KreditBee, a digital lending platform, has recently launched a ‘KreditBee Card’. The idea is to provide credit to unserved and underserved banking customers. The company has partnered with RuPay and RBL Bank for the launch of this product. According to TransUnion CIBIL consumer bureau enquiry data collated between January 2019 and January 2021, nearly 16 percent of the new-to-credit (NTC) customers wish to apply for the credit card.

What does KreditBee card offer?The company issues the KreditBee virtual credit card to select customers by evaluating their employment details, past repayment history, social media activities that provide vital clues to the borrower’s behaviour, etc. You can apply for a card through the KreditBee App and view the card details on the app.

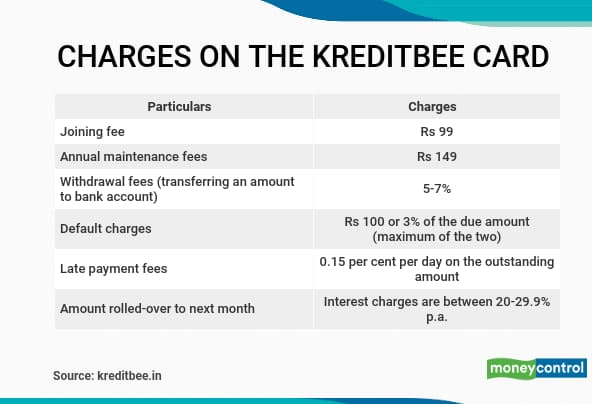

Initially, the NTC customers can avail a credit amount of up to Rs 10,000. The credit limit will be enhanced based on repayment ability and full KYC of the customers. You can transfer cash to your bank account or shop anywhere online from the credit limit on the card. The amount utilised on credit should be paid within a billing cycle, not going beyond 45 days. A one-time fee of Rs 99 is being charged when the card gets activated. From the second year onwards, Rs 149 is charged as annual maintenance fees. Once you pay your bills, your monthly credit limit gets reinstated.

Also read: Confused on which credit card to opt for? Here’s help on how to choose

What worksYou can use the KreditBee card like any other bank credit card while shopping online. You can only transfer the amount to your bank account or use the card online up to the limit available. Any purchase or transfer exceeding the limit available gets rejected. So, you must not exceed the credit limit.

“The virtual credit card assists the NTC customers to build their credit score, avail financing in the future, thus ushering in a healthy credit culture and financial inclusion,” says Madhusudan Ekambaram, Co-founder and CEO of KreditBee.

What doesn’t workThere are multiple charges levied on the card. For instance, if you transfer an amount to the bank account from the assigned credit limit (Rs 10,000 at present), the lender charges withdrawal fees of 5-7 percent of the withdrawn amount.

In case of default, a bounce charge of Rs 100 or 3 percent of the due amount (maximum of the two) is charged to the customer. Any delay in payment of due amount (beyond the credit cycle of 45 days) attracts late fees at 0.15 percent per day on the outstanding amount, from the date of default until receipt of monthly instalment. Aside from late fees, interest charges range from 20-29.9 percent per annum.

Also read: Want to use your credit card wisely? Stick to these spending and repaying rules

New to credit? Use the card wiselyAs a fresh borrower, your lender will scrutinise other aspects of your life to get to know you better before issuing the card. Do not default on the dues. Have a plan to avoid debt traps at the beginning of your career itself.

Avoid paying minimum amount due and rolling over the remaining amount to the next month. The outstanding due on credit card shouldn’t be more than 30 percent of your take-home salary. “If you are not in a position to repay your credit card debts and end up defaulting, it will affect your credit score,” says VN Kulkarni, Former Banker and financial counsellor. Defaults reduce your chances of getting a loan later for genuine purposes such as buying a house.

Having a credit card is one of the simplest ways to building a good credit profile. “Build a credit history over a period, and then apply for a home or auto loan,” says Gaurav Gupta, Founder, Myloancare.in.

Moneycontrol’s takeThe KreditBee’s credit card is offered to millennials in their first job and to new-to-credit customers. However, a better way to take a credit card despite having no credit history is to go for a secured credit card. State Bank of India, Bank of Baroda, Kotak Mahindra Bank and Axis Bank among others offer secured credit cards against fixed deposits. These banks issue secured credit cards provided you invest in their fixed deposits.

If you delay your payments, the bank simply liquidates your FD, or a part of it to the extent of your outstanding dues, and recovers the money. The bill gets paid on time, interest or late payment charges are lower compared to regular credit cards. Also, some banks charge lower interest on secured cards compared to regular credit cards.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.