Key stakeholders' expectations from FM Nirmala Sitharaman on July 23

Union Budget Expectations Highlights 2024: As we approach Finance Minister Nirmala Sitharaman’s presentation of the Union Budget 2024 on July 23, excitement and anticipation are at an all-time high. The salaried individuals are once again hopeful of potential income tax relief, adjustments in the new tax regime, standard deductions, and more. India, now the world’s fifth-largest economy, is poised to climb to the third spot in the coming years. The upcoming budget is expected to lay out a strategic plan for sustained economic growth to help achieve this milestone. Historically, the Modi government's budgets have emphasized high capital expenditure, particularly in infrastructure, to fuel GDP growth. Follow our Union Budget 2024 Live Blog to get real-time updates, expert analysis, and comprehensive insights on the top expectations for Budget 2024. Stay connected with the Moneycontrol.com to know what can we expect from this budget for the middle class, citizens, businesses, farmers, and various sectors such as manufacturing, services, and agriculture.

-330

July 18, 2024· 21:51 IST

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com

-330

July 18, 2024· 21:45 IST

Union Budget 2024: Real estate sector expects reduced burden with multiple and double GST taxation, Ashok Chhajer, Chairman and MD, Arihant Superstructures

Ashok Chhajer, Chairman and Managing Director, Arihant Superstructures Ltd. lists out expectations of real eastate sector

--The real estate sector has been burdened with multiple and double GST taxation, which needs to be streamlined to a one-time transaction.

--We expect the government to establish a monitoring cell to ensure that the cost of construction does not increase moving forward.

--Additionally, we urge the government to reduce the GST rate on cement from 28% to 18%, as it is not a sin category product.

--These measures will greatly support the growth and stability of the real estate sector." Mr, Ashok Chhajer, Chairman and Managing Director, Arihant Superstructures Ltd.

-330

July 18, 2024· 21:16 IST

Union Budget 2024: Real estate sector expects reinstatement of input tax credit on GST

Mayank Ruia, Founder and CEO of MAIA Estates spoke on expectations of real sector in the upcoming budget. He said, the government should reinstate of input tax credit on GST outflows towards cost of developing real estate assets. This would significantly reduce cost and cash flow pressures on developers, thus helping rationalize price increases for buyers, says Ruia

-330

July 18, 2024· 19:57 IST

Acquaviva CEO lists pre-budget expectations of hospitality and retail sector

Acquaviva CEO, Bantwal Ramesh Balinga listed the pre-budget expectations of hospitality and retail sector in the upcoming budget on July 23

--In the hospitality sector, with over 400 hotels announced and luxury retail growing rapidly, the government should consider policies that facilitate the purchase of second homes with reasonable interest rates. This will drive growth, reduce rental pressures, and promote market stability.

--The government’s focus on national skill development should extend to specialized training in plumbing, including engineering degrees, diplomas, and plumbing labs nationwide.

--Budget should support retail expansion, especially in tier 3 and 4 cities. As the IT industry moves to semi-urban areas, it’s creating employment opportunities and driving economic growth. Government incentives for rural employment, finance, and technology adoption will further boost these markets.

--Budget should also address evolving consumer behaviors by making home buying easier and reducing construction costs through technological advancements

--Continued support for MSMEs, infrastructure development, and financial aid for second-home buyers. Prioritizing tourism infrastructure, non-urban sanitation, solar-powered electricity, and reducing registration costs in semi-urban towns will foster robust growth and competitiveness in the hospitality and retail sectors

-330

July 18, 2024· 19:05 IST

Education sector anticipates significant investment shaping a dynamic and experiential learning environment, says Founder Chairman of VIBGYOR Group of schools

Founder Chairman of VIBGYOR Group of schools, Rustom Kerawalla said that the education sector expects significant investment within the sector. This includes enhancing infrastructure for effective education delivery, advancing teacher training, promoting inclusive education and focus on outcomes mapped to 21st century skills. These priorities aim to ensure equitable access to high-quality education and build a resilient system that prepares students early on for real-world scenarios, he said.

