are useful for examining the behaviour of returns for a selected time frame. They are considered more accurate than the performance in a single instance.

Data shows that among the three companies, Bergers Paints maintains the best three-year rolling returns, giving investors more than 100 percent return on investment almost 70 percent of the time (or 2,470 days out of 3,716 days). Asian Paints did the same 60 percent of the time and Kansai Nerolac Paints about 50 percent of the time.

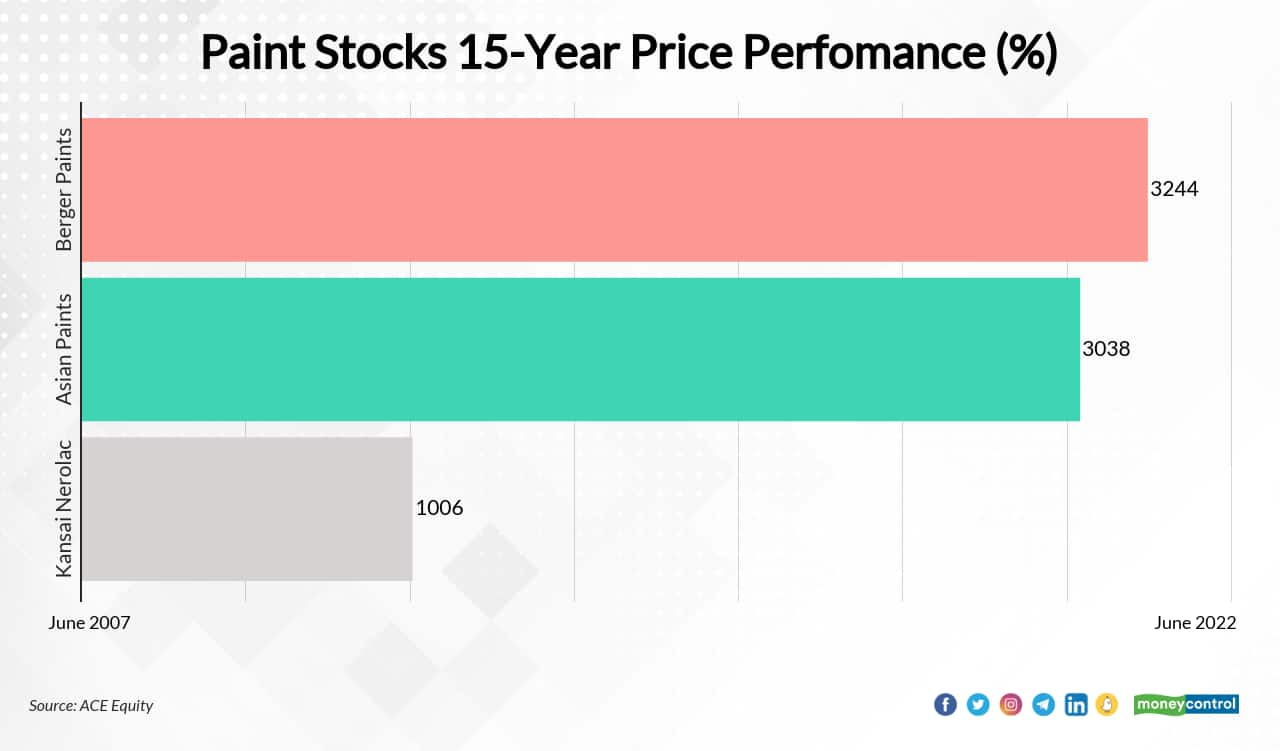

Even in absolute terms, Bergers Paints leads the pack with a 3,244 percent price return for the 15-year period. Asian Paints surged about 3,038 percent, and Kansai Nerolac Paints 1,006 percent, while the Nifty gained 261 percent during the period.

