Over 40 percent of family offices in India have doubled their allocation to private markets in the past five years, with allocations to startups and venture capital (VC) funds now comprising 18 percent of the overall pie, according to a new report by LetsVenture subsidiary trica in partnership with AZB & Partners and EY.

It said this is in comparison to a 36 percent allocation to listed equities, 20 percent allocation to fixed income and about 15 percent allocation to other alternative investments.

More than 83 percent of family offices have over 10 percent allocation to private markets from their overall asset distribution.

The report was created by data aggregated from an online survey completed by 103 family offices and ultra high net worth individuals (UHNIs)in India as well as interviews with multiple investors between July and October 2021. This was further supplemented with its proprietary research and intelligence derived from EY and AZB & Partners, the company said.

In a growing indication of larger cheque writers eyeing a direct participation in a startup's cap table, the report said direct startup investments contributed for 47 percent of their private market portfolio, while 32 percent went into venture capital and private equity funds and 11 percent to venture debt funds.

"The inclination of family offices to opt for direct startup investments is a sign of increased acceptance of the asset class given more liquidity, access and transparency reflecting well on the contribution of platforms like LetsVenture and trica," said trica CEO Nimesh Kampani.

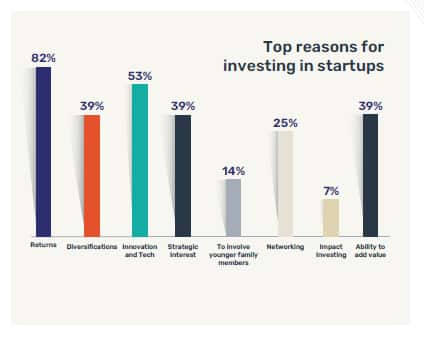

A key reason for participating in startup investments were non-linear returns, followed by direct exposure to technology companies and gaining strategic alignment with their core business along with the ability to add value to an early stage entrepreneur's journey, according to the report. Some of the family offices and UHNIs also saw this as a way to engage younger family members.

This rising interest in direct startup investments also comes amid an unprecedented startup funding boom in the country, having raised over $30 billion in the first 11 months of 2021 from investors, more than double of previous records and minting more than 40 unicorns within a year. Unicorns are privately held startups valued at over a billion dollars.

The country has also seen a wave of startup initial public offerings (IPOs), with some companies such as Zomato, Nykaa, and Freshworks having a spectacular public market debut while Paytm had one of the worst debuts ever by a major technology company.

Digital mapping firm MapmyIndia is expected to list on December 22 while several firms such as Oyo, Delhivery, Ixigo, Droom, Mobikwik, and Pharmeasy have also filed IPO papers with the regulator Securities and Exchange Board of India (SEBI) for their respective public offerings.

Investment stages and sectorsMore than half of the family offices and UHNIs surveyed said they preferred the seed to Series A stage to enter a startup investment while 40 percent preferred late to pre-IPO transactions.

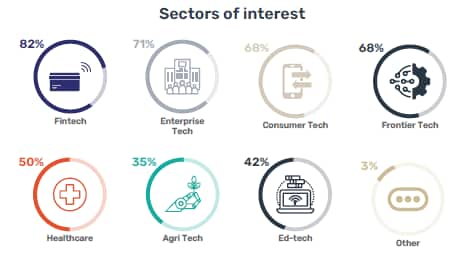

In terms of sectors, Fintech and Enterprise Technology were the top preferred sectors by a clear majority followed by other sectors such as Consumer Tech, Frontier Tech, Healthcare, Edtech, and Agritech.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.