These factors coupled with technology will play a pivotal role in shaping a dynamic and experiential learning environment. Through collaborative tech-driven solutions, infrastructure upgrades, comprehensive training, advancements in pedagogy, and adapting to new age learning methodologies, we can unleash the potential of educational reform. I strongly believe with these measures, India can establish a future-ready education system that is inclusive, equitable, and globally competitive, added Kerawalla

-330

July 18, 2024· 16:18 IST

Union Budget 2024 may revitalize FMCG sector with rural focus

Investors in FMCG companies have faced challenges due to food inflation, poor monsoons, and stagnant wages impacting rural demand. However, a shift in government focus towards the rural sector in the upcoming Budget, with increased social sector spending and welfare schemes, is expected to boost rural consumption. This could significantly benefit FMCG companies, particularly large-cap consumer staples and those expanding their geographical reach. Read more here

-330

July 18, 2024· 14:33 IST

Realty sector expects tax relief in the upcoming Budget 2024

- Industry Status: Granting industry status to real estate to improve access to funds and attract foreign investment.

- Affordable Housing: Funding for SWAMIH scheme, new subsidy schemes like CLSS under PMAY, and revising affordable housing definitions.

- Tax Benefits: Revising tax slabs, increasing standard deductions, and raising home loan interest deduction limits.

- Digitization: Digitizing land records to enhance transparency and streamline transactions.

-330

July 18, 2024· 13:18 IST

Budget 2024: Modi to focus on jobs, incomes in first budget after election setback

Prime Minister Narendra Modi aims to repair voter relations in the upcoming budget by focusing on job creation and income boosts amidst economic unevenness and rising food prices. Modi relies on regional allies TDP and JD(U) for support, as his party didn't secure a majority in the recent election. Finance Minister Nirmala Sitharaman will present the new budget on July 23, potentially introducing measures to support domestic manufacturing, reduce personal income tax for some, and increase subsidies on rural housing and food. Increased spending without expanding the deficit is expected, leveraging a record $25 billion transfer from the Reserve Bank of India.

(Source Reuters)

-330

July 18, 2024· 12:30 IST

Facilitating green FDI through international carbon markets tops Budget 2024 expectations

As India prepares for Budget 2024, there is a strong focus on advancing its sustainable development and climate leadership. India has made significant progress in renewable energy and climate action, aiming for a substantial non-fossil fuel energy mix by 2030 and net-zero emissions by 2070. The upcoming budget is expected to further accelerate this momentum, leveraging India's strengths in renewable energy and innovative initiatives like the Indian carbon market and Green Credit Programme. Read more here

-330

July 18, 2024· 12:04 IST

Cybersecurity industry seeks digital security push in Union Budget 2024 for Viksit Bharat

Cybersecurity experts are calling for increased funding and incentives in the upcoming Union Budget to bolster India's digital security amidst rapid AI adoption. Key figures like Tarun Wig of Innefu Labs and Shashank Shekhar of FCRF emphasize the need for government support in AI training, cyber talent retention, and cybersecurity infrastructure to enhance national defense and reduce cyber crimes. They advocate for collaborations with educational institutions for specialized training, and regular security audits for critical infrastructure. The article highlights the critical juncture India faces in becoming a global leader in cybersecurity.

-330

July 18, 2024· 11:29 IST

2024 Budget Expectations: Growth, inflation, and investment in focus

- Favorable Backdrop: Strong growth momentum, healthy external buffers, and robust corporate and bank balance sheets set a positive stage for the full Union Budget.

- Challenges: Stubborn food inflation, weak consumption demand, and sluggish private investments need addressing.

- Timing: With one quarter of the fiscal year over, budget measures will primarily impact the second half.

- Fiscal Consolidation: Maintain fiscal consolidation, aided by a higher-than-expected RBI dividend, to manage borrowing costs and debt ratio. Global bond index inclusion increases fiscal scrutiny.

