When you walk into your bank branch to buy a mutual fund (MF) scheme, what do you expect?You would want your relationship manager to understand your financial goals and recommend a solution that is in your best interests, right? Well, it doesn’t quite turn out that way.

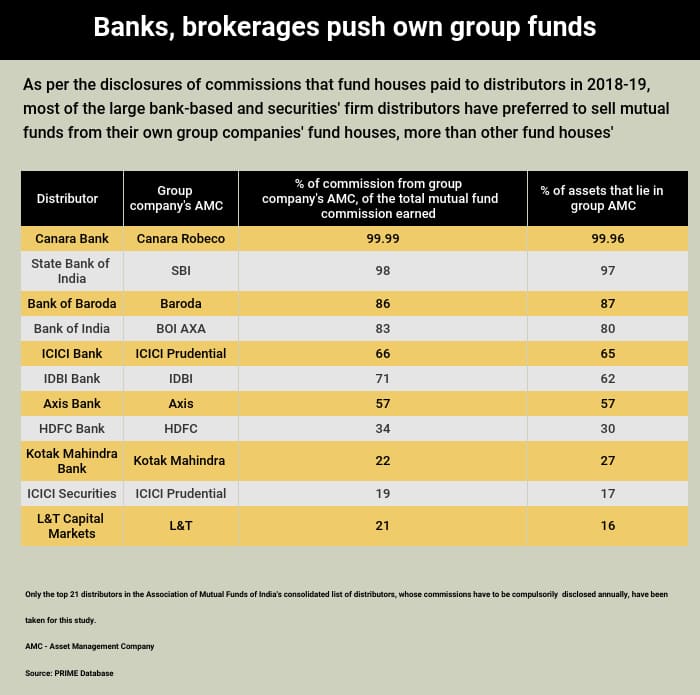

A compilation of data on commissions(from industry body AMFI) that distributors—including banks and brokerage houses—earned in the year of 2018-19 and the funds that they have sold, indicates that banks prefer to sell their sister firms’ MF schemes more than those from other houses. It doesn’t seem to matter if their in-house funds make the cut or not in terms of performance records and investor suitability.

And, the story doesn’t stop with just the banks; even brokerages belonging to large financial services groups seem are partial to their own sister firms’ MFs, according to a Moneycontrol analysis based on data provided by Prima database <see table>.

SEBI guidelines require mutual funds are required to disclose the commissions they pay distributors if these entities are present in at least 20 locations or if they generate inflows of a minimum of Rs 100 crore in a financial year or if they earn commissions in excess of Rs 1 crore annually across industry or Rs 50 lakh from a single fund house.

Illustration: Sudhir Shetty

According to AMFI data, there were 2,750 distributors who matched one or more of these criteria.

We shortlisted the top 21 distributors based on the quantum of commissions that all distributors earned in the year of 2018-19.

Preference for own group schemes

Of the total commissions that Axis Bank earned, 57 per cent of its commissions were earned from selling Axis Asset Management’s schemes. Of its total assets (amounts invested by its customers in the mutual funds through the bank), 57 per cent was in Axis AMC schemes alone. Next comes ICICI Prudential AMC, which accounted for just 11 per cent of Axis Bank customers’ mutual fund assets. Other private sector banks aren’t far behind in suggesting group company schemes to their customers.

State-owned banks paint a poorer picture. Take Bank of India for instance. A whopping 83 per cent of its commissions came just from BOI AXA AMC. Eighty per cent of its corpus lay in BOI AXA AMC schemes, despite the bank having sold schemes from other fund houses. The fund house is going through troubled times; in June 2019, on two occasions, its credit risk debt fund fell by 15 per cent and 26 per cent in a single day. BOI AXA AMC’s schemes come with average to poor track records; yet Bank of India deemed it fit to invest its customers’ money in the fund house.

State Bank of India, the country’s largest lender, appears to be the worst of the lot. Despite distributing schemes from 17 fund houses, it sold funds of its group firm, SBI Funds Management, the most. A staggering 98 per cent of its commissions earned came from SBI Funds Management. Around 97 per cent of its assets (money invested by its own customers into mutual funds, through the bank) are invested in SBI Funds Management. To be fair,

SBI Funds Management does come with a reasonable track record. But given the size of the bank (22.38 per cent of India’s bank deposits), its wide reach (22010 branches; the most among all banks in India) and the large number of customers (43.51 crore), it is strange that SBI appears have put, literally, so many eggs in just one basket.

Questioning the selling practice

Moneycontrol asked three questions to all the above distributors.

- With a high proportion of assets lying with its own sister firm, within the same group, isn’t the investment advice given to the bank’s customers, biased?

- Does selling a majority of its in-house fund house amounts to mis-selling?

