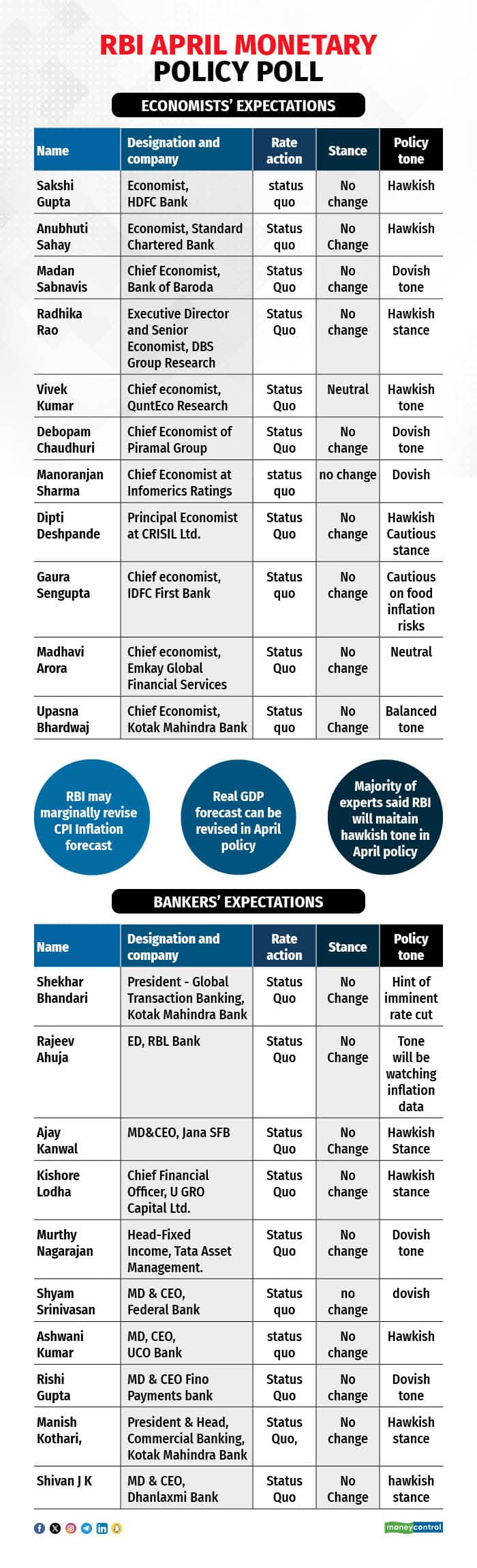

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) is likely to maintain the status quo in the upcoming April monetary policy while remaining cautious on inflation, according to Moneycontrol’s poll of at least 21 economists, bankers and fund managers.

This is because of the moderation in Consumer Price Index (CPI) inflation in February and stable economic activity, said a majority of the economists who participated in the poll. Also, experts pointed out that higher growth in Gross Domestic Product (GDP) gives the central bank room to focus more on lowering inflation.

The majority of experts said that the central bank will maintain its ‘Withdrawal of Accommodation’ stance. However, one economist said it will be changed to neutral.

“The MPC’s language on firm growth—above target inflation dynamics—is unlikely to change materially, suggesting there is limited room to manoeuvre on rates for the time being,” said Radhika Rao, Executive Director and Senior Economist, DBS Group Research.

Adding to this, Murthy Nagarajan, Head-Fixed Income, Tata Asset Management, said the RBI may acknowledge the fall in core inflation and the downside risk to growth from external demand conditions.

The six-member MPC will meet from April 3 to 5 to decide on interest rates.

