Tech Mahindra is expected to report flattish sequential revenue growth in the fiscal third quarter as its mainstay telecom and communications clients see sharp spending slowdown, and furloughs continue to hurt. However, the IT major’s October-December net profit is likely to grow by more than half QoQ, led by robust margin expansion. Tech Mahindra is scheduled to report its Q3 numbers on January 24.

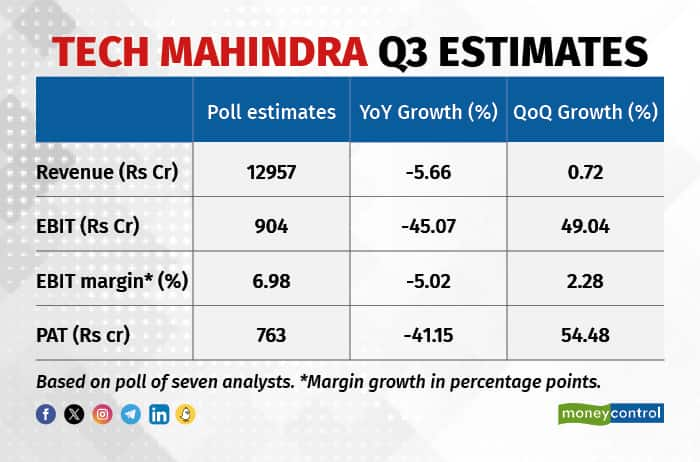

A consensus of seven analyst estimates pegs Tech Mahindra’s Q3FY24 net profit at Rs 763 crore, up 54 percent quarter on quarter (QoQ); and revenue at Rs 12,957 crore, up just 0.72 percent QoQ. Nearly 40 percent of Tech Mahindra’s revenue comes from the telecom and communications vertical, which show almost no revenue growth and are declining, said analysts.

Tech Mahindra Q3 margin set to expand; restructuring shows resultsThe poll pegs Tech Mahindra’s quarterly EBIT margin at 6.98 percent improving 228 basis points sequentially. In turn, the company’s EBIT is expected at Rs 904 crore, rising 49 percent QoQ.

Margins are projected to expand due to the company’s business restructuring actions, according to brokerages. Earlier, in October, Tech Mahindra CEO Mohit Joshi said that the company had cut its Americas business into three units, while it consolidated Europe telecom and non-telecom business into a single unit. Further, it consolidated its Asia Pacific and Japan business under a single management, while carving out its India business into a separate unit.

Nuvama in a note said Tech Mahindra will report a 1 percent QoQ decline in constant currency and a 1.4 percent decline in USD revenue driven by weakness in the telecom segment and higher furloughs. Margins are likely to expand by 85 basis points QoQ, staying in the 5-6 percent range, on the back of various business restructuring actions, it added.

Axis Capital said it expects a 0.2 percent QoQ decline in constant currency revenue thanks to struggling communications and enterprise segments. Reported EBIT margin is expected to improve by 170 basis points QoQ, though significantly lower than normalised margins due to the reprioritisation of the portfolio. “We expect EBIT margins expansion of 100 bps to 5.7 percent,” the brokerage house said.

According to a pre-earnings note by Phillip Capital, constant currency revenue will decline by 0.9 percent QoQ due to continued weakness in its communications vertical and weak discretionary spends impacting growth in enterprise vertical.

On an year-on-year basis, Tech Mahindra is set to see a sharp fall in both revenue and net profit, down 6 percent and 54 percent, respectively, according to brokerage estimates. Nuvama said deal wins are likely to be weak YoY, as is the overall outlook.

Earlier, even in the July-September quarter, Tech Mahindra reported a 61.6 percent fall in net profit to Rs 494 crore year-on-year driven by slowing demand in the telecom and communications segment and delays in deal cycles. Consolidated revenue declined 2 percent YoY at Rs 12,864 crore. On a QoQ basis revenue was down by 2.2 percent.

According to analysts polled by Moneycontrol, key things to watch from Tech Mahindra are:

- Qualitative commentary on timelines for recovery in margins given the significantly subdued levels in H1;

- Strategy to improve the operational profile;

- Near-term impact of the recently announced reorganisation that is leading to a few senior-level exits;

- New strategic initiatives by Mohit Joshi, the new CEO;

- Deal TCVs (total contract value) and pipeline;

- Outlook on growth/margins for FY24;

- 5G commentary

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.