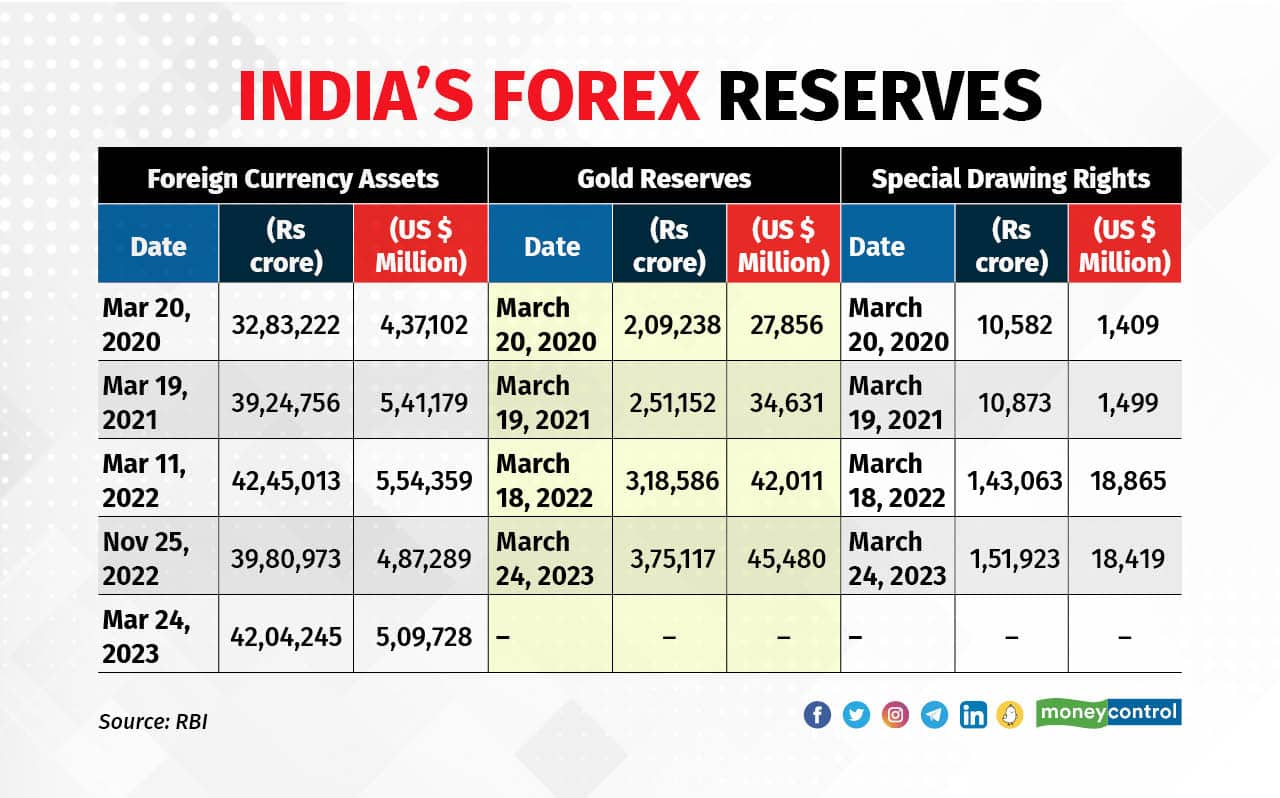

The Reserve Bank of India (RBI) has increased its gold reserves due to uncertainties in financial markets that have triggered risk aversion. According to a Moneycontrol analysis of RBI data, gold, which constituted around 6 percent of its forex reserves as on March 20, 2020, rose to 7.85 percent as on March 24, 2023. RBI’s gold reserves stood at Rs 3.75 lakh crore on Mar 24, 2023, as against Rs 2.09 as on Mar 20, 2020.

The move, analysts said, isn’t unique to the Indian central bank as other major central banks too have turned to gold post Covid, having become more risk-averse in the backdrop of higher inflation and interest rate fluctuations.

According to Reuters, central banks have added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the maximum any year since 1967, per data shared by the World Gold Council (WGC).

“Gold acts like a cross-border currency which is a safe liquid asset amid global uncertainty. It also offers the benefit of basket diversification to central banks,” said Rahul Kalantri, VP, Commodities, Mehta Equities Ltd.

Also read: The Adoor Co-operative Urban Bank gets RBI nod to be a non-banking institution

Other componentsOn the other hand, foreign currency assets (FCA), which were on the rise since the start of the pandemic, saw a sharp decline post March 2022, after the central bank spent from its forex kitty to defend the falling Rupee. But the kitty increased later that year due to improved domestic and international conditions.

In 2022, the Rupee depreciated around 10 percent and breached the 83 per Dollar mark. The sharp depreciation in the Rupee was witnessed due to persistent outflows courtesy foreign institutional investors (FII), and aggressive rate hikes by the US Fed. At present, the Rupee is trading at 81.89 against the US dollar.

According to RBI data, FCA, which is a major component of India’s foreign exchange reserves, moved from Rs 32.83 lakh crore as on March 20, 2020, to Rs 42.45 lakh crore on March 11, 2022, but fell to Rs 39.81 lakh crore on November 25, 2022. Since then, it has recovered to Rs 42.04 lakh crore as on March 24, 2023.

Special Drawings Rights (SDR) rose to Rs 1.52 lakh crore as on March 24, 2023, from Rs 10,582 crore on March 20, 2020.

RBI ups gold reserves post pandemic as risk aversion sets in

RBI ups gold reserves post pandemic as risk aversion sets in“The increase in gold reserves is due to money being parked in a low-risk asset in times of high inflation and interest rate fluctuations,” said Jateen Trivedi, VP and Research Analyst, LKP Securities.

Trivedi explained that the pandemic and the Ukraine war had led to higher inflation and interest rates, which in turn had led to the accumulation of gold reserves.

According to WGC data, the RBI bought three tonnes of gold in the month of February, taking India’s total gold reserves to 790.2 tonnes. India now holds 8 percent of the world's gold reserves.

Since the start of calendar year 2022, India’s forex reserves (FCA + gold, etc.) fell to Rs 44.94 lakh crore on November 25, 2022 , compared to Rs 47.02 lakh crore as on January 7, 2022.

Also read: No framework from Sebi or RBI yet, financial influencers turn a threat to markets

OutlookDealers expect that the trend of rising gold reserves is likely to sustain.

According to Kalantri, this is because historically we have seen the RBI turn to gold in situations like an appreciating Dollar, war, an uncertain global environment, banking crises, etc.

Trivedi said that he sees further rise in gold reserves as most central banks are turning to safe and high-returns assets, rather than just holding foreign currencies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.