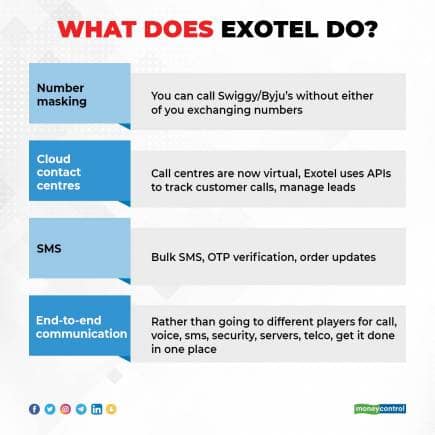

When you order food on Swiggy, have you noticed that neither you nor the delivery partner exchange numbers if you end up talking? Same goes for when you hail a cab on the Ola app, or if you call Byju’s to raise a query about their education services. The apps of these companies connect you to the relevant person, without both his and your phone getting inundated with the numbers of strangers, circumventing a massive privacy threat.

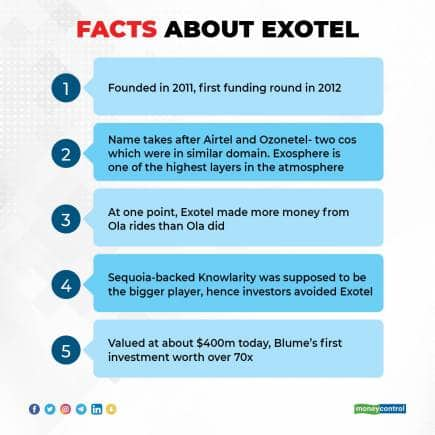

Startups such as Swiggy, Ola and Byju’s are well known. The company that powers vital communication software for them less so. Exotel is hardly a newbie — it has been around for more than 10 years. Yet beyond the closeknit startup and investment scene, it is largely unknown. You could say Exotel is not a man about town in the startup world.

That is not because the company was ‘built in stealth’ or was secretive, as some startups love to claim. It is simply because no one took Exotel seriously until they were forced to.

Exotel is a classic startup story. The company and its founder and CEO Shivakumar Ganesan have seen all the vagaries of business.

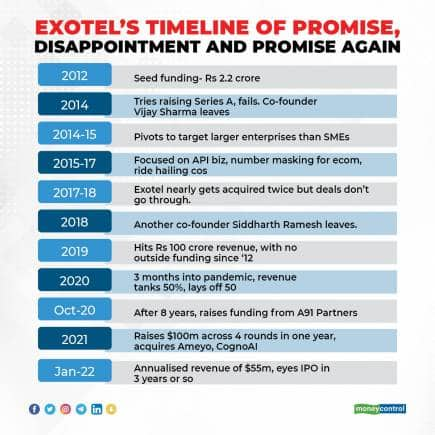

After its first funding round of Rs 2.5 crore in 2012, no investor touched them for eight years. In the intervening period, co-founders left, the company almost shut down or was sold multiple times, people were laid off and well-funded competitors breathed down its neck. The founders battled self-doubt and frustration. Oh yes, there was the matter of a global pandemic.

Cut to 2021. Exotel raised $100 million, 300 times its first round and made two acquisitions. From a startup nobody, it has become a startup VIP, suddenly the subject of quiet speculation and even shock among Indian tech investors.

Exotel is an underdog in every sense of the word. Even internally, employees are addressed in mails as Gauls, referring to a small tribe in Caesar’s Rome that flourished and battled the numerically and culturally superior Romans at the height of their reign-- and a community popularised by the Asterix and Obelix comics, a person said.

“I think Exotel’s survival and success is a seething indictment of India’s venture capitalists. How did no investor invest in this growing, profitable company for so many years?” one investor who missed the boat said, requesting anonymity. So what happened?

“I don’t even have time to take a loo break man,” Ganesan laments as we start our call. “I can keep doing this till I die and it still won’t be over.” This second statement is less a lament, more an acknowledgement of the crazy journey Ganesan, better known as Shivku, and Exotel are undergoing.

Exotel’s revenue has quadrupled in the last 18 months to about $55 million annually, and its valuation has risen even more, to about $400 million. But this isn’t even what Ganesan had set out to do.

In 2010, Ganesan, a former executive of Yahoo and Flipkart, wanted to buy a refrigerator. “I said let me not waste money, let me buy a second-hand fridge. I couldn't find one and found it bizarre; obviously there is someone out there who doesn't want his fridge and wants to give it away.”

That led Ganesan to start a marketplace (a classifieds portal essentially) to buy and sell stuff. “No one had a smartphone. So you send an SMS saying ‘second-hand fridge for sale’, and get back 2-3 SMSs asking for details and who has put it up for sale,” he recalled.