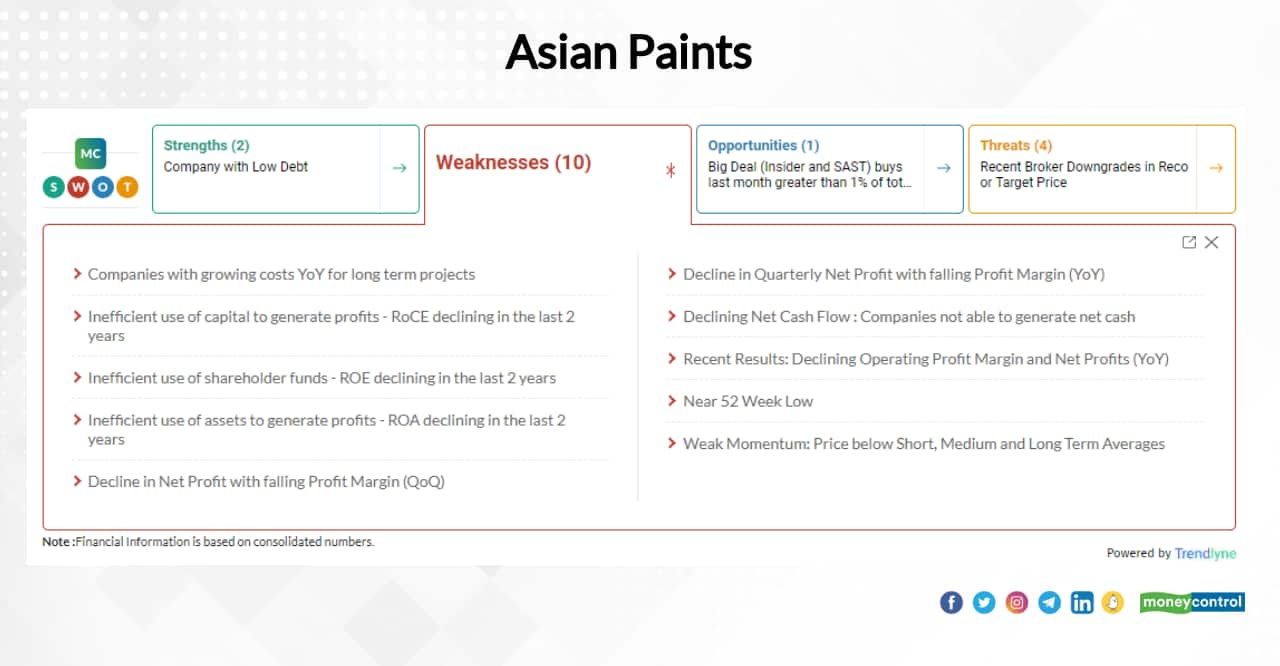

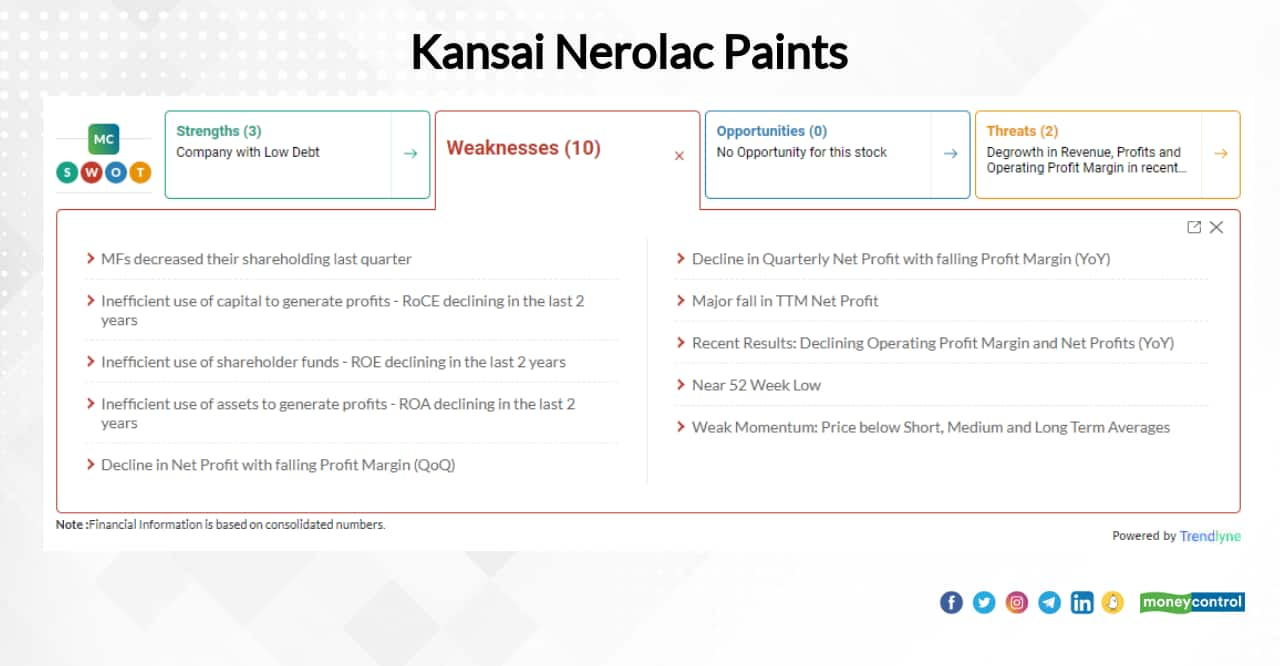

The industry has changed over the last 15 years as many new players have entered the market, which has led to a decline in the market share of the Big 3. Companies are also facing profit-margin pressure due to high input costs.