- Does the bank conduct detailed risk-profiling and ensure that its relationship managers and branches sell mutual funds that fit the customer’s risk profile and requirements?

By the time of publishing, only ICICI Securities and Kotak Mahindra Bank had responded. None of the other banks / securities firms responded. Axis AMC refused to respond. “The second largest fund house’s contribution to our MF (commission) revenue is about 15 percent, which is only slightly less than that from ICICI Prudential.

The top five contributing AMCs have a 61 per cent share in our MF income, which at the industry level is around 50 per cent, again reaffirming that we follow the broad market trend,” said an ICICI Securities spokesperson. He added: “There is absolutely no bias towards any fund house, as we operate in an open architecture model (a platform that sells multiple- other- fund houses and not just one), which is backed by independent research.”

To demonstrate that the form was unbiased, it gave Moneycontrol the number of funds—and of these, the number of schemes that belonged to ICICI Prudential—for every MF category it recommends. Half of these categories carry a single scheme each from the fund house; the other half of categories don’t have an ICICI Prudential AMC scheme on offer.

“At the group level, there are customers who prefer to avail of services and products for varied financial needs from within the same group. Hence, it is only natural that various subsidiaries will have a slightly higher saliency of group company products,” added the spokesperson.

Rohit Rao, Chief Communication Officer, Kotak Mahindra Group said “the bank conducts a detailed fund selection exercise based on a number of parameters, due diligence on the fund house and fund manager etc., and thereafter prepares a list of recommended mutual funds for customers based on their risk-return profile. Importantly, an independent investment committee reviews and approves the recommended schemes.”

“Kotak Mutual Fund accounts for 27.8 percent of the bank’s MF AUM share as on March 31, 2019 as against 15.8 percent as on March 31, 2014. Further, in the same period, Kotak Mutual Fund’s AUM has grown from Rs 37,000 crore to Rs 149,644 crore – a 300 per cent growth in a span of five years as opposed to the mutual fund industry’s growth of about 150 percent in the same period. The bank’s customers contribute little to the growth of Kotak Mutual Fund AUM, when compared to either the wider rate of growth of the industry or the overall growth of Kotak Mutual Fund itself. Our customers’ interest is always at the forefront while distributing financial investment products, including mutual fund products,” adds Rao.

Testing the advice

Industry experts say that if a bank recommends in-house products significantly, then the advice is likely to be biased. “Banks have pulls and pressures from within their group to sell mutual funds, if any, from their own group, first. Unfortunately, investors suffer as they do not get the full benefit of complete product bouquet,” says Deepak Chhabria, CEO and Director, Axiom Financial Services, a Bengaluru-based distributor of financial products. Speaking from his own experience, Chhabria says that many times, while visiting his Bank of India branch where he and his wife have a savings bank account, a sales official tries to persuade him to invest in a BOI AXA mutual fund.

Chandresh Nigam, managing director of Axis AMC points out that typically first-time equity investors, who walk in to their bank branches to buy a MF scheme, prefer a good and trusted brand. “They usually do not make the distinction between a banking and a mutual fund product. The easiest thing for them is to buy a mutual fund that bears the same brand name as that of the bank. Probably, their second or third mutual fund scheme would come from another fund house.”

Nigam also points to the distinction between a bank’s customers and a securities firm’s customers. The latter, he says, are more evolved and knowledgeable because they would be investing in direct equity shares and other instruments. They ask intelligent questions and prefer to diversify. This, he says, is perhaps why 50 per cent of all (net) inflows that Axis Bank got, was invested in Axis MF, where Axis Securities invested just invested 18 per cent of its net inflows in Axis Bank.

“Retail banks—those that cater to the small saver—get a strict diktat from their group to sell their in-house mutual funds the most,” says the chief executive officer of a fund house, requesting anonymity. The other reason, he adds, why it pays for fund houses to stick to in-house distributors is also because they can get away by paying lesser commission to their in-house distributors, as opposed to external ones. “Besides, a bank gets a lot of operational support, training for the bank’s sales staff, and customer service from its own group’s fund house. It’s a cosy arrangement”, says Jignesh Desai, Co-founder & joint managing director, NJ India Invest Ltd.

What should you do?

Chhabria says that if a bank sells too much of its own fund house, customers run concentration risk; too much of their corpus would be invested in just a single fund house. If anything drastic happens with this fund house, say the fund management changes, then all funds get impacted.

Just because you trust your bank, you are not obliged to buy all its products. Your banker has historically preyed upon your dependence and kept the options hidden. Have a chat with your bank's relationship manager about your financial goals and insist on options that go beyond your bank’s brand name. Study the performance of the schemes and risk figures, and ensure you buy a fund that fits you the best.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!