Indians are known to be very smart consumers; always looking for value-for-money offerings. Fortunately or unfortunately, that should make us very good ‘Value Investors’ as defined by Ben Graham.

However, how do we know if a stock is a bargain or not? By default price-earning ratio has become that barometer on which majority is trying to answer this critical question. You mention a stock and the first question would be ‘Boss iska P/e kitna hai?’ (How much is its P/e?)

The reason for its popularity is its simplicity; P/e of 20 means the business is available at a market capitalization which is 20 times its annual earnings, in other words the stock price is trading at 20 times its earnings per share (EPS).

I will briefly cover three ways in which lot of us get it wrong when it comes to making sense out of P/e:

Folly 1: Lower the better; always true?

A lower P/e does not always imply that the stock is a bargain. Though the numerator of this ratio (price) is for everybody to see, what we ignore is the denominator (quality of earnings) where lies the most important information. This is all the more important in case of cyclical businesses. For instance look at following information pertaining to Ceat Tyres:

An investor basing decision only on P/e would find it expensive in 2012 at P/e of ~17 and may give a pass to a potential 10-bagger, without realizing that the earnings are depressed due to sky rocketing rubber prices (key raw material) that almost went 3x in previous three years and effected profitability of entire industry.

The same investor might find Ceat attractive in 2016 given the P/e is much lower at 10 times, again missing the point that operating margins and hence earnings are cyclically high, thanks to huge tailwind provided by falling rubber prices which doubled margins.

In reality, Ceat was cheap at 17 P/e in 2012 and relatively expensive at 10 P/e in 2016.

Then there are some businesses where inherent economics are bad or are run by crooks. These businesses are being offered to you at low P/e because of some ‘reason’ and not necessarily because they are ‘hidden gems’.

On the other side of the spectrum, there are some beautiful companies out there which trade at optically ‘High’ multiples; but what many ignore is how their earnings are grossly understated.

Warren Buffet spoke about ‘Owners Earnings’ in his 1986 Letter to Shareholders. Thomas Russo also talks about such companies as ones with ‘capacity to suffer' in the short term to reap benefits in the long term. These companies are investing today to remain relevant and to have ability to continue to grow tomorrow, with meaningful investments going into R&D, technology, branding etc. which all may be creating intangible assets but are being expensed to P&L.

Folly 2: Comparing apple with oranges

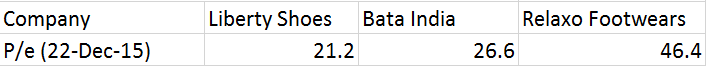

Based on the limited data given in the table below, please answer the following three questions

1. Given that all three operate in the footwear industry, can we assume they are all ditto same?

2. Is Liberty cheap given valuation multiple of other two?

3. Is Relaxo expensive given market leader Bata trades at lower multiple?

The correct answer to all three questions is ‘Insufficient Information’

And the reason is because all three may be vastly different in terms of:

1. Presence in different categories within that industry

2. Business Model: In-house manufacturing Vs. Outsourcing (Asset light)

3. Different geographic exposures, reach and growth strategies

4. Quality of Balance Sheet

5. Lala Vs Professional Management

6. Big Talk Vs Proven Execution Capabilities

7. Respect for Minority Shareholders and other Stakeholders

8. Me too Vs. Differentiated, Established/Emerging Brand etc.

Just the way no two humans are 100% alike and hence cannot be compared; we should ideally not be comparing two different companies to benchmark valuations against each other.

Let’s say even if both have a lot in common, aren’t we assuming the peer is rightly valued? What if even that is grossly overvalued/undervalued and hence making this stock seem cheap/expensive?

Folly 3: To drive while looking at rear view mirror

Majority of the investors talk about trailing-twelve-months (ttm) multiple, as that is what is widely available. This is nothing but earnings per share of previous four quarters / 12 months.

But aren’t we betting on the future earnings? So, do entry multiples really matter? I am sure a lot of people would still answer ‘yes’ to it.

In that case my follow-up question would be- how would one arrive at a P/e for a company that incurred one-time loss last year and has negative earnings? One cannot, as the denominator is now negative. In this case the same person will try to work out the expected earnings next year or year after that and decide whether its attractive or not. This essentially makes last year’s profit/loss figure less relevant and future earnings potential the key.

Whether you pay a trailing P/e of 10 or 30, in the long term your returns broadly would depend on three factors:

1. Future earnings growth A function of sales growth, margin expansion due to operating leverage and/or sales-mix change and interest cost saving (retiring debt).

A 10 P/e stock would fail to generate good returns if the business fails to grow its earnings per share, whereas a 30 P/e stock can create massive wealth if its earnings grow consistently at 30-40% CAGR. That is what makes earnings growth the most important driver of stock returns in the long run. Classic example is Page Industries which was never ‘cheap’ but due to consistent and high growth in earnings became a multi-bagger.

2. Exit multiple A function of market perception of further growth potential in the business, over the next period.

Prof. Sanjay Bakshi, who has been a guiding force in investing community, suggests to be conservative while assigning exit P/E as its far out in the future. He himself never assumes more than 20, which is by the way is his best case scenario.

3. Dividends A function of reinvestment opportunity within the business.

If you invest in large companies generating lot of free cash and high payout, dividends can make meaningful contribution to returns. However in our case, we primarily invest in emerging companies from small & mid cap space, and these companies have a huge run way to grow by reinvesting capital; dividend payouts are low and hence the yields contribute insignificantly to overall returns.

Now, there is no way we can predict the earnings of a company for next year or for 2020 with any precision. However, as investors we would fail in our role if we do not even have a range of possible outcomes with their likely probabilities.

We do not know whether company X from our portfolio can report Rs 23.56 EPS in 2020, but can we attach a high (lets say 70-80%) probability that the figure will be above Rs 20 and with a reasonable exit multiple of 15 we can at least make XX% CAGR in this stock, which is above or close to our hurdle rate? And the answer is ‘Yes We Can’. By keeping assumptions conservative and working out a base case (highly likely) scenario, one can position himself for good luck. At the end of the day, investing is never certain, it’s all about probabilities.

Disclaimer: The stocks mentioned above are for illustration purpose only and not investment advice, please consult your advisor before investing. It is safe to assume author, his firm and clients have position in the stocks discussed.About the AuthorJatin Khemani is Founder & CEO at Stalwart Advisors (www.stalwartvalue.com), a SEBI Registered Investment. He has seven years of experience in investment analysis and portfolio management. He is a CFA(US) Charter holder, earned his MBA in Finance from Christ University, Bangalore and graduate in Commerce from Delhi University.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.