A phone call will work similarly, with a voice recognition system built by Ganesan to connect to the first buyer, second buyer, and so on. Those things are called a bot today. Ganesan was effectively Exotel’s first customer.

But while the marketplace wasn’t really taking off, the software he used to build it did. By the time the marketplace got Rs 30,000 in revenue, companies were buying the software separately paying the same amount. Since a non-core product was taking off, he decided to focus on something that customers were anyway willing to pay for.

In 2012, Exotel raised its first (seed) funding round of Rs 2.5 crore from Mumbai Angels and Blume Ventures, with plans to build cloud contact centres for small and medium businesses (SMBs) in India. Compared to age-old call centres, newer contact centres support customers across voice calls, emails, messages and video, in addition to analytics to judge customer support quality and client-specific API integrations. An Application Programming Interface (API) is a piece of software that helps two apps to talk to each other. It is like a messenger that takes your message, delivers it to the app you want to interact with and gets back a response.

Having grown 40-50% year-on-year in 2014, Exotel was again looking for its next round of funding. But it was in for a rude shock.

We make more money on Ola rides than Ola does, but…Exotel was told by every investor in town that Indian SMBs simply aren’t a big enough market to sell software to (a suspicion that persists among investors to date) and therefore, they wouldn’t invest. With no capital and bleak prospects, one co-founder Vijay Sharma left. The rest—Ganesan, Ishwar Sridharan and Siddharth Ramesh—stayed, although they did wonder for how long.

When funding round did not happen, Ganesan was forced to change his focus, moving from SMBs to enterprises, from cloud contact centres to a platform that enables communication end-to-end.

It was the right call (more on that later), but it wasn't easy. It involved changing beliefs the founders had held for years, digesting the ugly truth of a failed fundraise, and pivoting a SaaS company when its leader had no prior SaaS experience (remember, Ganesan hails from Yahoo and Flipkart, pioneers of different consumer internet eras, if anything)

In 2015, he got a call from Ankit Bhati, co-founder of a new hot cab-hailing app named Ola. Bhati wanted to use Exotel’s APIs for customers and drivers to be able to talk to each other, without exchanging numbers.

Today such solutions are ubiquitous, and companies such as Stockholm-based Sinch and US-based Twilio are multibillion dollar companies. But back then, only Exotel was doing this in India.

“We were making more money per Ola ride than Ola was. We were making Rs 2.2 per ride,” Ganesan says, laughing. Ola was burning millions of dollars to acquire customers and beat rival Uber to the punch.

As India witnessed its first real technology funding boom in 2014-15, new apps that cropped up all began using Exotel—in sectors such as ecommerce, logistics, online education and doctor consultations. Which is when it got even weirder.

You may have heard of the motto Go Big or Go Home, encouraging boldness and extravagance to chase victory.

“There is something very weird about growing 40% year-on-year. You’ve heard ‘go big or go home’ right? 40% growth is no big or no home. 40% is not trivial at all, you can't just shut down the company and go home. But it is also not extraordinary. Neither could we leave it nor could we raise (money).”

“Because we were selling to enterprises, we were making money. We weren’t burning or discounting. We were growing profitably. So we said, screw it, let's just build,” Ganesan said.

Shattered hope and an obsessionAmong other reasons, investors did not fund Exotel because they thought its competitor, Sequoia-backed Knowlarity, had first cornered the market, and then paradoxically, underperformed despite Sequoia’s capital.

“Knowlarity was a big reason many investors didn’t take Exotel seriously. They were seen as the big elephant in the room and had raised 20-30 times more money than Exotel. But while Exotel realised that the SMB market was miniscule and targeted enterprise clients, Knowlarity dug deeper into SMBs and never took off as much as they should have or were expected to,” a person familiar with Knowlarity’s operations said. It is now in talks to be acquired by SaaS unicorn Gupshup for around $100 million, as per a CapTable report.

Knowlarity has an annual revenue of about Rs 100-120 crore compared with Exotel’s Rs 350-400 crore. Its founder Ambarish Gupta left in 2018, with the company now run by former Airtel COO Yatish Mehrotra.

But Exotel continued growing profitably, drawing different kind of suitors in 2017-18. It had two acquisition offers, one of which went to an advanced stage, but the buyer pulled out.

A person involved in the deal said the acquiring company’s stock price was getting hammered in the stock market, resulting in cold feet. Video communication giant Zoom’s $14 billion acquisition of Five9-- a communications software platform like Exotel-- fell through for similar reasons.

Ganesan did not comment on why the acquisition didn’t happen but said he felt frustrated, angry and nervous. A glimmer of hope after years of toil had been extinguished.

“Being that close to a deal and then not happening was a shock to the system and all of us,” said Karthik Reddy, managing partner at Blume Ventures and a board member at Exotel since 2012. “Not raising money or being acquired, they became obsessed with profits, operating efficiency and margins,” he added.