- Weak Consumption: Private consumption growth is at a two-decade low. Rural demand may rise with a good monsoon, while urban demand may soften. Tax relief and rural infrastructure support are needed.

- Food Inflation: Persistent high food inflation, exacerbated by climate change, requires budget allocation for climate adaptation, storage, transport infrastructure, and increased agricultural R&D.

- Private Investments: Sustainable investment growth requires private sector participation, supported by government infrastructure, healthy corporate balance sheets, competitive tax rates, and incentives.

- Reforms: Pursue necessary reforms in land and labor to promote private and foreign investments, enhancing economic growth potential. Benefits of past reforms show delayed but significant impacts.

- Click here to read more

-330

July 18, 2024· 11:01 IST

Power sector's key budget expectations: Renewable incentives and hydropower support

The power sector has numerous demands and expectations from the upcoming Budget, especially concerning incentives and financing for the renewable energy segment. The industry is looking for support for the hydropower sector by establishing a nodal agency dedicated to hydropower development and providing incentives for pumped storage hydropower plants. They also hope the Finance Ministry will extend the eligibility for the ISTS waiver for renewable projects beyond June 2025. Read more here

-330

July 18, 2024· 10:45 IST

India’s economy poised for robust growth ahead of Union Budget, says report

India’s economy is currently expanding at an impressive rate, leading the pack among major emerging markets. This economic momentum is further supported by increased tax revenues, creating a favorable fiscal environment. These positive indicators may encourage Finance Minister Nirmala Sitharaman to boost expenditure in the upcoming 2024/25 budget, set to be unveiled in parliament on July 23. Read more here

-330

July 18, 2024· 10:27 IST

New scheme for domestic medical device manufacturing likely in Union Budget 2024

The Union Budget is expected to introduce a scheme aimed at boosting the domestic manufacturing of medical devices, similar to existing initiatives for drugmakers, as reported by Mint. This move is intended to promote self-reliance in medical equipment and reduce healthcare costs. Although the specifics of financial support are yet to be finalized, discussions about including this initiative in the 2024-25 Budget are ongoing. Read more here

-330

July 18, 2024· 10:10 IST

Budget 2024: Experts call for key reforms to boost growth and trade

- Focus on Reforms: Emphasis on reforms to position India as the fastest-growing economy.

- PLI Scheme Expansion: Expected to extend to new sectors, especially those with high import volumes and export potential.

- SEZ Policy Overhaul: Clarity sought on the Development of Enterprise and Service Hub (DESH) Bill to replace the current SEZ Act.

- MOOWR Scheme Issues: Address challenges in the Manufacturing and Other Operations in Warehouse Regulations (MOOWR) scheme, including IGST deferment and capital goods valuation.

- Trade Facilitation: Improvements in the Authorized Economic Operator (AEO) program and Special Valuation Branch (SVB) processes.

- Technology in Trade: Push for digitalizing customs appeal and refund processes to enhance efficiency and transparency.

-330

July 18, 2024· 09:41 IST

Affordable housing market expectations from Union Budget 2024

According to Anarock, the affordable housing market has shrunk over the past five years. Despite this, affordable housing finance companies (AFHCs) have seen increased interest from investors due to growth expectations. Analysts believe the upcoming Union Budget will announce crucial measures to boost this market. Flagship schemes have helped AFHCs meet the rising demand for affordable housing. While AFHCs cater to a vulnerable segment, they have demonstrated impeccable asset quality. Read more here

