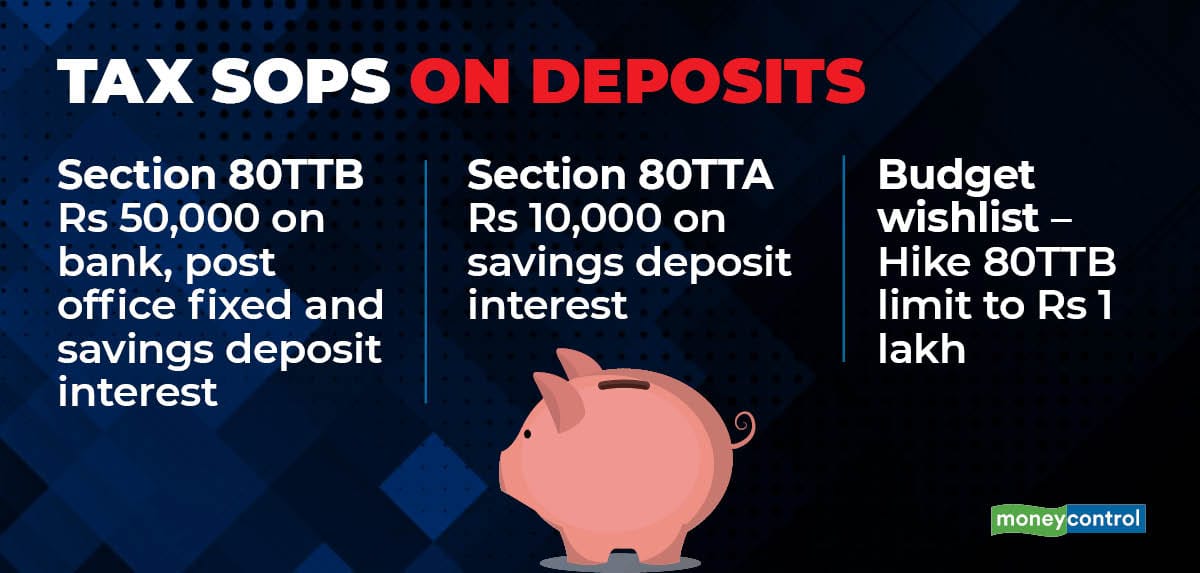

Under section 80TTA, depositors are entitled to a tax deduction of up to Rs 10,000 on interest earned on bank and post office savings deposits. If you are senior citizen (over 60), you can avail of a tax deduction of up to Rs 50,000 under section 80TTB on interest from bank, co-operative society and post office savings and fixed deposits. However, in that case, you will not be eligible for the 80TTA tax sops. At present, higher policy rates have pushed up fixed deposit rates, but higher inflation results in lower real rate of return for senior citizens. Given this, tax experts feel this limit should be raised to Rs 1 lakh in Budget 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.