Payments solution provider Mswipe has decided to pause its merchant lending operations, as it looks to focus on its core payments business. It now plans to operate as a digital service provider (DSA) and not lend from its own book, co-founder Ketan Patel has told Moneycontrol.

The decision was taken nine months ago. Mswipe gives loans through its non-banking finance company (NBFC) Mcapital .

As a DSA, Mswipe’s role will be restricted to documentation, onboarding, and collections, while the risk and underwriting would lie with the lender. It is already in talks with banks and other NBFCs for partnership.

“We took a call before our loans could turn NPAs. Lending was a minor part of our business, and we will continue to focus on our core payments business. We have the license (NBFC), and will take a call after a year,” said Patel, who was recently elevated from chief executive officer (CEO) to a co-founder.

Before hitting a pause, MCapital, which started lending in 2021 to its merchant network, claimed to have a loan book of Rs 150 crore and planned to achieve Rs 1,000 crore AUM by March 2024.

Rationale behind the decision

Though temporary, Mswipe’s decision comes at a time when the regulator has tightened screws on unsecured lending.

“We saw this (regulations) coming. The board was not convinced initially but understood the rationale later,” Patel said.

With multiple fintechs doling out easy small-ticket loans, Patel questioned the underwriting processes and credit to “ineligible” borrowers, which can pile up bad loans.

“How many fintechs giving out instant loans are profitable? There is a euphoria in the market. Ineligible candidates are given out huge loans. In such cases, it becomes difficult for us to analyse the borrower. The FOIR is gone for a toss,” he said.

FOIR, a debt-to-income ratio, is a popular parameter that lenders use to calculate the loan eligibility of an applicant, and their ability to pay back. Less than 50 percent score is considered ideal.

For instance, an applicant with an income of Rs 30,000 is tied up with monthly installments of Rs 20,000. In this case, their FOIR would be 20,000/30,000x100= 66 percent. This deems the applicant ineligible.

“Becoming is partner seems much more feasible than lending via own book, at present,” the co-founder said.

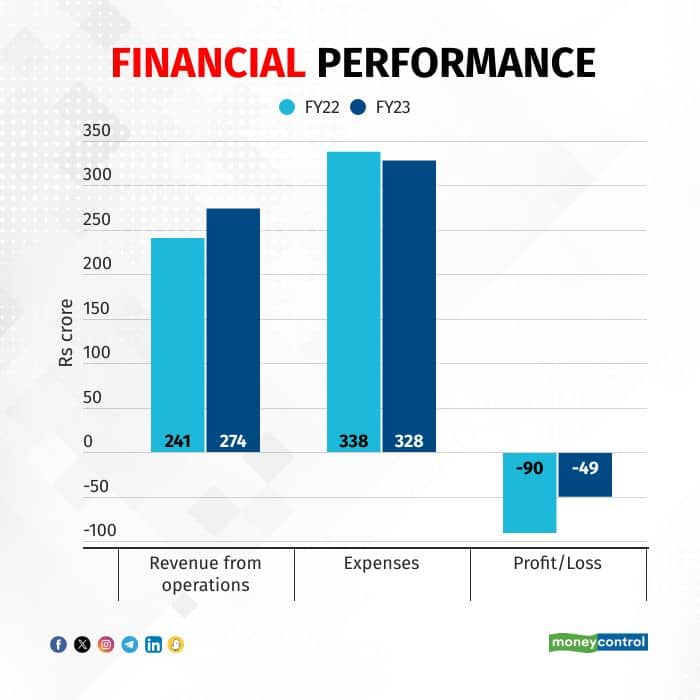

In FY23, Mswipe brought down its losses by 45%

In FY23, Mswipe brought down its losses by 45%

Focus on collections, PaaS

The Mumbai-based fintech is predominantly in Mobile Point of Sale (PoS) terminals business for merchants and facilitates the acceptance of diverse digital payments such as cards, wallets, mobile apps, QR code scanning and payment links.

With a merchant network of more than 6 lakh, the fintech has been looking to diversify its revenue streams with sound box and loan collection services (to banks and NBFCs), both launched a year back.

The company claims to have installed over 3 lakh sound boxes and aims to touch a million by the end of 2024. For collection business, it has tied up with 15 partners, clocking a 20 percent month-on-month revenue growth.

The startup is waiting for the Reserve Bank of India’s final approval of payment aggregator (PA) licence to offer online gateway service to SMEs and other e-commerce players.

“We are vertically integrating all our services, including gateway, risk management, BNPL, onboarding, payment settlement, collections, and launching payment-as-a-service (PaaS) platform. We have already started this in UAE,” said Patel.

In August 2023, the Mswipe expanded its footprint to the UAE through a partnership with Etisalat by e&, to launch an integrated payments terminal, uTap, for SME businesses.

The fintech firm competes with Razorpay, PayU, Pine Labs, CCAvenues, BharatPe, BillDesk and new entrants like Paytm and PhonePe in the offline payments space.

Mswipe, which holds a prepaid instrument licence (PPI), has white-labelled its BNPL platform, which it offers to clients like Worldline and Hitachi.

A white label platform is a ready-made solution offered by third-party providers (Mswipe, in this case) to other financial institutions and other lending entities.

In FY23, the fintech's revenue grew 14 percent to Rs 274.5 crore, while losses came down by 45 percent to Rs 49 crore from the previous year.

Patel said MSwipe, which has raised over $107 million from investors like Falcon Edge, Matrix Partners India, B Capital, Epiq Capital and DSG Growth Partners, is EBITDA positive since FY22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!