Mumbai-based Ankit Bansal, 28, was working in the digital marketing team of a travel & tourism firm. He lost his job in April 2020 due to the COVID-19 lockdown. Being the sole income earner in his family of four (including elderly parents and a younger sister), managing expenses for monthly groceries, utility bills, etc. fell on his shoulders.

Ankit’s story is not unique in these times of job losses and pay cuts. In the last couple of years of the pandemic, thousands have faced a similar situation.

If you find yourself out of a job or face a steep wage cut, you must not despair. You must take control of your finances even more now and follow a rigorous budget.

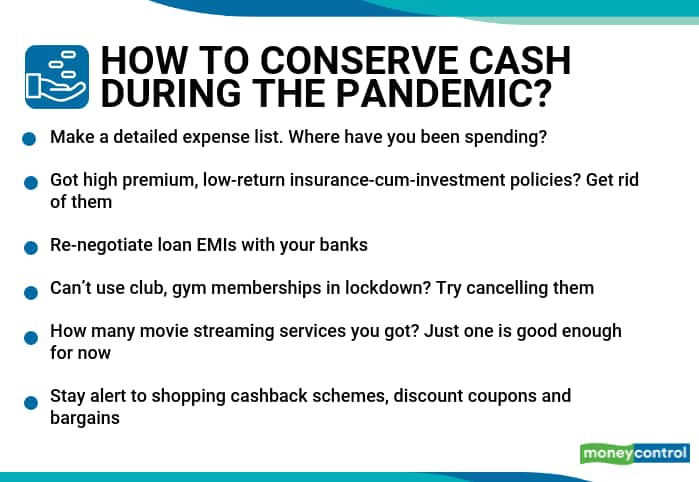

Here are some budgeting tips for people who feel cash-strapped during this crisis.

Prepare a budget immediatelyUnderstanding the current financial situation of his family, the first thing Ankit did was to list all the expenses of the previous three months, including grocery costs, utility bills, insurance premiums, dining and entertainment expenditure, education loan EMIs. “It’s important to maintain a stringent record of all essential expenses. Be disciplined with your budget and ensure that every penny spent is for a genuine reason,” says Saurav Basu, Head of Wealth Management at Tata Capital.

Ankit evaluated the expenses and prepared a budget from the savings available. He cut down on unnecessary expenses, including on non-essential shopping, watching movies at the theatre and dining in restaurants. Some of these expenses would anyway not figure during the lockdown.

Dev Ashish, founder of StableInvestor.com says, “If you are unable to save the required amount every month for essential expenses, then you have to cut down on other expenses to create more surplus or reduce the budget.”

Review your portfolio carefully. Too many traditional insurance policies that you don’t need, consistently underperforming mutual funds or a portfolio with too many liquid fund investments with negligible balances in each, but when combined make a tidy portion can be a contingency corpus in this situation. Kalpesh Ashar, CFP, Full Circle Financial Planners and Advisors says, “Your financial advisor can help you identify such investments that you can sell.”

Re-negotiate with your bank for loan instalmentAnkit is servicing education loan. In the second wave of COVID-19, his company has reduced the salary. To avoid default on education loan instalment he approached the bank and discussed the financial situation. Prashant Bhonsle, Head Student Loan and CMO, Incred says, “If the bank finds your application legitimate and claim to be genuine, it may extend your loan tenor. This will reduce the EMI burden immediately.”

Analyse your monthly and annual membershipsCancel any membership and claim for refund for any club memberships you may have. Given that sporting and group social activity would anyway be disallowed in these pandemic times, it makes sense to give up such memberships. The refund may be given after deducting charges. But it would still help your cashflows.

You might have paid software installed on your mobile phone or laptop. You would be charged on your credit card every month. If you haven’t used that paid software in the last three months, then consider opting for a free version. This will also save on recurring expenses.

Also, restrict yourself to one video streaming app. You could also check for a bundled plan with your mobile network service provider. For instance, Vodafone red post-paid customers can avail free subscription to Netflix for one year.

Use cash-back scheme wiselyWhile shopping for monthly groceries and essentials, use the debit/credit cards, mobile wallets or net banking services wisely. These days, there are multiple instant cashback schemes available on e-commerce websites while making payments digitally. Use these payment options as a priority instead of cash. You also get cash-back for paying utility bills (telephone, mobile, electricity, piped gas, etc.) on Paytm, Amazon pay, FreeCharge, etc.

Sapna Tiwari, Co-founder and COO, Rupeewiz Investment Advisors says, “Explore these options when you pay your next bill online. These are some of the methods to expand your monthly budget and save on your next bill.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.