A recent newspaper report about suicide by a Bangalore-based man, Nanda Kumar, stated that he had availed loans from at least 40 instant loan mobile apps and his inability to repay led to recovery agents coming after him. After being harassed by them, Kumar decided to take the drastic step and ended his life.

Kumar is not alone when it comes to loan repayment going wrong. The harassment in many other reported cases is similar and relies on morphing publicly available information of the borrower, particularly personal pictures, in a compromising way. This leads to extreme embarrassment which is difficult to explain away, given that the explanation itself would reveal the extent of debt that person was reeling under.

According to data from National Crime Records Bureau, the number of suicides has seen a big jump since the pandemic hit and roughly 25,200 of those are attributed to job losses and being in debt.

The story is similar each time. Loan apps enable small-sized loans, which many individual borrowers take several times across different app-based lenders. However, if the borrower has just lost his job or the salary is just enough to sustain timely repayments, then the equated monthly instalments (EMI) just keep adding up. All this leads to loan recovery sharks coming after not just you, but your friends and family too.

RBI has recently published recommendations of a working group on Digital Lending which lays down guidelines around customer protection and conduct issues. Hence, the regulator is watching out for loan traps and misconduct by lenders.

Also read: Know your rights to fend off recovery bullies unleashed by fintech lenders

“We use analytics to understand consumers’ background and get insights on their purchase behaviour to determine their spending limit and ensure that they have not overleveraged. We believe in prudent lending, ensuring that the debt obligation for the consumer is within his capacity to repay. This is one of the important pillars of our strong underwriting system. With the new guidelines in place, Lending Service Providers (LSP), whether regulated or unregulated, have also come under the new guidelines’ purview,” Mayuresh Kini, Chief Operating Officer (COO), PayU Finance.

While the more organised fintech lending platforms are perhaps more cautious before approving loan applications, there are others who may not go the whole hog. Being cautious while adding numerous loans and managing your money judiciously are important and in your control. You’re best placed to know if your loan is laying out a death trap.

Living off borrowed money is not a plan that can be followed to perpetuity. At some stage you will not be able to get the next loan, and if that happens, you will not be able to repay the previous one. As a first step, distinguish between loans taken to build an asset versus loans taken for consumption.

Typically, experts advise on taking a home loan when we buy a house. This is because a house is an asset. We either build a house for us to live in or to rent it out which gets us rental income. In other words, it’s an asset. This is different from, say, buying a smartphone on loan or using a payday loan to buy a birthday gift for your spouse.

Home loans are also used to create an asset which gains in value over time.

However, if the size of your home loan is disproportionate to your income or if your earning capability is adversely affected, repaying your housing loan can get tricky.

Education loans are considered for creating the ability to repay in future with the help of skills garnered, thanks to the education the loan has funded. However, all other kinds of loans linked to personal consumption should not be taken for granted, and if you are indulging then make sure you repay on time every time.

According to Deepali Sen, Founder, Srujan Financial Services LLP, “A home loan for a place you will stay in, is a good loan, but a very high-value loan can end up being a trap if you want to take a sabbatical, retire early, start an enterprise or end up losing your job. The risk with loading up too many consumption loans is that they can be life-altering and not easily reversible. We cultivate habits, and after a while, those habits tend to run our lives.”

