There's no need to worry if you're a business owner finding it difficult to open a bank account and constantly facing rejections because of complicated paperwork and administrative procedures. You can now effortlessly open a business bank account by providing your EIN.

Setting up your business banking can be simpler and quicker without frustration or delays. This article will provide instructions on how to open a business bank account with EIN only. By following these steps, you can concentrate on the growth of your business and avoid any banking-related difficulties.

>> Check Out Bluevine Plans >>

How to Open Business Bank Account With EIN Only in 7 Easy StepsOpen a business bank account with EIN only (Employer Identification Number) as shown below. This process is usually done online and can be completed following the steps below.

Step 1: Determine the Type of Bank Account You NeedTo begin with, it’s important to decide on the most suitable EIN bank account for your business, considering its requirements and objectives. There are several alternatives that you may want to contemplate:

After determining the type of account required, it’s essential to conduct thorough research and evaluate various EIN bank accounts to identify the one that provides services and features that meet your business requirements.

Key factors to consider include charges, interest rates, internet banking options, and quality of customer service.

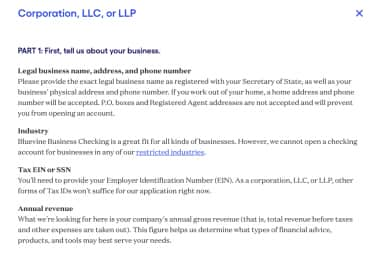

To open a business bank account with EIN only, opting for FinTech and online business banks instead of conventional brick-and-mortar banks is recommended. These banks offer cost-effective services, making them a preferred choice for online business transactions.

In addition, they have fewer regulations and red tape, resulting in a more convenient and expeditious account opening procedure. For startups, there’s also an EIN bank account and banks specifically tailored to their needs.

An EIN bank account is available for a business, tailored to meet specific requirements. This can include checking accounts, savings accounts, and credit union accounts.

Businesses can opt for a business bank account with EIN that doesn’t incur monthly fees or require a minimum balance.

If you want to start an open business bank account with EIN only without fees, you may refer to Bluevine and Novo.

>> Check Out Bluevine >>

Step 3: Gather the Required Documents

To initiate a business bank account with EIN, it’s necessary to furnish specific documents for validating your identity and business details, which usually comprise

Before you open a business bank account with EIN only, gathering all the documents is essential. One of these documents is the EIN, a distinct business identification number. Like a social security number, it has nine digits and is given by the IRS.

Your EIN is essential for submitting your yearly business taxes and can be found on the IRS website. Additionally, other documents may be required depending on the type of business.

Some banks may require an Operating Agreement or Corporate Resolution, which delineates your company's financial and operational decisions. Although banks can usually retrieve these documents from your state's Secretary of State website, keeping them on hand in case they're unavailable is advisable. These papers contain crucial details about your LLC, such as its purpose, stock offerings, and information about directors and officers.

>> Use Bluevine >>

Step 4: Open Bank Account With EIN OnlineAfter selecting a bank and collecting all the necessary paperwork, you can submit your application electronically by accessing the bank's website and clicking the "open an account" option.

Follow the instructions to complete the application form online, providing precise and current details about your company.

Step 5: Verify Your IdentityUpon submission of your application, you may be required to authenticate your identity to safeguard against fraudulent activities and secure your EIN bank account. This process may entail providing supplementary paperwork or responding to security inquiries to confirm your identity.

Step 6: Wait for ApprovalAfter completing your application and confirming your identity, the bank will assess your submission, which may take several days, depending on the bank's policies and procedures. If there are any uncertainties or inquiries regarding your EIN bank account application, the bank may contact you for additional details.

Step 7: Fund Your Open Business Bank Account With EIN OnlyAfter your EIN bank account gets the approval, you’ll be provided guidance on financing it. This usually involves depositing money or transferring funds from another account. It’s important to follow the bank's instructions thoroughly to ensure the successful funding of your account. Well done on successfully establishing an open business bank account with EIN only!

>> Visit Bluevine >>

Reasons to Open a Business Bank AccountHaving an open business bank account with EIN only protects your SSN from being needlessly disclosed. The advantages of obtaining an EIN and starting a business bank account comprise various benefits, including the following, although not limited to them.

