Anubhav SahuMoneycontrol research

It's still early days, but recent results hint at a good Q3 CY18 earnings season for the S&P 500. So far, micro factors in the US seem quite in sync with the favourable domestic macro data there. However, corporate commentary reflects concern over trade war risks and dollar appreciation.

The minutes of the Federal Open Market Committee (FOMC), released on October 18, also pointed out to trade policies and foreign economic developments as downside risks for the growth forecast. However, it said there is a case for a gradual increase in the policy rate with a section believing rates may have to be raised above the assessed longer-run level in order to reduce the risk of a sustained rise in inflation.

Q3 results: earnings beat higher than the long-term run rate

So far, more than 10 percent of S&P 500 companies mostly from the financials, technology, consumption and industrial sectors have reported earnings. Nearly 69 percent of the companies reported better-than-estimated revenue. This was higher than the long-term average of 60 percent, but lower than the average 73 percent over previous four quarters. On earnings, however, 84 percent companies performed better than expected, way above the long-term average of 64 percent and four-quarter average of 77 percent.

Earnings surprise factor of 4 percent is majorly contributed by financials and communication services. Earnings surprise factor indicates how much of the aggregate earnings is higher than the consensus estimates.

Chart: S&P500 sectoral net profit margins expected higher than medium term average

Source: Factset

The strong earnings are coming despite high consensus expectation.

Consensus earnings growth estimate for S&P 500 companies in Q3 CY18 is 21.9 percent to be aided by a near doubling of earnings from the energy sector and strong traction in the materials and financials sectors.

Financials lead the earnings league table

The earnings of financials' companies were quite positive with some such as Morgan Stanley and Goldman Sachs witnessing higher net interest income and better equity trading income. However, fixed income trading declined. Interestingly, even in a rising rate regime, cost of bad loans declined as in the case of Wells Fargo and Citigroup. That’s a positive state of affairs for the US financials.

Tech stocks, which recently witnessed a sharp correction were buoyed by the stronger-than-expected earnings report from Netflix which added more than expected number of subscribers both internationally and locally. However, IBM result was disappointing on the revenue front even though it notched higher deals on the cloud computing platform.

Semi-conductor companies such as Lam Research Corp. and ASML Holdings also posted good results with ASML, in particular, giving an encouraging forecast for CY 2019. The good results augur well for Asian technology stocks though trade tariff remains a critical factor in demand shift and pricing environment.

Among metals and mining, Alcoa earnings beat estimates. The company raised profit guidance on account of higher aluminium prices (trade tariff impact). Other metal which may see supportive pricing dynamics is copper, on account production guidance cut by Australian major BHP Billiton.

Further health care major, Johnson & Johnson and health insurer United Health positively surprised with their quarterly numbers.

Source: Factset

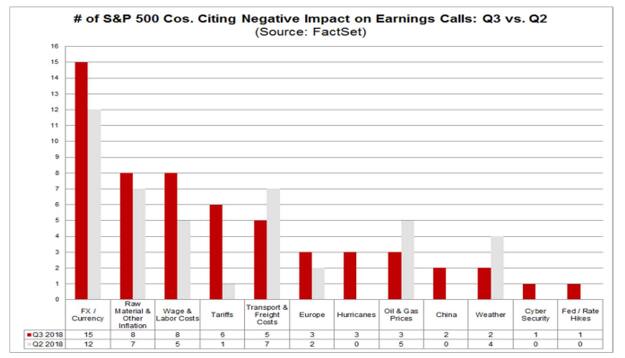

Currency appreciation bigger risk

Majority of the companies that reported earnings so far have cited dollar appreciation as a primary concern compared to trade tariff. However, one should acknowledge that a major chunk of industrials, materials and consumer discretionary companies that tend to be impacted by trade tariffs are yet to report.

FOMC minutes signal a hawkish stance

Steeper interest rate path is another factor which corporates would have to grapple with. The FOMC minutes highlighted market-implied probability for a rate hike in December meeting reaching 75 percent.

Further, FOMC participants have acknowledged considerable uncertainty surrounding estimates of the neutral federal funds rate. It’s noteworthy that neutral rate is an “equilibrium” rate, at which Fed neither stimulates nor restrains economic growth by a change in interest rate policy.

Few FOMC participants expected that policy would need to become modestly restrictive and it may be needed to temporarily raise the federal funds rate above their assessments of its longer-run level in order to reduce the risk of a sustained overshooting of the inflation objective or the risk of significant financial imbalances.

Given this context, FOMC asserts that neutral federal funds rate would be only one among many factors that the Committee would consider in making its policy decisions.

Overall higher earnings beats from the US corporate results brings a timely reality check on the corporate health. It remains to be seen if this momentum continues as the remaining earnings are on the way. What also needs to be monitored is whether the earnings would be able to offset global negative market sentiments magnified by macro factors such as interest rates, oil prices, trade war and emerging market currency depreciation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!