Nitin Agrawal

Moneycontrol Research

Proven track record of delivering strong financial performance, marquee clients in its kitty, strong presence in automotive cable industry with large wallet share from leading OEMs, new product development, no capex in foreseeable future and strong industry tailwinds make Suprajit Engineering Ltd. (SEL) a long-term bet.

The business

SEL is a manufacturer of an array of automotive and non-automotive cables. It has established itself as India’s largest manufacturer of automotive cables with a capacity of over 250 million units. It has also acquired Phoenix Lamps, a dominant player in Indian Automotive lighting industry and Wescon Control, a leading designer and manufacturer of mission-critical mechanical and electronic controls for outdoor power equipment and non-automotive markets. The objective of these acquisitions is to strengthen SEL’s product portfolio and reach.

Group structure

Diversified across businesses – De-risking itself

Following “De-risk and Grow Profitability” mantra, SEL has diversified its business across segments. In 2001-02, SEL was predominantly focused on 2W segment and used to generate around 96.5 percent of the business from the same. Since then it has added customers from PV, CVs and non-automotive segments. Now, it generates 34 percent of the business from 2W and 23/23/20 percent from aftermarket/ non-automotive/ automotive businesses, respectively. Hence, the company has well diversified itself across all segments.

Moreover, the acquired businesses Phoenix Lamps and Wescon Control are expected to de-risk SEL’s product portfolio.

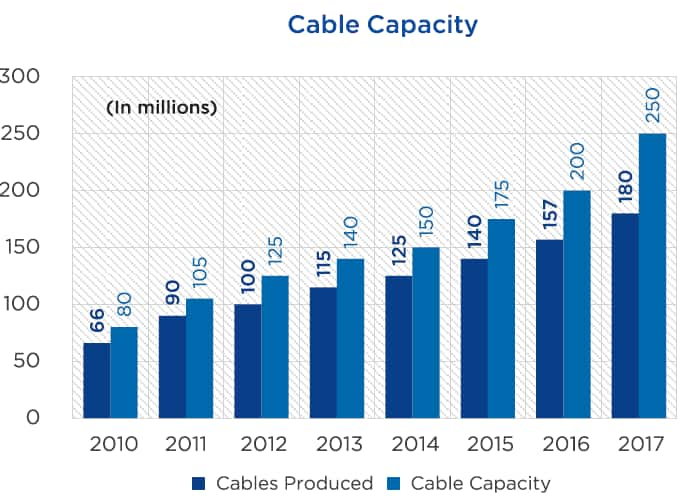

Sufficient capacity available to cater to rising demand

The company has been investing heavily in expanding the capacity. Its cable capacity addition has registered a compounded annual growth (CAGR) of 15.6 over FY11-17 and currently stands at 250 million units. In FY2017, SEL had capacity utilisation of around 72 percent. In terms of Halogen segment, the capacity utilisation level stands at 67.8 per cent out of the total capacity of 180 million units.

At these levels of utilisation, the company is in comfortable position to capture the rising demand without incurring additional capital expenditure. This is also backed by the management as it has guided for capex to be meagre 2 per cent of sales which would lead to cash surplus over long run that could be used to grow the business inorganically or for paying dividends.

Immune to Electric Vehicle (EV) disruption

According to the management, EVs would impact components related to engine pack and SEL does not supply products related to engine. Thus the company appears to be immune to the disruption led by EVs.

Growth triggers:

Strong 2W industry tailwinds

SEL generates around 34 per cent of its business from 2W segment and has more than 50 per cent of wallet share from Hero MotoCorp, a formidable player in 2W industry.

The 2W industry is on upward trajectory as is evident from the stronger volume numbers for last few months. The trend is expected to get some additional support on the back of pick-up in rural economy, especially in an election year. As per Nomura Anchor Report, the India’s 2W industry is expected to show 8% growth compounded over FY18-21F.

New product launch – increasing content per vehicle

As per new braking norms, effective from April 2018, vehicles under 125cc should have combined braking systems (CBS) and vehicles over 125cc should have anti-lock braking systems (ABS). In light of this, SEL has started working on CBS technology and has brought in new technology to start supplying CBS module. This is expected to increase content per vehicle supplied by the company.

Exports to get doubled – new order flowing in

In terms of geographies, SEL generated 40 percent of the business from the globe and the remaining from India in FY2017. SEL has set up dedicated branch in Atlanta, USA to gain market share in North America. Additionally, the management has indicated that the company has received new orders from VW, BMW, Daimler and Ford for the supply of cables and it expects export revenue to double in next 3 years to Rs 2.5 billion annual run-rate.

Aftermarket – GST to augur well

This part of the market is mainly dominated by unorganised players. But the shift from unorganized to organised players is expected to happen post GST implementation and SEL with its superior product quality and competitive pricing would be able to gain traction in the segment.

GST, however, impacted the company’s performance in aftermarket negatively for the first two quarters of this fiscal. From 3QFY2018 onwards, the management believes that the negative impact is largely behind and strong traction is expected in aftermarket.

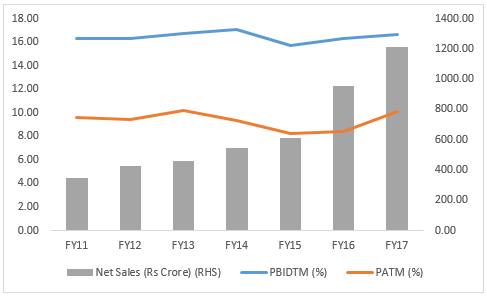

Strong financial performance

Historically, the company posted superior financial performance. Net revenue has posted a growth of 23.2 per cent compounded annually over FY11-17 and EBITDA also mirrored the strong revenue performance showing a CAGR of 23.6 per cent. The company has a very healthy EBITDA margin which averages around 16.5 per cent over the same period. In fact, the company has a very strong profit-after-tax (PAT) margin, averaging 9.3 percent over the same period.

Prudent capital allocation

Prudent capital allocation has led the company to report strong return ratios. SEL has posted average RoE (return on equity) and RoCE (return on capital employed) of 29.4 percent and 29.2 per cent, respectively, over FY11-17. Its debt-to-equity ratio has remained largely stable which averages around 0.71x over the same period.

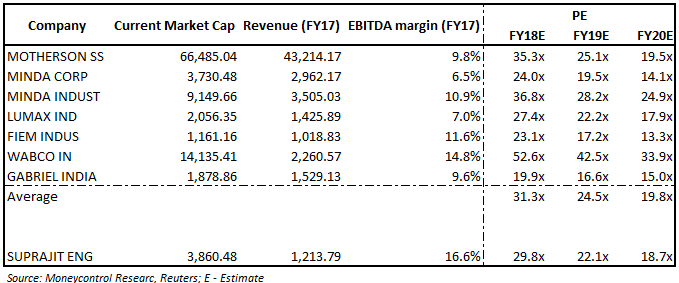

In terms of valuation, the company is trading at 22.1 and 18.7 times FY19 and FY20 projected earnings.

Peer analysisPeer analysis suggests that the SEL is currently trading at a reasonable valuation compared to the average multiple of its peers.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!