Protect Your Assets and FinancesThe EIN is a unique number that identifies your business as a separate entity.

This number is necessary to open a separate bank account for your EIN account, which is distinct from your personal bank account. You can also protect yourself from business debt by registering your business as an LLC or corporation.

It’s important to maintain a clear distinction between your personal finances and business dealings to prevent creditors from accessing your personal assets in case your company cannot pay its debts.

Using a business account with EIN only for your company's finances can simplify bookkeeping and protect you from potential business liabilities.

To minimize the threat of identity theft, it’s recommended to use an EIN instead of disclosing your social security number. While there’s still potential for theft of the EIN, instances of SSN theft are more prevalent.

>> Check Out Bluevine Plans >>

Simplify Tax Preparation and Accounting TasksHaving a separate open business account with EIN only for your business can simplify tax preparation by consolidating all business-related income and expenses in one place.

By employing tax preparation software, you can connect to your bank account data and automate several processes to avoid errors and maintain an accurate tax record. If you mix personal and business finances, it's more likely to make tax errors that could lead to IRS issues.

If you handle your bookkeeping or plan to hire a tax preparer, having an open business account with EIN can only simplify the tax preparation process and save time. By having a separate account for your business transactions, you can avoid the hassle of sorting through personal and business expenses when it's time to organize your finances.

It’s important to keep personal and business finances separate using an EIN bank account to fully use the benefits of such programs.

Additional Perks of Use of EIN to Open Bank AccountAn open business bank account with EIN only offers several advantages not found in personal bank accounts. These perks comprise promotions such as cash incentives and attractive interest rates for savings and checking accounts, along with the opportunity to apply for business loans.

Benefit From Tax DeductionsAny expenses arising from pursuing a hobby are liable for business taxation. Still, you can get tax deductions if you can prove to the IRS that your hobby is more than just a personal interest.

The simplest method to show this is by seeking an EIN and establishing an open business bank account with EIN only. It’s crucial to maintain all financial documentation.

>> Try Out Bluevine >>

Enhance Your Professional ImageIf you use invoices and wire transfers to transact money with your customers, having an open business account with EIN only can improve your professional image. Avoiding personal accounts is crucial as it may seem unprofessional and give your operations an illegitimate vibe, which could make your clients feel insecure about the use of an EIN bank account.

Customers who receive invoices or wire transfers from an EIN bank account bearing your business name will consider your venture established and reputable. This branding indicates that you are serious about your business and have taken steps to maintain high professionalism, rather than just treating it as a hobby.

Build Business CreditMaintaining an open business account with EIN only ensures that all financial transactions are recorded accurately, including customer income, expenses, taxes, and other relevant information.

These records can be useful when applying for a business loan, as lenders can assess your eligibility and repayment ability by analyzing your banking data.

Before granting a loan, it’s common for lenders to request to see your cash flow statements in your EIN bank account. If your statement contains personal expenses, it may not benefit your business and may decrease the likelihood of loan approval.

When looking to grow your business or gain additional assets, a business line of credit can be a useful tool. Maintaining an open business bank account with EIN can also help establish credibility with potential lenders.

Also, a strong credit history can increase the likelihood of securing favorable interest rates via your EIN bank account.

Qualify for a Business Credit CardSeparating your business finances can simplify obtaining a business credit card, but obtaining a business bank account with EIN will still be necessary to apply for one.

If customers have a business bank account with EIN, they may pay for goods or services with debit and credit cards. In contrast, those with only a personal bank account may be restricted to cash or check payments.

>> Consider Bluevine >>

Why Open Business Bank Account With EIN Only?Getting an EIN can provide your business with additional choices for banking services. By having an EIN, your business will access a wider range of benefits financial institutions offer.

It’ll be easier for your business to meet the requirements for various options from credit unions, online, or physical banks with an open business account with EIN only.

If you don’t possess an EIN, you’ll be required to provide an equivalent alternative: your social security number. Although this may appear acceptable, it could expose your SSN unnecessarily to other organizations, including the IRS.

With an EIN, your firm may take on a personality of its own. You may do this to separate your personal funds and affairs from your business's. You shouldn’t be concerned that your personal assets will be taken if your company has legal issues.

