The Securities and Exchange Board of India’s (SEBI) proposal to allow mutual funds to charge higher fees if a scheme beats the benchmark consistently will certainly benefit fund houses, but experts are unsure whether this move will be beneficial for retail investors or not.

Mutual Funds in India charge certain operating expenses for managing a mutual fund (MF) scheme, such as sales/marketing expenses, administrative expenses, etc., as a percentage of the fund’s total assets.

This is referred to as the total expense ratio.

While equity funds can charge up to 2.25 percent, non-equity schemes can charge up to 2 percent.

SEBI is now contemplating a fundamental change in this approach, wherein it is looking at allowing mutual funds to charge performance-based fees for managing funds.

Also read | Performance-based fee for mutual funds: What stakeholders say

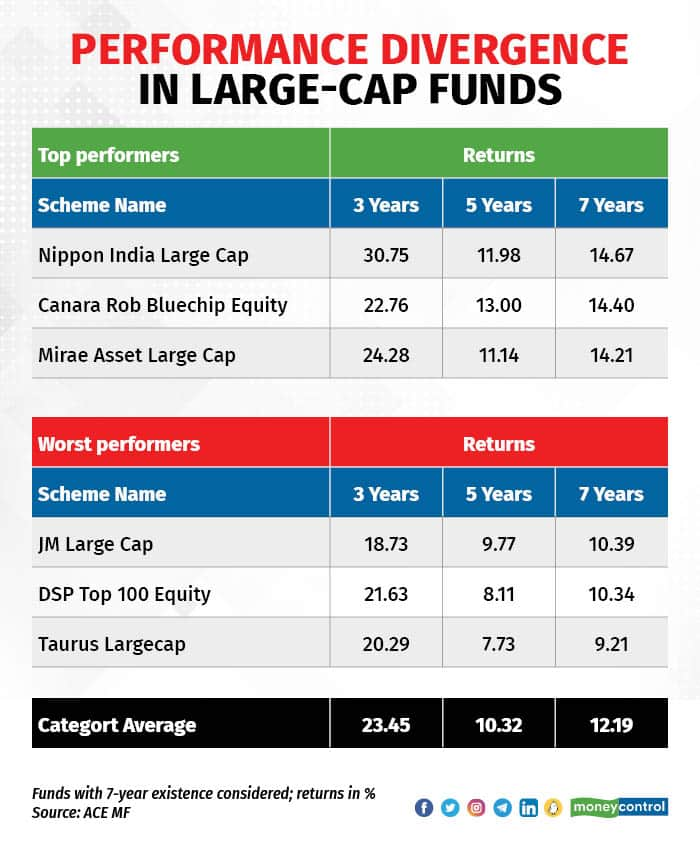

Do we need such plans?While the details are still sketchy, experts say the regulator is contemplating such a move given the underperformance of active schemes over the past few years.

Per the findings of the recent SPIVA India report by S&P Dow Jones Indices, 88 percent of actively managed funds underperformed the S&P BSE 100 index in the year ended December 2022. Over a three-year period, this underperformance widened to 96.67 percent.

While active schemes have struggled to beat their benchmarks, passive schemes have dominated the MF industry, garnering net inflows of Rs 1.57 trillion in the financial year 2022-23.

On the other hand, active funds saw net outflows of Rs 53,826 crore during the recently concluded fiscal, mainly due to the selling in debt funds.

Despite this, experts are of the opinion that a new performance-based fee structure will complicate things for both investors and MF houses.

Also See | Curated list of investment-worthy mutual fund schemes

“This is over-regulation. If you look at global markets, only the UK and the US have performance-linked fees for mutual funds. Just because active funds are underperforming the index, the regulators are looking to introduce this,” said Kirtan Shah, founder of Credence Wealth Advisors LLP.

Dhirendra Kumar, Chief Executive Officer of Value Research, meanwhile, believes that the biggest issue is that there is no reasonable way of implementing this in open-ended funds that is fair to investors.

“In theory, performance-based fees sound like a good idea. If a fund makes more money for its investors, it gets to earn more. At a cursory glance, it looks like a good incentive system that will encourage funds to perform better. Whether it actually functions like that will be a challenge,” he added.

Globally, there are two ways of charging performance-linked fees. One is an asymmetric performance fee (APF) that rewards outperformance relative to the benchmark over a period, but does not penalise poor performance. A symmetric performance fee imposes a penalty for underperformance equal to the gain for outperformance.

What structure the Indian capital markets regulator may prefer for the Rs 40-trillion mutual fund industry is not known yet.

Experts feel that implementing performance-based fees may be a big challenge in case of open-ended mutual funds.

“If a fund starts doing well, it will attract more investors. Better performance will mean that the fund can start charging a higher fee. It will charge higher fees from those who invested in the scheme after looking at the outperformance. But then, these new investors haven’t seen the outperformance. So the question is, when will you charge more for outperformance, after or before. To be fair and equitable amongst all investors, expenses must be charged on a daily basis as investors keep getting in and out of an open-end fund every day. Hard to see how this can be made to work,” said Kumar.

Also read | Cruise control: How extra charges can inflate your cruise expenses, and how to control them

Experts also believe that while performance-linked fees could incentivise better fund performance, it could also prompt excessive risk-taking.

“It seems fair to pay higher fees for higher returns, but the system could lead to benchmark manipulation, with managers choosing easy targets to maximise earnings. The complexity of implementing this in mutual funds, where thousands transact daily, is a logistical challenge,” said Sonam Srivastava, Founder at Wright Research, a SEBI-registered investment advisory firm.

Therefore, there are fears that the system might encourage short-term focus for immediate gains, compromising long-term growth.

“While better performance justifies higher fees, if unchecked, this could escalate costs for investors. So, while performance-based fees could enhance accountability, the specifics of implementation, like defining 'performance,' fee calculation, and conflict of interest management will determine its effectiveness,” added Srivastava.

Also read | 54% of new mutual fund investors are millennials

Experts are split on whether the move will help investors.

For mutual fund houses, there is a built-in incentive for doing well as investors usually reward such asset management companies with higher inflows.

“Even now, we effectively have a performance-linked fee. If you do well, you get more money, and then you end up making more money. Mutual funds are a very attractive business. When you do well the rewards are disproportionate,” Kumar said.

On the other hand, Shah said, “If something like what prevails in some global markets is introduced in India, then definitely the investor community will benefit because you will pay lower charges if the fund is underperforming, and if it is outperforming, you might end up paying slightly more than you would have otherwise.”

Shah is also of the opinion that performance-linked fees structure will also make things complicated for investors who currently have to decide between direct and regular plans. “Not sure how many retail investors will understand these nuances,” he said.

Also read | AMFI asks fund houses to stop training programmes based on SIP targets for distributors

Vidya Bala, Co-founder of PrimeInvestor.in, also doesn’t see SEBI’s move to be a game changer.

“Investors switch to better-performing funds, that’s the scenario today. Fund houses have become increasingly cost-conscious, they have gone for lower-cost products. It doesn't benefit me to stay with an underperforming fund. Lower-cost products and passive products coming up will matter to investors more,” said Bala.

Investor education is another key factor that will determine whether retail investors benefit from performance-linked MF fees.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.