When the retrospective income tax law was scrapped in August 2021, Prime Minister Modi said the decision showed the government’s commitment to providing a stable investment regime and consistency of policy.

It’s now time to show the same commitment to both the investor community and industry. Through a change in the gratuity provision in the new Code on Social Security, 2020, the industry is likely to face a huge retrospective cost impact.

The code was notified on September 29, 2020, and is likely to come into force soon.

What is gratuity?Gratuity is a lump-sum paid to an employee on the termination of employment. Gratuity is regulated by the Payment of Gratuity Act, 1972, and is payable only if the employee completes five years of service before termination, except on account of death or disability of the employee.

Once the new labour codes are enforced, gratuity will be regulated as per the Code on Social Security.

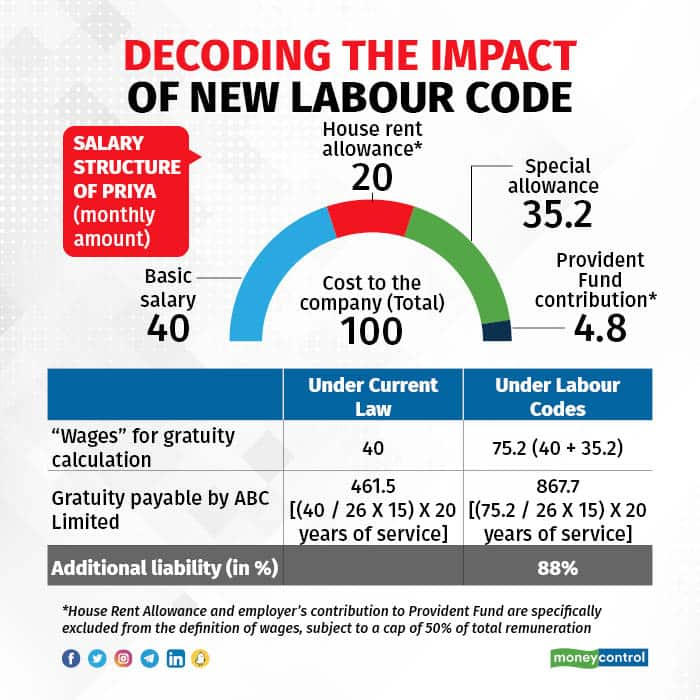

What is the retrospective impact?Under both the current law and the new labour code, an employer is required to pay gratuity to an employee at the rate of 15 days’ wages, based on the rate of wages last drawn by the employee. Also, under both laws, it is clarified that 15 days’ wages will be calculated by dividing the monthly rate of wages last drawn by the employee by 26 and multiplying the quotient by 15.

Gratuity = (Last drawn wage/26 x 15) x years of service

However, there is a difference in how the term wages is defined under both laws. Under the Payment of Gratuity Act, wages cover basic salary and dearness allowance. In most private companies, under the cost to company (CTC) model, dearness allowance is not paid. Hence, gratuity is calculated on the basis of the employee’s last drawn basic salary.

Under the Code on Social Security, wages has an exhaustive definition and covers all remuneration payable to an employed person, with a specified list of exclusions and a cap of 50 percent of total remuneration on such exclusions.

For most companies, wages under the labour code will be much broader than the basic salary and this will result in a retrospective cost impact.

Let’s understand this through an example:

Priya has worked at ABC Ltd. for 20 years and is now in a leadership position in the company. Every year, as per general accounting principles, ABC Ltd. makes a provision in its books of accounts for the gratuity payable to Priya on termination of her employment. Such provisions are made as per the last drawn basic salary every year.

Now, if Priya was to leave after the Code on Social Security comes into force, the provision made by ABC Ltd. will fall short. This is because ABC Ltd. will need to calculate the gratuity payable to Priya on the basis of her last drawn wages, as defined under the labour code, for all the years of service till the date of termination. This will mean an additional cost for 20 years of Priya’s service, which was not budgeted.

If ABC Ltd. caps the gratuity pay-out at Rs 20 lakh, as allowed by both the current law and the labour codes, the additional liability may be limited. However, many companies do not follow a cap on gratuity payments to provide higher benefits to employees. If ABC Ltd. does not follow this cap, the additional cost will be much higher.

As per the illustration, ABC Ltd.’s provisions for gratuity will fall short by 88 percent.

Companies make such provisions taking into consideration variables such as the attrition rate, the likely change in salary, the number of employees, the retirement age, and the cap of Rs 20 lakh. Overall, the additional liability for a retrospective period will be dependent on these factors.

Leave encashmentSimilarly, leave encashment for workers under the Occupational Safety, Health and Working Conditions Code, 2020, is to be calculated on wages as defined.

Also, unlike current state-specific laws where leave encashment is required only on termination of employment, under the labour code, leave encashment may be sought every year.

For leave that hasn't been taken, some companies would have made provisions for the encashment payable on the basis of basic salary (subject to specific company policies). With the labour codes, since such leave encashment is payable on wages, the current provisions may fall short, leading to a retrospective impact.

Policy objectiveThe objective of the labour codes is to facilitate implementation and remove a multiplicity of definitions without comprising the basic concepts of welfare and benefits to workers. Also, the aim is to ensure transparency and accountability and to facilitate ease of compliance.

A common definition of wages for the calculation of all employee benefits covered under the labour codes is a very positive step taken by the government, which will facilitate compliance and ease the administrative burden of employers.

One hopes that given the policy objective of the labour codes and the government’s promise to do away with retrospective laws that adversely affect the investment climate in India, the retrospective impact of both gratuity and leave encashment under the labour codes will also be taken away.

(Views expressed are personal)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.