Life Insurance Corporation (LIC) added 15 stocks to its portfolio for the first time in Q1 FY19 and raised stake in as many as 58 companies.

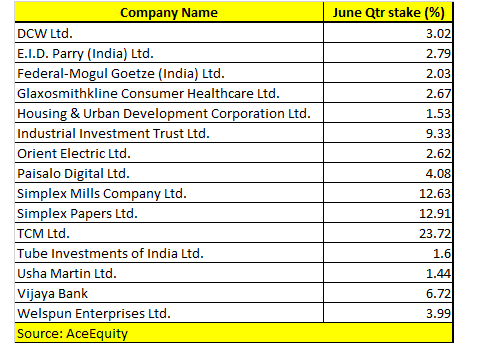

The government-owned insurance major added above 1 percent stake in as many as 15 companies, according to data compiled from AceEquity. These include: DCW, E.I.D Parry, Federal-Mogul Goetze, Housing and Urban Development Corporation (HUDCO), Orient Electric, Vijaya Bank, Tube Investments of India and Simplex Papers.

Though some of these companies are among the top performers in their own areas of business, experts feel betting blindly on these stocks might not be the right way of building a portfolio.

“LIC’s current additions include some reputed brands and fundamentally sound opportunities. Vijaya Bank is one of the best performers in the state-run banking space with an increase in net interest income of 27.9 percent and an improvement in asset quality. E.I.D Parry is another feather in their portfolio belonging to the reputed Murugappa Group,” Jimeet Modi, Founder & CEO at Samco Securities, said.

“Federal-Mogul and GlaxoSmithKline are other brands which are expected to create strong growth going forward. However, betting blindly on these and other stocks isn’t advisable as one must understand the percentage LIC holds in comparison to its total assets and its rebalancing strategy in the larger scheme of things. Also, its diversification perspective must be studied before getting into stocks,” he said.

Some sectors in which LIC added stake for the first time are witnessing momentum such as consumption, chemicals as well as banks.

If investors plan to shortlist stocks for their portfolio based on LIC’s investment methodology, then they should ideally have a long investment horizon, experts suggest.

“LIC’s investments are long term in nature: 8-10 years. Their current investment in consumption stocks is perfectly in line with the market's investment strategy. The drivers of consumption stocks would be the intact urban consumption story and a revival in rural consumption. The latter is expected to be revived from higher rural and social spending by the government,” Sumeet Bagadia, Associate Director at Choice Broking, said.

“Investments in chemical stocks can be considered as a complementary to the consumption story. Chemicals play a vital role in various sectors: food, clothes, automobiles, among others. In the banking space, the market is expecting an improvement in the financial performance of state-run banks in the next 2-3 quarters,” he said.

LIC increases stake in 58 companies LIC increased stake in as many as 58 companies in the June quarter. These include: Britannia Industries, Hindustan Unilever, Asian Paints, Dewan Housing Finance, HCL Technologies, City Union Bank, ICICI Bank, State Bank of India, Tata Chemicals, Gillette India, CRISIL and Piramal Enterprises.

Most stocks in which LIC hiked stake and added for the first time belong to the small- and midcap space. After the recent correction, most experts feel this space has bottomed out and there is higher probability of a revival in momentum.

Despite benchmark indices notching record highs, the broader market (most mid-and smallcaps) has failed to participate in this bull run. Among domestic institutional investors, the state-owned insurance behemoth is one of the biggest investors, known for buying stocks that are attractively priced.

“The carnage in the broader market has turned valuations attractive and opened up several value buying opportunities. Many stocks from the broader market, which have fallen due to various reasons, have reported robust financial performance,” Soumen Chatterjee, Director Research, Guiness Securities, said.

“There is certainly a strong buy case in lot of such mid- and smallcap stocks which have corrected due to stretched valuations or inclusion in Additional Surveillance Measures (ASM) and general market sentiment etc. Most stocks in the above mentioned list belongs to the BSE Midcap or Smallcap segments,” he added.

Chatterjee said LIC has always maintained their principle of buying dips and booking profits on a rise. “LIC continues to follow their above-mentioned strategy as they believe the market will provide the opportunity to again enter into dips. As one the biggest institutions, they are well placed to weather any sort of volatility to come and use that panic to buy,” he added.

(The above list of stocks are for information and not buy recommendations from analysts’ mentioned in the article. They might/might not have a stake in the stocks mentioned. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.