-330

July 18, 2024· 09:25 IST

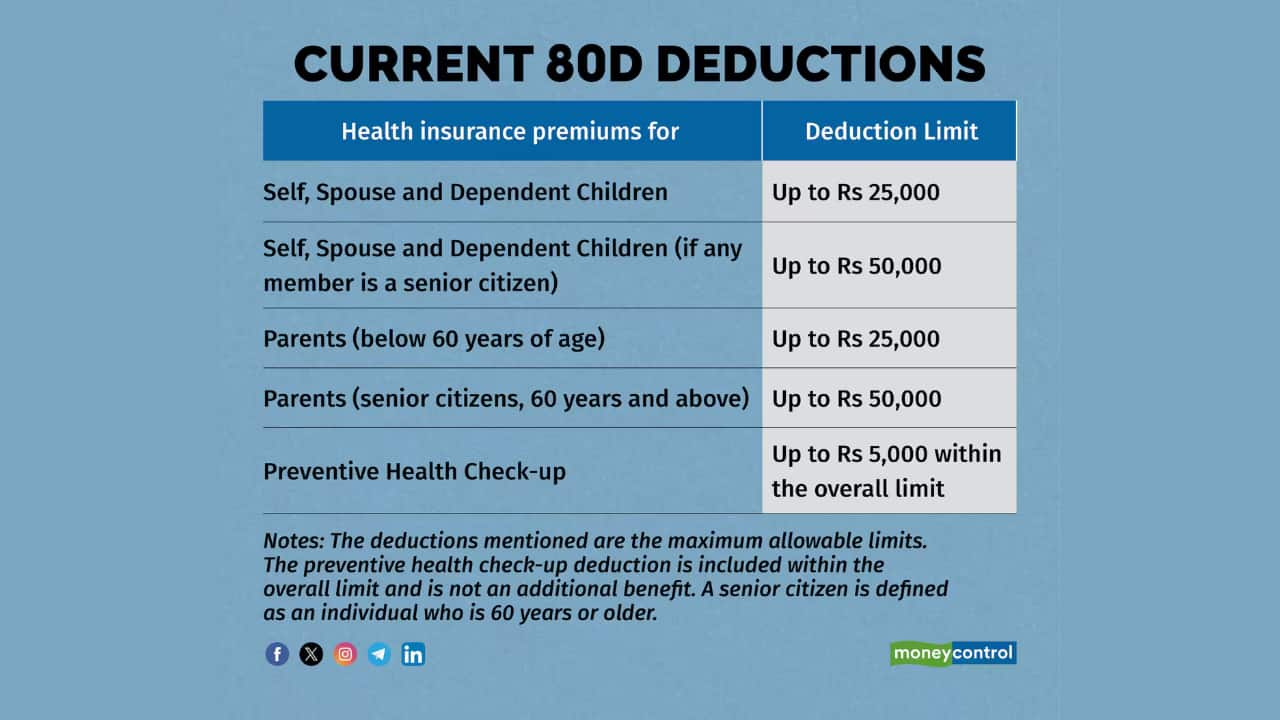

As the Union Budget approaches, there's anticipation for an increase in Section 80D deductions for health insurance premiums, potentially raising the limit from Rs 25,000 to Rs 50,000 for individuals and up to Rs 1 lakh for senior citizens.

-330

July 18, 2024· 09:01 IST

Union Budget 2024 likely to prioritize farmers and women ahead of state elections

The upcoming budget may prioritize farmers and women, with potential increases in payouts under the PM Kisan Samman Nidhi to Rs 12,000 annually and a new scheme offering Rs 1 lakh to women below the poverty line. Read this Moneycontrol.com exclusive here

-330

July 18, 2024· 08:46 IST

Union Budget 2024: Expectations high for increase in standard tax deduction

Both new and old tax regimes offer a standard deduction of Rs 50,000, introduced in 2018 and increased in 2019. This exemption, which requires no investment proof, has remained unchanged since. There is a longstanding demand to raise this deduction to keep up with inflation. Experts suggest the government may increase it to Rs 1 lakh, providing substantial tax relief, especially for fixed-income groups like pensioners. Such an increase would boost disposable income, particularly benefiting lower and middle-income earners. This potential change is highly anticipated in the upcoming Union Budget 2024.

