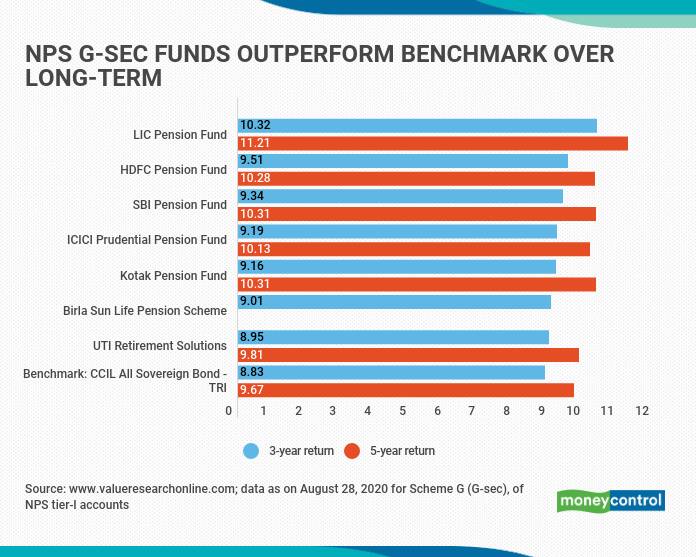

All the national pension system (NPS) managers have delivered well on their scheme G (government bond funds) and outperformed the benchmark CCIL All Sovereign Bond-Total Return Index over three years, as per data from Value Research.

Even UTI Retirement Solutions’ Scheme G, which yielded the lowest three-year returns (8.95 per cent) amongst the lot, is marginally ahead of the benchmark (8.83 per cent). The seven pension fund managers delivered returns of 8.95-10.32 per cent annually during the period, with LIC Pension Fund grabbing the top spot with 10.32 per cent returns.

It was also the top performer in the five-year period, clocking 11.21 per cent return. In fact, all NPS government securities funds, barring UTI Retirement Solutions’ scheme G, recorded double-digit returns annually over five years. The other four pension fund managers with at least a five-year track record registered returns between 10.13 per cent and 10.31 per cent annually during the period. Again, all schemes outperformed the CCIL All Sovereign Bond-Total Return Index by a distance.

G-sec funds are the safest amongst the asset classes – equities, corporate bonds, alternative funds –thanks to the sovereign backing. You can allocate up to 100 per cent of your investments towards government security schemes. In the case of auto choice, where the allocation is pre-determined, exposure to G-secs goes up gradually as you grow older and move closer to retirement, to insulate your corpus against market volatility.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.