Even if gross margins fell by 2% one month, it would distress the founders. “You never see this in startups. Profits became their overriding culture and gene,” Reddy said.

By this time, the Indian startup scene was well and truly alive with new unicorns and large funding rounds. Even Walmart’s $16 billion Flipkart purchase was imminent.

But Ganesan struggled to retain engineering talent, the core of any tech company. Another co-founder and CTO Siddharth Ramesh left in 2018. While it couldn’t promise the salary or stock options of other hot startups, Ganesan focused on making Exotel a fun workplace where people can solve interesting problems. Senior talent at Exotel has spent 6-8 years in the company, indicating the strategy bore fruit.

“It is very tiring for founders to not have the resources to play to their potential. In a startup it is doubly tiring because you know your own opportunity cost and need world class talent, which needs money,” Blume’s Reddy said.

So when seemingly nothing was going for him, or at least not going the way he or his investors would have liked to, what kept Ganesan going? Ganesan mentions perseverance about five times in a minute in his answers, but also rattles doubtful phrases such as “I guess” or “people say” or “it seems.”

He then pauses for a few seconds. “Okay let me not screw around with this. I also think I persevere a lot. As and when difficulties come, I become more interested in solving, not less. Keep at it, keep at it, keep at it, and never give up. I think perseverance is my superpower. I want to get challenged,” he said.

Reddy said Exotel is an example for Blume’s over 100 portfolio companies, on how to build revenues and scale without excessive capital. Not that he would wish Exotel’s arduous journey on them.

The pandemicAt the start of 2020, Exotel had annualised revenues of over Rs 100 crore. The tide was beginning to turn. A new deal was on the horizon.

Gautam Mago, partner at A91 Partners, had kept in touch with Ganesan since 2012, chatting every now and then, more as a friend, less as an investor. Far less as an investor, because until 2017, Mago was a partner at Sequoia India, which owns over 50% in rival Knowlarity. But he saw Knowlarity underperform with money and Exotel slowly prosper without money.

A91 eventually led a $5.4 million Series B round in Exotel in late 2020, but the deal was in the works for a year. “We had decided to invest before the pandemic. It is rare to find a combination of product and business building quality along with resilience. That’s what Shivku embodied,” Mago told Moneycontrol.

But when the pandemic hit, Exotel’s revenues fell 50% in April. It hardly had Rs 5-10 crore in the bank, having reinvested past profits back in the business.

And it had to let go of 50 out of 180 people, what Ganesan says was among the hardest calls in his life, but needed to be done. “We have to stay profitable month on month, and can’t dip into reserves because there just isn’t that much.”

But 3-4 months into the pandemic, a new trend emerged. As the world worked from home, previously offline-heavy industries such as banking and insurance needed communication support—collection calls, contact centres, click-to-call relationship managers. Cue Exotel to the rescue.

Similar to other industries, rising digital adoption helped Exotel faster than it had planned, raise more money and even pull off two acquisitions—Ameyo and Cogno.AI

In the last year, Exotel has raised over $100 million from investors such as IIFL, Steadview Capital and Sistema Asia. Its revenue has quadrupled and its ambitions are bigger.

“Every single transaction that was happening offline today is going to become remote tomorrow. And that will happen only if communication tech works well. Therefore, it is a no brainer to bet on communication as a sector. Investors globally did,” Ganesan said, adding that even he didn’t expect things would be looking this good.

But today’s Exotel is almost a different company from 2019’s Exotel because it has not just the freedom, but the need to expand and grow fast with money in the bank. Ganesan has consciously worked on changing his mindset from cautious to aggressive. He has mandated internally that speed takes precedence over efficiency, unthinkable not long ago

“As entrepreneurs we approach things with a certain speed, impatience and conviction. The bank balance seems to catalyse that. Between 2012 and 2020, the cost of making mistakes was very high. Now our entrepreneurial instincts have come back. Finally we are in the zone,” he said.

A91’s Mago agrees. “We think Exotel in 5-10 years will be a very important company for India. The main question today is, can the company expand its own worldview? It is always a journey, never the press of a button.”

Now Exotel wants to add video, voicebots and a customer data platform to its capabilities, in addition to ramping up marketing efforts in the Middle East and SouthEast Asia.

Ganesan is still worried that Exotel may get distracted and falter on execution—the one facet which kept it alive all these years. But is a far smaller worry compared to his challenges over the years.

He wants to take the company public in a few years. Ganesan owns 16% and the founders together own about 30% of the company. A successful Initial Public Offering could give them the wealth and recognition many other founders have got in half the time these days.

But Ganesan said he is now “very, very happy”. “I am doing the work of my life. I did not expect to be here. I got here and I’m like wow.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.