Despite elevated volatility in Indian equity markets—driven by ongoing macroeconomic headwinds including geopolitical instability, global trade uncertainties, and muted foreign institutional inflows—domestic mutual funds maintained a strong buying stance, actively participating in high-value block deals and multiple IPOs. This aggressive capital deployment led to a notable reduction in cash reserves across leading fund houses.

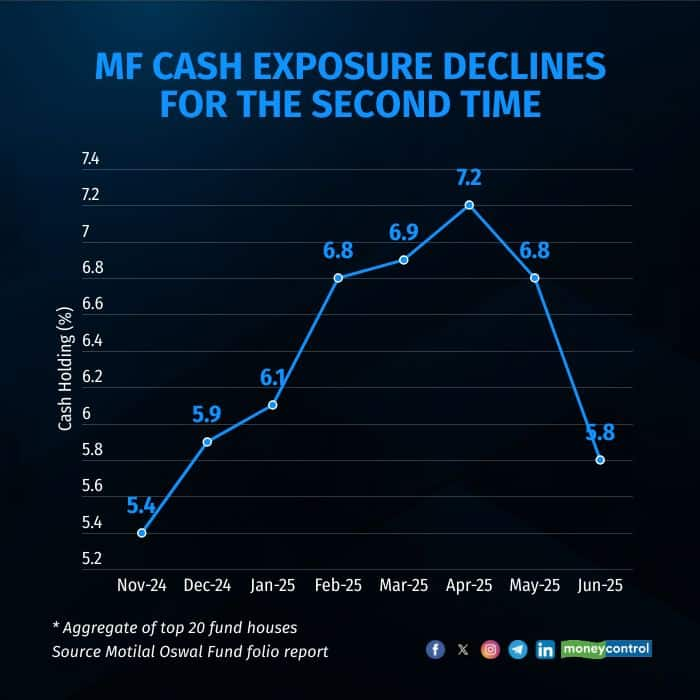

For the second consecutive month, equity mutual fund schemes trimmed their cash holdings, which reached a seven-month low in June. According to data from Motilal Oswal Financial Services, the top 20 mutual fund houses held 5.8 percent of their assets in cash as of June 30, down from 7.2 percent in April 2025.

Mutual Funds invested over Rs 39,000 crore in equities during the month, nearly matching the total block deal value of Rs 41,000 crore, as per ACE Equities. In the primary market, eight IPOs with a combined issue size of Rs 17,690 crore were launched, with mutual funds contributing around Rs 2,700 crore through anchor investments.

One of the most prominent transactions was Reliance Industries’ Rs 11,000 crore stake sale in Asian Paints Ltd, where mutual funds acquired shares worth Rs 10,454 crore. SBI Mutual Fund led the charge with an investment of Rs 8,165 crore, followed by ICICI Prudential Mutual Fund at Rs 1,860 crore.

Another major block deal involved Vishal Mega Mart, in which Samayat Services divested over 20 percent stake worth Rs 10,500 crore. Mutual funds collectively invested Rs 8,200 crore, with SBI MF contributing Rs 2,530 crore, HDFC MF Rs 2,170 crore, and Kotak Mahindra MF Rs 1,410 crore.

Bajaj Finserv also saw heightened fund activity. Promoters Jamnalal Sons and Bajaj Holdings & Investment offloaded a 1.94 percent stake in a Rs 5,828 crore transaction. Mutual funds picked up Rs 4,860 crore worth of shares, led by ICICI Prudential MF at Rs 1,660 crore and SBI MF at Rs 1,520 crore. HDFC, UTI, and Aditya Birla Sun Life MFs also participated, investing between Rs 300 crore and Rs 400 crore each.

In the case of Sai Life Sciences, TPG’s Rs 1,500 crore exit through a block deal witnessed mutual fund investments exceeding Rs 1,100 crore. Nippon India MF led with Rs 440 crore, followed by Aditya Birla, Axis, and Invesco MFs with contributions ranging from Rs 200 crore to Rs 300 crore.

Premier Energies attracted Rs 1,000 crore from mutual funds out of a Rs 1,600 crore block deal. Other significant investments included Niva Bupa Health, Suzlon Energy, Jyoti CNC Automation, and Yes Bank, with each receiving Rs 370 crore to Rs 390 crore from mutual funds.

Mutual fund participation in IPO anchor placements remained robust. Ellenbarrie Industrial Gases secured Rs 428 crore from mutual funds in a Rs 852 crore offering. HDB Financial Services attracted Rs 1,400 crore in MF anchor commitments for its Rs 12,500 crore issue. Kalpataru Projects saw Rs 377 crore allocated by mutual funds in its Rs 1,590 crore IPO, while Oswal Pumps garnered Rs 432 crore out of a Rs 1,388 crore issue. Sambhv Steel Tubes received Rs 55 crore from mutual funds in a Rs 540 crore offering.

This intense capital deployment notably impacted cash allocations across fund houses. SBI MF reduced its cash levels from 8.6 percent to 8.1 percent, ICICI Prudential MF from 6.9 percent to 6.1 percent, and HDFC MF from 7.6 percent to 7.2 percent. Nippon India MF saw a modest decline from 2.8 percent to 2.6 percent.

Among funds with traditionally higher liquidity cushions, PPFAS MF lowered its cash allocation from 21.6 percent to 19.6 percent. Motilal Oswal MF made a substantial cut from 16.4 percent to 10.1 percent, while Quant MF brought its cash position down from 10.4 percent to 7.2 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.