Sachin PalMoneycontrol Research

Visaka Industries reported a decent set of numbers for Q1 FY19. The performance during the quarter was driven by a favourable base led by GST destocking and slight expansion in operating margins.

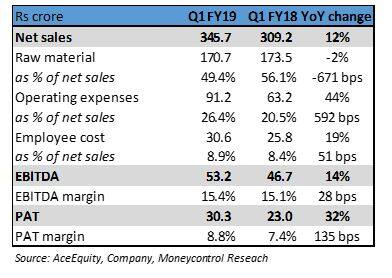

Revenues for the quarter increased by 12 percent year-on-year (YoY) to Rs 346 crores. Operating profit increased from 47 crores in Q1 FY18 to 53 crores in Q1 FY19 representing a growth of 14 percent YoY. Profit after tax came in higher at 30 crores in comparison to 23 crores in same quarter last year as the company received insurance claims during the quarter.

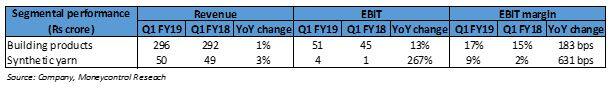

The revenues for building products segment (adjusted for excise duties) grew by 13 percent YoY. The volumes for asbestos cement sheets grew by 8-9 percent during the quarter. The company undertook price hike for asbestos cement sheets which offset the increase in input costs for the segment. For panels and boards, the continuous rise in pulp prices (constituting around 40-45 percent of the raw material costs) might impact the profitability.

The profitability of synthetic yarn segment improved in Q1FY19 as the margins benefitted from higher cotton prices. Going forward, the management expect the yarn division to witness double-digit volume growth in FY19 and expects the margins to improve in a favourable demand environment.

The company is setting up a new board plant with a capacity by 50,000 tons. The same is expected to come on-stream by Q2 FY19. The management expects the new plant to touch full capacity utilisation by FY20.

Outlook and recommendation

The performance of business has been benefitted from the stabilisation in industrial demand post the introduction of Goods and Services Tax (GST) and Real Estate Regulatory Authority (RERA) last year.

The demand in the building materials industry is likely to be boosted by a normal monsoon and a pick-up in rural economy. With a capacity utilisation of around 80 percent, the company has sufficient headroom to capture the growth without incurring any major capital expenditure. The performance of it recently launched roofing product ATUM (integrated solar panel with a cement base) needs to be monitored closely. New products along with recovery in the yarn business should help the company post an earnings per share of Rs 48-50 for this financial year. The stock trades at nearly 10 times FY19 earnings and offers value at current levels as the company has double digit return ratios and trades at a significant discount to other building material players.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.