Siemens and ABB will be among some of the biggest beneficiaries of power consumption driven by data-centre capacity additions being done in India and across the world, according to Jefferies.

"India’s data centre capacity is seeing 50%+ CAGR and should rise to 6% of demand by 2030 from less than 1%. The US and Europe are discussing grid upgrades in the wake of rising (power) demand and green energy transition. Transmission equipment vendors benefit from the strong domestic and global demand," wrote the brokerage's analysts in their recent report titled "Energy-the food of AI".

According to the analysts, due to this increase in power consumption, Indian companies will benefit from both capex spends and export opportunities.

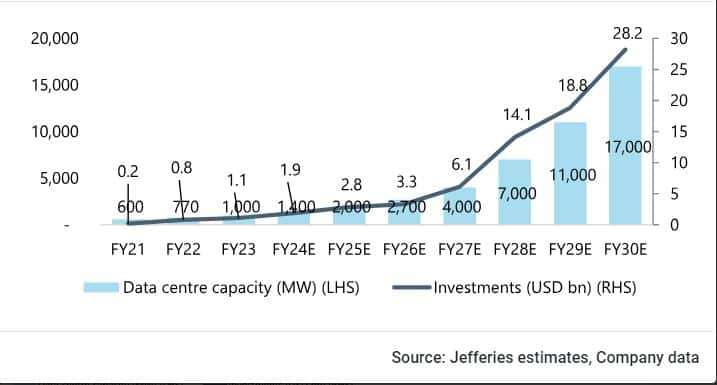

The analysts expect India's data centre capacity to rise 12 times over FY24-30E to 17GW from the present 1-1.5 GW.

Data centre: Upside surprise likely based on announcements

Data centre: Upside surprise likely based on announcementsThe report stated, "Leading global data centre companies NTT, AWS, Colt DCS and Indian conglomerates Reliance and Adani groups have reportedly shown interest in setting up capacity... Occupants include Amazon, Netflix, banks and fintech companies, among others. Investments worth $27 billion have been announced in the last 36-48 months."

This will benefit the value chain of power utilities, the analysts wrote.

The report stated, "Siemens has the largest exposure to data centres in our coverage universe at 40-45 percent of project cost and ABB at 20-25 percent. L&T, Voltas and Bluestar have 15 percent exposure each. Power back-up gensets is 10 percent but largely imported as 2,000 KVA+ capacity lacks local manufacturing. Cummins management indicated data centres accounted for about 10 percent of FY24 power gen segment revenues (4 percent of total)."

Indian companies are also exploring export opportunities. As the analysts noted, KEI began exporting power transmission cables to the United States from Q4FY23 and was expecting incremental orders. Transformers and Rectifiers India, a leading transformer company, saw a 117 percent YoY rise in FY24 exports and was expanding capacity with an export focus approach. And, Apar Industries, Voltamp Transformers, MNC subsidiaries GE T&D, Hitachi Energy were indicating potential benefits from export orders for component/product supply.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.