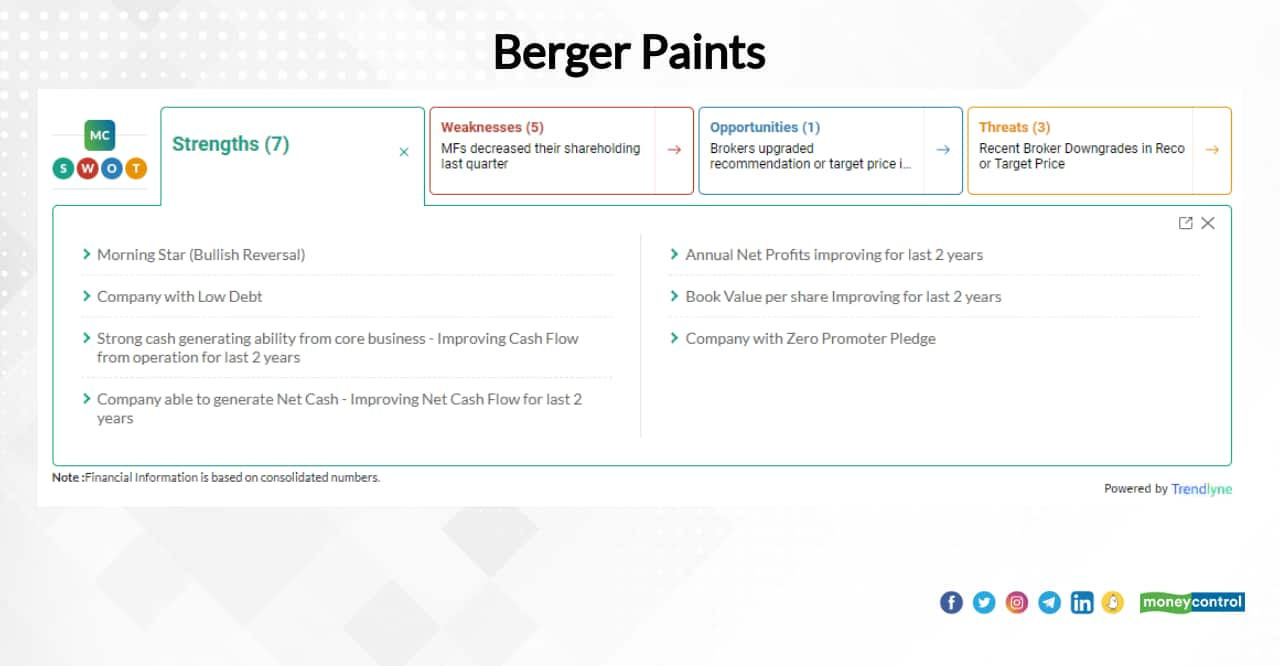

Moneycontrol SWOT analysis reveals that Asian Paints and Kansai Nerolac look a bit weak, while Berger Paints has more strengths than weaknesses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!