-330

July 18, 2024· 07:59 IST

Budget 2024 Expectation: Will govt increase Section 80C deduction limit?

Individual taxpayers are primarily requesting a revision of income tax slab rates and an increase in Section 80C tax deduction benefits, which currently allow a Rs 1.5 lakh reduction in taxable income for specific investments and expenditures. The limit, last reviewed in 2014 by the NDA government, has not been changed since, leading to widespread anticipation of an increase this year.

-330

July 18, 2024· 07:34 IST

FM Nirmala Sitharaman set the stage for Union Budget 2024 with Halwa Ceremony in New Delhi on July 16

-330

July 18, 2024· 07:19 IST

Union Budget 2024 expectations of salaried class: Will income tax slabs finally change?

Among the various expectations for the Full Budget 2024, the most eagerly awaited aspect is income tax slabs. In the interim budget, the Finance Minister Nirmala Sitharaman did not alter the tax slabs, explaining that it wasn't the appropriate time for such revisions. Therefore, taxpayers are hopeful for some changes this time.

-330

July 18, 2024· 07:13 IST

Modi 3.0 budget to boost clean energy investments: Experts predict

The government is expected to announce significant measures in the 2024-25 Union Budget to promote investments in renewable energy. Experts predict policies including viability gap funding, incentive schemes, and tax concessions to boost the clean energy sector. Additionally, there may be a focus on battery storage, hydrogen purchase obligations, and tax reforms to support green hydrogen projects. These measures aim to streamline investment and encourage growth in renewable energy infrastructure.

-330

July 18, 2024· 07:09 IST

Budget 2024: Will Modi govt offer capital gains tax relief to investors?

With the NDA government working on its first full Budget of the third term, investors hope for relief on capital gains taxes. Experts suggest standardizing holding periods and rates, and changing the base year for indexation to benefit investors. Simplifying the tax structure could encourage higher compliance.

-330

July 18, 2024· 07:00 IST

Indian Chamber of Commerce Urges Modi Govt to Rationalize Customs Duty to Boost Domestic Manufacturing

The Indian Chamber of Commerce (ICC) has urged the government to rationalize customs duties in sectors like steel, solar batteries, aluminum, and lithium cells to boost domestic manufacturing. ICC President Ameya Prabhu emphasized the need for protective measures and correcting inverted duty structures to reduce import dependency and drive self-sufficiency. He also recommended setting up a commission to review and simplify the Income Tax Act 1961 and suggested not taxing dividends. Finance Minister Nirmala Sitharaman will present the Union Budget for 2024-25 on July 23.

-330

July 18, 2024· 07:00 IST

Modi 3.0 Budget will showcase govt's fiscal discipline and vision for the next 5 years

"The first budget of Modi 3.0 will be an important platform for the government to signal its intent on fiscal consolidation, showcase how it plans to manage allies' financial demands and present its vision for the next five years." - Says Sonal Varma, chief economist for India at Nomura

-330

July 18, 2024· 06:59 IST

Reuters poll predicts steady spending in Modi's final budget despite political turmoil

Three-fifths of economists, 27 of 45, said the PM Modi led BJP government will not significantly change its planned spending in the final budget compared to the interim one presented on Feb. 1. The remaining 18 in a July 5-16 Reuters poll expected a change.

-330

July 18, 2024· 06:59 IST

Modi govt to stick to February budget goals despite election rebuke, says Reuters poll

PM Narendra Modi-led BJP govt plans to keep its budget goals the same despite losing its majority in the recent Lok Sabha election. According to a Reuters poll, the Union Budget 2024 on July 23 will focus on economic growth through infrastructure spending, aiming to tackle unemployment. Most experts think the final budget will stick to the targets set in February, with a fiscal deficit of 5.10% of GDP and borrowing of 14.13 trillion rupees. The government will use a large payment from the Reserve Bank of India for extra spending, while also trying to manage financial demands from political allies and maintain fiscal discipline.