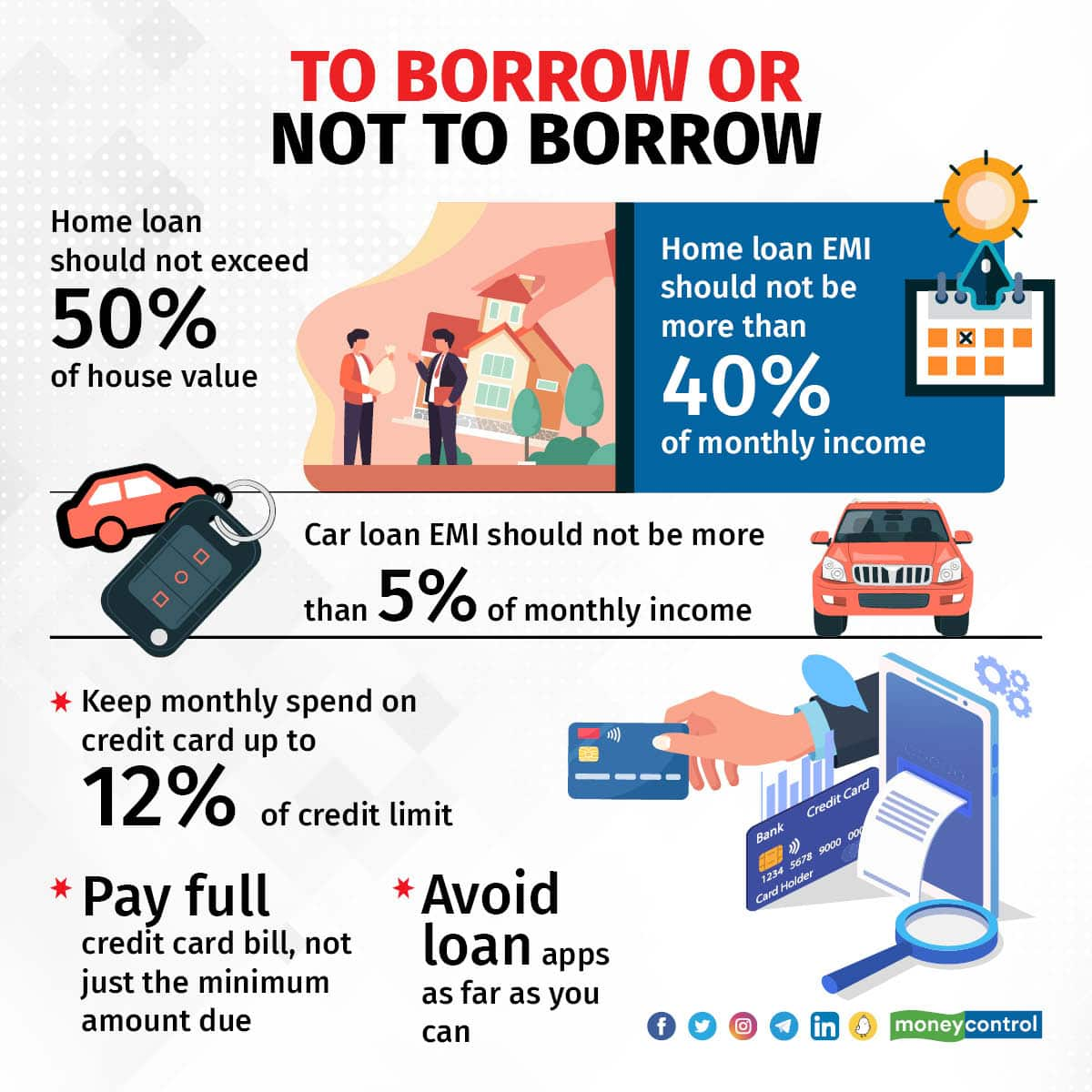

To avoid going overboard on loans, keep these thumb rules in mind:

- Your home loan should not exceed 50 percent of the value of the house you are buying.

- The home loan EMI ideally should not be more than 40 percent of your monthly income.

- If you have a car loan, ensure the monthly repayment is up to 5 percent of your monthly income and not more.

- If you use a credit card, make sure your monthly spend is not more than 10-12 percent of the credit limit and repay the full overdue amount before the due date every month.

- Education loans can start to become a burden if you are unable to secure a well-paying job. Hence, keep it as a last option.

- Avoid all kinds of personal loans and app-based loans which nudge you to spend on basic consumption.

- In case of zero interest loans, ensure that not more than 10 percent of your monthly income goes towards repaying these loans.

- Don’t confuse a business loan with a loan taken for personal consumption

"Borrowing through the app is the easiest way out. The mechanism is more straightforward than any other form of borrowing. But the borrower has to be mindful that it's not about getting money faster but servicing the debt. A new edge platform does the lure of advertising, or the way messaging is to get the buyer/borrower to click. When advertising flashes (while making any purchase online) convert to EMI or easy loan available in clicks, it's difficult to ignore the offer,” says Kshitija Shete, cofounder of Gaining Ground Investment Services

According to Sen, “Pay-later schemes and zero interest EMIs just aid further in building slack in spending patterns. In my opinion, there are no free lunches; you end up moving further away from prudent money behaviour impacting you or your family.”

What should you do?The lure of upgrading your lifestyle in today’s times when everything is available at the click of a button is very high. There are nudges all around us, telling us to buy more and more of things which don’t last long or we don’t really need. The loans happen when we consistently focus on buying things beyond our affordability and what we don’t need.

Shete advises to be mindful about your cash flow; income vs commitment. "Doing this exercise at periodic intervals helps balance expenses/ loan commitments. Moreover, we have seen that awareness to invest more or to feel in control comes from cashflow planning,” she says.

Learning to spend within your income is not really an easy task. Once you get used to spending more than you earn, get used to the good things, then turning back to owning less is the hard part.

Nevertheless, focusing on living within your means and taking loans only to create income-generating assets is the answer to ensuring that your loan(s) doesn’t kill you.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!