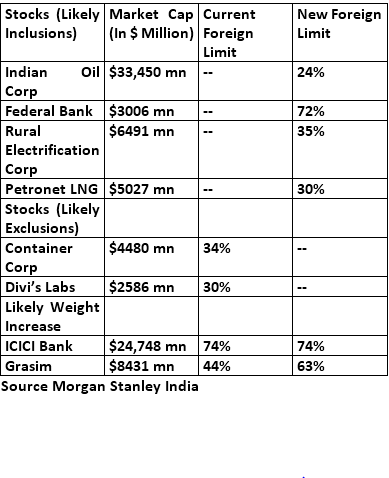

In its semi-annual review of the MSCI India Index, Morgan Stanley’s Ridham Desai expects Indian Oil Corporation, Federal Bank, Rural Electrification Corporation and Petronet LNG to be included in the index, while Container Corporation and Divi’s Labs could be removed.

Other than these four inclusions and two exclusions, the weightage of two companies could go up, which implies higher allocations by funds to these stocks. Morgan Stanley expects the weightage of ICICI Bank and Grasim to be increased on the index. India’s largest private sector bank ICICI Bank is expected to see its weightage go up from 1.2 percent to 2.2 percent on the MSCI India Index, while Aditya Birla Group’s flagship company Grasim could see its weight go up to 1.3 per cent from the existing 0.9 percent.

Index inclusion and weightages are important as foreign investors tend to mimic the index composition while allocating funds to a certain geographies. This makes the MSCI India Index rejig important, as stocks which have been included would see higher allocation from FIIs.

MSCI India Index is designed to measure the performance of large and mid-cap companies of the Indian market. With 76 constituents, the Index represents 85 per cent India’s equity universe.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.