Opting for an open business bank account with EIN only simplifies establishing business credit. This can be advantageous when applying for loans through credit unions since they’ll only consider your business's trustworthiness in repaying debts. Even if your personal credit rating is low, it’ll not interfere with your business-related matters.

>> Visit Bluevine >>

Why Do You Need an EIN to Open a Business Bank Account?The application process requires the inclusion of your EIN as a key element. The employer identification number is a distinct identification code for your business, used by the IRS to recognize your business for tax-related matters. This number is particularly used when submitting your business's income tax returns.

By obtaining an EIN, your business gains legitimacy and establishes its identity. It shows to financial institutions that your business is eligible for opening an open business account.

Sometimes, having a business account with EIN may not be necessary. For instance, if you have a sole proprietorship or a single-member LLC without employees, you aren’t legally obliged to get an EIN.

In case of uncertainty, it’s recommended to refer to the IRS website to determine whether an EIN is required.

It's important to remember that some financial institutions may ask for an EIN, even if you operate as a sole proprietorship or single-member LLC. Therefore, it's recommended that you confirm directly with the bank you plan to work with.

Can I Open a Business Bank Account Without an EIN?Before creating an open business bank account with EIN, most banks will require you to provide your business's identity and nature of business, which an EIN can prove.

The policies of different financial institutions vary, and some may mandate that companies have an open business account with EIN only. To open a business checking or savings account with Wells Fargo, for instance, an EIN for your business and the SSN of individuals opening the account are mandatory.

In contrast to an open business account with EIN, It’s possible to open a business bank account without an EIN sometimes, depending on the bank's policies. For example, sole proprietors may only need to provide their social security number.

Lili Bank allows those operating under a DBA name or a single-member LLC to open an account without an EIN, and later add their business name by submitting documents such as tax returns or business licenses.

>> Use Bluevine >>

What Are the Best Business Banks to Open an Account With Only an EIN?If you want to open a business bank account with EIN only, various choices are available. This business account with EIN only. answer will concentrate on three of the top-rated business banks where you can open a

In general, if business owners want to open a business bank account with EIN only, they can consider Bluevine, Novo, and Axos. Each platform offers distinct advantages and features, hence it’s crucial to conduct extensive research and select the one that aligns with the requirements of their business.

>> Start Using Bluevine >>

How to Open Business Bank Account With EIN Only – Frequently Asked QuestionsWhat Is an EIN?An EIN, or employer identification number, is a unique business tax ID number issued by the IRS that's necessary to file your company's income tax return and ensure that your business is correctly taxed.

Suppose your business operates as a multi-member LLC, partnership, or corporation. In that case, an EIN is legally required, and certain business types or trades may also necessitate an open business account with EIN only. Hiring employees or contractors mandates getting an EIN.

However, single-member LLCs and sole proprietors are exempt from needing an EIN if they have no employees. Possessing an EIN isn’t limited to IRS purposes, as it can offer advantages to small business owners.

Apart from simplifying the process of an open business account with EIN only, an EIN can accelerate the business loan application process, reduce the risk of identity theft, establish business credit, and provide other benefits.

How Do I Obtain an EIN for My Business?To obtain an EIN, one can go to the IRS website and must keep their social security number or taxpayer identification number ready. It’s important to note that EINs don’t have an expiry date, and one must keep track of all previously obtained EINs.

Gathering all required information beforehand is recommended, as the application session times out after 15 minutes of inactivity.

Why Does the Bank Need My EIN to Open a Business Account?

Financial and banking organizations must comply with state and federal banking laws. Because of this, even Internet banking providers will want to confirm your legitimacy before offering to assist you in managing your company's funds. An EIN shows the legitimacy of your business transactions and your company's name.

>> Check Out Bluevine >>

Bottom Line on How to Open Business Bank Account With EIN OnlyTo ensure proper bookkeeping and tax compliance, creating an open business account with EIN is advisable only.

It’s recommended to use the business's identification to open a business account with EIN only and keep its financial transactions separate. This facilitates maintaining an accurate audit trail for the IRS, establishing business credit, and qualifying for loans that can aid in advancing the enterprise.

>> Consider Bluevine >>

Moneycontrol Journalists were not involved in the creation of the article.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!