Shares of HDFC Bank gained almost four percent during the morning trade as investors made big bets ahead of the FII buying window being opened on June 1.

The SEBI decided to open the window for institutional trading series (6 lakh series) just for a day on June 1, 2018. In fact, the regulator has decided to scrap the mechanism from July 1 onwards. This has led to an increase in demand for the stock.

This is popularly known as the FII Trading Window – when stocks get into FII restriction, there is a separate window on which only FIIs trade so that FIIs still have the option of buying the stock. Since the buyer will be purchasing from another FII, it ensures that there is no change in FII shareholding. For stocks in demand this usually leads to an FII premium

Global research firm Macquarie expects a huge quantum of buying on June 1. “The scrapping of FII window will increase the quantum of buying that will come in on 1st June. The buying could be more than US$1bn on June 1st. We expect the local stock to move up sharply,” it said in a report.

For the uninitiated, this FII trading window is used by such investors when the stocks get into a FII restriction mode. Macquarie’s note further explains that there is a separate window which only FIIs trade so that they have the option of buying the stock.

Since the buyer will be purchasing from another FII, it ensures that there is no change in FII shareholding. For stocks in demand this usually leads to an FII premium, the note further explained.

Further, the report added that the stock sees the highest premium. “It used to be higher than 20% before it came crashing down in February 2017 when the stock opened up for FIIs for a day.

The premium is now running at 3.5%. Stock will be open for FII trading on 1st June – the headroom will be 1.43 % based on our calculations. Now that this will be the last opportunity for FIIs to buy the stock,” the note further added.

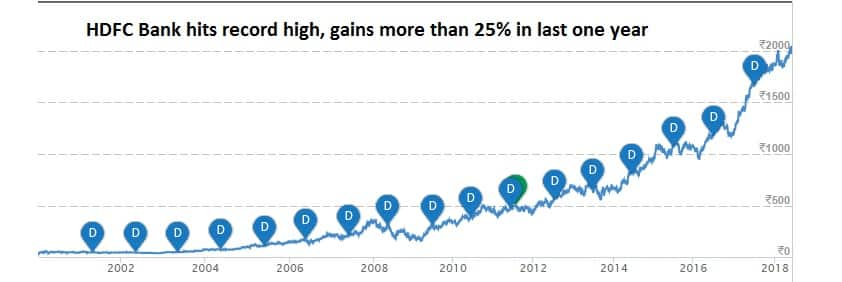

The stock has gained around 8 percent in the past one month. Its three-day gain stands at over 2 percent. At 10:30 hrs HDFC Bank was quoting at Rs 2,091.50, up Rs 44.65, or 2.18 percent, on the BSE. It touched a 52-week high of Rs 2,126.65.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.