2022 started on a positive note for the booming domestic Software-as-a-Service (SaaS) ecosystem in India and globally. The Indian SaaS startups raised more than $5 billion this year, according to data research and analysis firm Venture Intelligence.

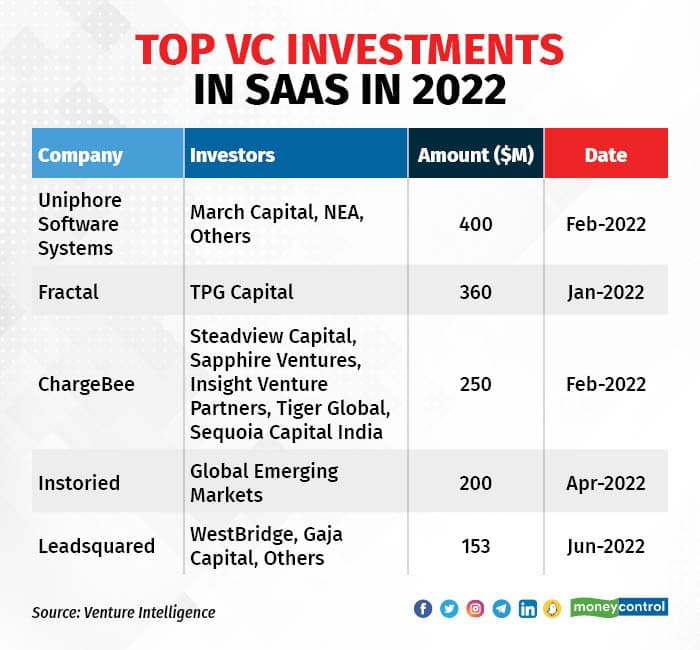

Rewind 2022Mega fundraising deals like Uniphore’s $400 million and Chargebee’s $250 million at the start of the year made investors, founders and other SaaS stakeholders upbeat about the sector. In 2022, India also minted unicorns like Fractal, DarwinBox, Uniphore, Leadsquared.

However, SaaS firms started to feel the heat of slow demand growth in the second half of the year.

However, SaaS firms started to feel the heat of slow demand growth in the second half of the year.

The Russia-Ukraine war and its impact on supply chains, runaway inflation and the US Federal Reserve’s aggressive interest rate hikes led to fears of a recession in the US. Experts are concerned this may lead to lower spending on software, which would be a dampener for SaaS companies.

Top SaaS firms including Salesforce, Freshworks, and Chargebee announced layoffs while other firms resorted to stringent cost-cutting measures like freezing hiring or reducing marketing spends.

"Predicting what will work in 2023 is difficult Even a large firm like Salesforce, for the first time since its inception, did not provide a 2023 forecast, saying “Things are too unpredictable to provide a forecast," said Prasanna Krishnamoorthy, founder of VC firm Upekkha.

However, there are general themes and exciting sectors that may take off in 2023.

What’s in store for the SaaS ecosystem in 2023?

While several Investors and founders Moneycontrol spoke to said that the year 2023 is going to be rough for many due to the likelihood of a recession, themes such as generative AI, Platform-as-a-Service (PaaS) offerings, and Low Code/No Code (LC/NC) platforms cloud security-based software will see more adoption next year.

“I think every company will have to build a predictive as well as embedded AI experience into their platforms and it is going to become table stakes through 2023,” said Krish Subramanian, Co-Founder & CEO, Chargebee.

Founders believe that the ideas that originated in predictive AI technology which found use-cases in HRTech, ChatBots including climate change analysis will start getting the attention of many investors.

“AI will continue to hold a strong ground. Businesses are realising the operational excellence, decision intelligence, and overall value addition that robust AI capabilities can bring to the table. In 2023, CXOs are likely to increase their AI investments to improve their CX and EX,” said Praval Singh, VP - Marketing & Customer Experience, Zoho Corp.

DeepTech will continue to be a favourite betWith many top SaaS firms betting big on DeepTech and doubling down investments, the segment is poised to grow further.

“Any products especially in the DeepTech category that are built to improve operational efficiencies, cut down costs and directly improve bottom lines/revenues will do well,” said Prabhu Ramachandran, Founder and CEO of Facilio Inc.

“The focus is always on building products from the ground up instead of acquiring them, and investing heavily in R&D to gain the know-how and develop deep-tech capabilities like audio-video conferencing and AI frameworks,” said Zoho’s Singh.

Cloud infra, data security and developer tools will grow bigCybersecurity is transitioning to a board-level imperative and is now a non-negotiable capability for every organisation, private or governmental.

“Cybersecurity is a critical national security risk for every country and cyber warfare capabilities will increasingly determine outcomes in military conflicts. The recent breach at AIIMS should serve as a wake-up call,” said T.N. Hari, Co-Founder of Artha School of Entrepreneurship.

