Debt fund investors are in a dilemma. Yields on short- and long-duration funds are attractive, and so are yields of liquid funds. If rates were to go down, long-duration funds can do better, but it’s not clear when this will happen.

These factors make it difficult for debt fund investors to choose a debt segment they should bet on and when they should move from one to another. Should fund managers decide these matters? It is possible with dynamic bond funds.

What is on offer?Dynamic bond funds are debt schemes of mutual funds that allow fund managers to invest in bonds, depending on their view on interest rates. The fund manager decides the portfolio duration.

If the fund manager anticipates that interest rates will rise, he can choose to remain invested in a relatively shorter maturity paper. If interest rates are expected to decline, the choice may be longer-maturity paper.

As the rate cycle progresses, fund managers change the portfolio composition. No wonder some fund houses call such plans all-season debt funds.

Since the regulator, the Securities and Exchange Board of India (SEBI), does not specify the credit quality of bonds, fund managers are free to invest in securities rated AA and below. However, most dynamic bond funds focus on good-quality bonds.

Dynamic bond funds on average allocated about 5 percent money to bonds rated AA and below as of November 30, according to Value Research. Individual scheme portfolios need to be checked before forming an opinion about them.

Most dynamic fund managers try to optimise returns by managing the duration of the portfolio rather than taking credit risk.

“The duration is actively managed with the help of an in-house model,” said Chintan Haria, head of product and strategy at ICICI Prudential Mutual Fund. “The model takes into consideration parameters like current account deficit, fiscal deficit, and credit growth, to name a few.”

Based on the interest rate scenario, ICICI Prudential All Seasons Bond Fund invests in corporate bonds or government securities. This call is tactical. In effect, when interest rates are high, the fund behaves like a long-duration scheme and when rates are low, it behaves like an accrual scheme, he added.

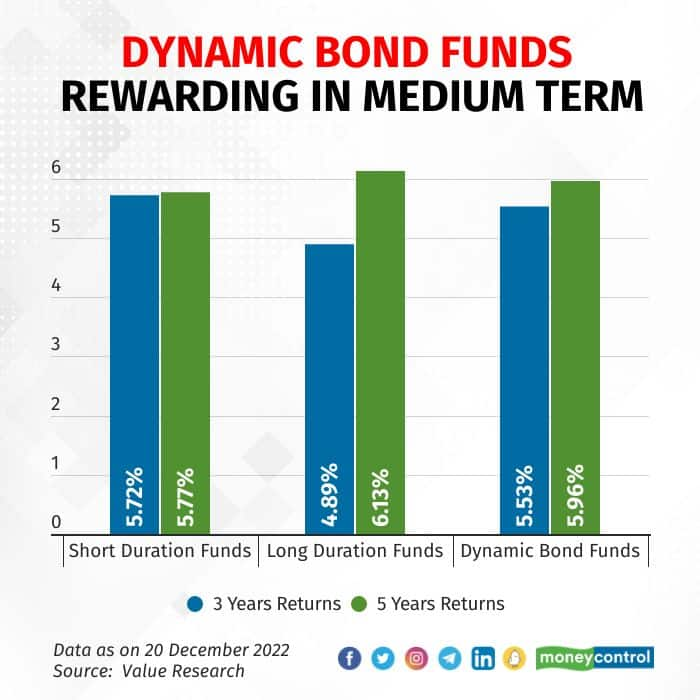

Dynamic bond funds have generated 2.92 percent returns in the year ended December 20, 2022. Comparatively, short-duration funds and long-duration funds have returned 4 percent and 1.37 percent, respectively.

Dynamic bond fund managers are seen increasing the duration of portfolios. The dynamic bond fund schemes of JM, ITI and PGIM India mutual funds have seen an increase in the Macaulay duration (MD), which is a measure of a bond’s sensitivity to interest rate changes.

For JM, ITI and PGIM India, the MD has gone up to 3.86 years, 3.79 years and 2.49 years in November from 2.50 years, 0.03 years and 1.57 years in October, respectively.

By increasing the MD of the portfolio, fund managers seek to benefit from high yields on relatively longer tenured bonds and possible capital gains if interest rates come down in the future. When rates fall, bond prices go up. The impact is more in the case of long-term bonds than short-term ones.

Why dynamic bond funds now?Interest rates are at a crucial juncture. Moreover, the repo rate hikes are likely behind us.

However, there is no clarity on when rates will start falling. Till then, most investors want the current high yield on very short-term papers held by liquid funds and low-duration funds. When interest rates start tapering, the shift towards long-duration bond portfolios would be more rewarding. Getting this switch right is quite a task for most average fixed income investors.

“Most investors do not have a view on interest rate movements,” said Pankaj Pathak, fund manager-fixed income, at Quantum Mutual Fund. “Dynamic bond funds manage the interest rate risk by active management of duration.”

Investors must also keep in mind the tax angle.

“If investors choose to move from a relatively short-duration fund to a long-duration fund or vice versa, as the view on interest rate changes, there could be a tax impact on each such switch,” said Joydeep Sen, corporate trainer-debt. “However, such moves done by a dynamic bond fund manager do not attract tax in a mutual fund scheme.”

What should you do?Though dynamic bond funds can be considered in the core fixed-income portfolio, do not jump into it with all your money. These schemes carry significant fund manager risk.

“Since a fund manager decides on the duration of the bond funds, go for schemes that have demonstrated good performance,” said Sen.

The interest rate cycle plays out over the medium term – three to five years – and these schemes can reward investors over the medium to long term. Investors should ideally remain invested through an entire interest rate cycle.

“Dynamic bond funds can work for relatively long-term investors with a minimum three-year timeframe, who are comfortable with a bit of volatility,” said Pathak.

However, investors need to set their expectations right. Though interest rates are expected to fall, it is highly unlikely that dynamic bond fund managers will increase the duration in line with that offered by long-duration funds. Hence, even if rates are cut aggressively, dynamic bond funds tend to score less than long-duration funds. When interest rates were hiked in the past year, these schemes gave lower returns than short-duration funds.

Dynamic bond funds are not magic wands that offer top-of-the-chart returns. The advantage here is that they reposition investments in line with the interest rate cycle. These schemes can be considered by investors who may not have a view on rates and are comfortable entrusting their money to fund managers.

“These funds are a suitable choice for direct investors who may not have access to good quality advice or may not have a view on interest rates,” said Sen.

The potential risk class matrix (PRCM) of a scheme can be another checkpoint. PRCM AIII, which signifies relatively low credit risk and relatively high-interest rate risk, ensures that the fund manager is less likely to invest in bonds with low credit ratings. However, schemes with PRCM BIII offer some legroom for the fund manager to invest in relatively low-credit quality bonds.

Those keen on investing in a dynamic bond fund should opt for one with a risk-taking capacity in line with their profile.

If you are saving for very short-term financial goals or using debt funds for the purpose of an emergency fund, you should not be investing in these schemes. Instead, choose liquid funds or low-duration funds, depending on the time frame.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.