Jitendra Kumar Gupta Moneycontrol Research

The road sector continues to remain a promising theme within construction for the long-term. This is particularly so in the light of government's renewed focus on roads and consolidation in the sector that will allow serious players to reap dividends.

The government recently stated its intention to spend close to Rs 7 lakh crore over the next five years in developing 83,677 km of roads. Out of this, close to 5.4 lakh crore will be spent on Bharatmala Pariyojana comprising development of 34,800 km of roads.

This is a large number indeed. In Q1FY18, the government is estimated to have spent close to Rs 4500 crore which is about Rs 18,000 crore annually. This is minuscule compared to Rs 7 lakh crore, which is equal to Rs 1.4 lakh crore annually that the government intends to spend. While most of the companies are sitting on an order book to sales of about 2.5-3 times, it further enhances revenue visibility and confidence about future growth.

“The government’s announcement of its five-year road map entailing development of 83,677 km at an outlay of Rs 6.9 lakh crore further adds to te growth visibility for companies focused on construction of highway projects. Other measures like delegation of more powers to NHAI (including powers to approve projects) will further improve the pace of execution of these development programmes," said Ashish Shah, tracking the sector at IDFC Securities.

Bigger the better

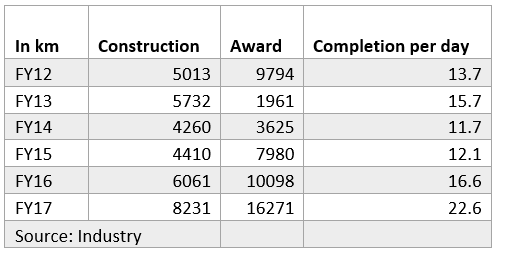

Beyond the tall targets what is interesting to note is that the pace of construction and awarding of the projects has been encouraging. To put it in perspective, the government has targeted building roads at the rate of about 40 km a day. The current run rate is at around 30 km a day, which though lower than the actual target, is still better than the pace of 22.3 km per day that we saw in FY17.

While the opportunities are huge, investors will be better off investing in companies which have balance sheet strength and demonstrated good execution track record.

"I think going ahead, the larger and serious players having balance sheet strength, execution capabilities and national presence could possibly gain market share because of the nature of projects that will come up for bidding in the next round of awarding such as Bharatmala projects," said Rohan Suryavanshi, Director, Strategy and Planning at Dilip Buildcon.

Amongst stocks, IRB Infrastructure could be a good play with its balance sheet strengthening. It has good EPC capability and now since the most of its BOT assets are being transferred to InvITs, it will have more capital and take larger, bigger projects without much constraints on the finances. The company is having a strong revenue visibility in its construction business, backed by Rs 9000 crore order book (3x revenue).

The other important national player in this space is Dilip Buildcon which has demonstrated a good execution track record, currently executing about 2.5-3 km per day. The company recently signed an agreement to sell its entire BOT portfolio at an equity value of Rs 1,600 crore and enterprise value of Rs 10,500 crore. This should unlock large capital and reduce debt substantially in order to leverage the future opportunity. The company is sitting on an order book of close to Rs 16,000 crore, which is little over 3 times its revenue.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.