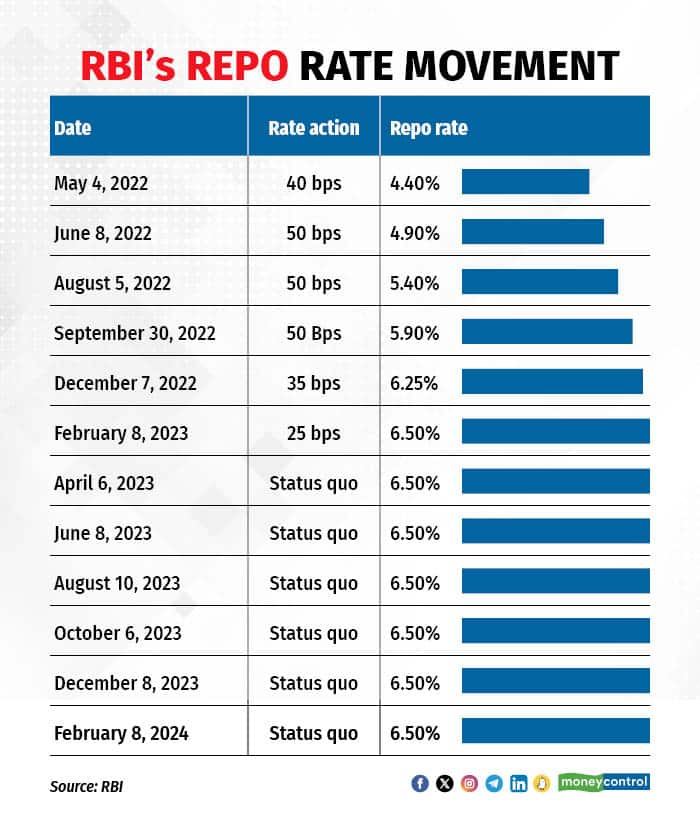

In its February monetary policy, the central bank kept the repo rate unchanged at 6.50 percent for the sixth consecutive time. The RBI has kept the repo rate unchanged since the April 2023 monetary policy. This was after inflation showed signs of moderating.

Earlier, the MPC had steadily raised the repo rate by 250 basis points (bps) starting from May 2022. One basis point is one-hundredth of a percentage point.

Economists and bankers said that the central bank is likely to make minor changes in the inflation forecast due to easing fuel and cooking gas prices.

“Minor changes in the quarterly profile for inflation are likely. Average inflation for FY25 is likely to be maintained at around 4.5 percent,” said Gaura Sengupta, Chief economist, IDFC First Bank.

Further, Dipti Deshpande, Principal Economist at CRISIL, expects headline CPI inflation to continue to soften next fiscal year to 4.5 percent from an estimated 5.5 percent this fiscal, supported by the assumption of a normal monsoon, softer domestic demand, and benign global oil prices.

In February, India's headline retail inflation rate was almost unchanged at 5.09 percent, from 5.10 percent in January.

The inflation print in February was far above the central bank’s medium term target of 4 percent.

According to the RBI's latest forecast, CPI inflation is seen at 5.4 percent for 2023-24 with Q4 at 5 percent.

Assuming a normal monsoon next year, CPI inflation for 2024-25 is projected at 4.5 percent with Q1 at 5.0 percent; Q2 at 4 percent; Q3 at 4.6 percent; and Q4 at 4.7 percent, the RBI said in its February monetary policy.

GDP numbersExperts also believe that the central bank will revise its projection of India's GDP after a surprise increase in the third quarter of the current financial year.

India's GDP grew 8.4 percent in the December quarter.

“GDP numbers have pleasantly surprised everyone. India is the fastest-growing economy among all the large economies, and it is quite likely that we will continue to be so in 2024-25 as well,” said Kishore Lodha, Chief Financial Officer, U GRO Capital Ltd.

Lodha added that this year, GDP will grow north of 7.5 percent and next year, north of 7 percent.

“GDP growth will remain over 7 percent and with private capital and investment coming in, growth will improve further. The new government is expected to take immediate measures to increase jobs and employment,” said Shivan JK, managing director and CEO of Dhanlaxmi Bank.

The statistics ministry now expects full-year GDP growth to be even higher than its unexpectedly high first advance estimate of 7.3 percent. The second advance estimates now peg GDP growth at 7.6 percent for 2023-24 even as economists had expected it to be lowered to 6.9 percent.

At 8.4 percent, the latest quarterly GDP growth rate is the highest in six quarters. The last time India's economy grew at a faster rate was in the first quarter of 2022-23, when it grew by 13.1 percent, on a lower base, a figure now revised down to 12.8 percent.

In its February monetary policy, the central bank has projected real GDP growth in FY25 at 7 percent for the full year, with Q1 growth at 7.2 percent; Q2 at 6.8 percent; Q3 at 7 percent; and Q4 at 6.9 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.