A tiny security or privacy lapse can topple even the biggest brands.

“Data privacy and protection will remain critical and see a larger degree of technology investment. This may also push larger companies, especially in certain sectors, to consider on-premises cloud setups in order to retain more control over the software they deploy and their data,” said Zoho’s Singh.

More and more businesses are moving towards cloud, said Manav Garg, founding partner at Together Fund and Co-Founder of Eka Software Solutions.

“Cloud Infrastructure and developer tools are going to be big themes in 2023. India has more than five million developers and this market is going to go big from India to global companies,” Garg added.

He said India will see a lot of regulation coming around data privacy, security, and cloud infrastructure, which will shape how businesses in these segments will grow.

SaaS is getting commodifiedSaaS and software are getting commodified, said Mohan Kumar, Managing Partner, Avataar Ventures.

“While that may not have been true ten years ago, today, it increasingly is…In this setup, SaaS companies should make sure the product features are of absolutely low- cost but still make money out of it. If SaaS companies cannot acquire customers without massive marketing spending then that means there is no market for that product. They have to be very efficient in acquiring customers,” Kumar said.

Companies which are still figuring out product market fit and haven’t raised yet will find it difficult, this is the biggest learning from our business too, said Facilio’s Ramachandran.

The SaaS ecosystem may see consolidationInterestingly, lots of Sales and CRM related tools eg pre Sales / Sales enablement and different "slivers" are becoming a very competitive space, said Sanjay Nath, cofounder, Blume Ventures.

"Unless these products are able to differentiate themselves, there will be consolidation and a sharp narrowing of vendors. Security, storage, data privacy, compliance ("Reg Tech") on the other hand, are must-haves but again differentiation is key," Nath added.

Together Fund's Garg said that companies’ net retention ratio (NRR) may grow slowly or may not grow at all in 2023 and if enterprise SaaS is targeting only SMB businesses, which are more prone to shut down or have financial issues in scaling up.

Due to this many smaller organisations may not sustain in the market. However, their products still make sense for bigger firms. This will eventually result in industry-wide consolidation of SaaS as small-scale businesses will be absorbed by bigger companies. While there have been fewer acquisitions, investors say that there may be more in 2023.

Consolidation will be driven from the customer end as well. As more businesses start up directly or shift their entire operations to the cloud, demand will increase for consolidated—i.e, unified—online platforms.

Companies may go all the way to improve efficiencies

“The numbers like unit economics, churn and SaaS magic numbers which will determine sales efficiency will take centre stage,” Kissflow’s founder and CEO, Suresh Sambandam told Moneycontrol.

Efficient growth is definitely going to be big and a very different breed of companies that will survive through this will emerge stronger,” added Chargebee’s Subramanian.

“SaaS companies selling their products to other SaaS companies may see a hit in their businesses. They are very vertical focused and there is no scope for hedging,” he added.

“Earlier companies started and were structured only for growth, now companies should balance between growth and profit,” Garg of Together Fund added.

Light at the end of the tunnel in 2023Investors said that while the early stage may remain active in terms of deals, the late stage will go through massive challenges.

"We have all seen that valuations are extremely volatile and unfortunately mean little on the ground. Founders should monitor their LTV to CAC and keep improving it to show a healthy business," said Bhanu Chopra, Founder, and Chairman, RateGain Travel Technologies.

“The incentive for someone to start a business is growing, and pre-seed and seed stage investors are still enthusiastic. Maybe not be as active as in 2021 but will be similar to 2022. However, the late stage will go through massive challenges because of the valuation gap. And the IPO market looks very bleak too,” said Manav Garg of Together Fund.

However, founders feel that the recession is helping in some ways and aiding many SaaS firms to grow stronger.

“Exorbitant valuations have come down. 2021 and 2022 saw some frenzy valuations like 40X and 30X, I think that will change. An ideal number can be in the range of 10X to 20X,” said Kissflow’s Sambandam.

“The recession is a good thing in a way because talent is available at an affordable cost, especially in the US. After the great resignation hiring cost went up very high. And it is very affordable,” he added.

"Controlling burn, retaining customers, and growth with a view to profitability are all becoming key survival factors for 2023. And as I indicated above, managing and meeting key metrics such as NDR (net dollar retention), NNR (net new revenue), payback period (sales efficiency) will be key," added Nath of Blume Ventures.

Valuations in 2023 will be realistic and straight-cut.Avataar Fund is very bullish on vertical SaaS, consumer SaaS and banking SaaS, said Mohan Kumar.

“I think a lot of us will build up muscle through 2023. And that means the companies that survived this particular phase over the next 18-24 months will have an opportunity to build those long-lasting companies,” said Chargebee’s Subramanian.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.