Tyre companies posted a healthy set of numbers for the final quarter of FY18 on the back of falling raw material (RM) prices and strong demand from automobile manufacturers. However, RM prices would continue to pose challenge for tyre makers going forward.

Historically, tyre companies were unable to fully pass on the rise in RM prices to customers due to high competitive intensity, resulting in huge margin pressures. During the first two quarters of FY18, the sector bore the brunt of rising RM prices along with disruptions related to Goods & Services Tax (GST) and dismal set of results. However, decline in RM prices since then improved performance of companies in the last two quarters.

While RM price volatility is something that the sector has to contend with, the end market looks exciting and offers secular growth opportunities.

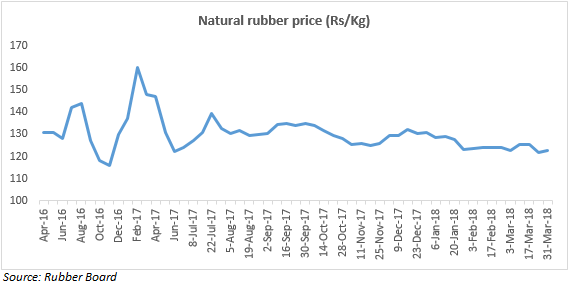

Should investors bet on tyre stocks?RM worries to continueWhile natural rubber prices for the quarter gone by have come off 6.5 percent, rising crude and carbon black (CB) prices, another dominant components of the RM basket, continue to pose a challenge. As per the Automotive Tyre Manufacturers’ Association (ATMA), the demand-supply gap in CB has widened 20 percent in FY18 as compared to 14 percent in FY17, resulting in a huge price rise. As per the All India Rubber Association, CB prices have increased 60 percent in the last six months. Tyre manufacturers too expect pressures from RM prices to continue.

As highlighted in our previous note, GST-led destocking impacted performance of tyre companies in Q2 FY18. However, rollout of GST helped as it deterred Chinese imports. The benefit of which was visible in the results from second quarter onwards. We continue to expect demand to grow going forward.

Anti-dumping duty a big respitePost-implementation of anti-dumping duty in September 2017, Chinese truck bus radial (TBR) tyre imports are down 40 percent on a full year basis. This augured well for players as is evident from the segmental volume growth registered by them.

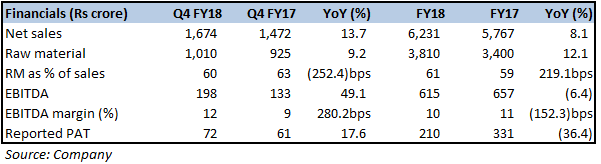

CEAT: Reasonably valuedIn Q4 FY18, the company achieved 13.7 percent year-on-year (YoY) growth in topline on the back of a 11.5 percent YoY volume growth driven primarily by original equipment manufacturers (OEMs) and export market. The company was able to post EBITDA margin expansion of 280bps YoY on the back of a fall in RM prices, although EBITDA margin declined on a full-year basis.

CEAT has been facing capacity constraints in both truck bias and truck radial segments as its plant is operating at full utilisation. To overcome this, new capacity expansion in the TBR segment (200MT/day) is expected to commence production from Q3 FY19. The management expects strong growth in this segment from the new capacity. Additionally, its greenfield plant at Chennai is expected to commence operations from FY20. The management has maintained its FY19 and FY20 capex guidance of Rs 1,500-1,700 crore and Rs 1,000 crore, respectively.

MRF is leader in the Indian tyre space with close to 28 percent revenue market share. The company has built up a strong brand and has a formidable distribution network which helps in cater to a large number of customers.

Being a leader in this space, the company could capture strong growth emerging from the automotive industry. The company posted 15.8 percent YoY growth in net sales backed by a 13 percent YoY growth in volumes. EBITDA margin expanded 209.8bps YoY. On a full-year basis, EBITDA margin declined 418.8bps due to a significant RM pressure in second quarter of FY18.

With the capex cycle coming to an end, the stock is due for a re-rating. Apollo Tyres has invested heavily in the Hungary and Chennai TBR greenfield projects over FY16-18 and is now in the production ramp-up phase.

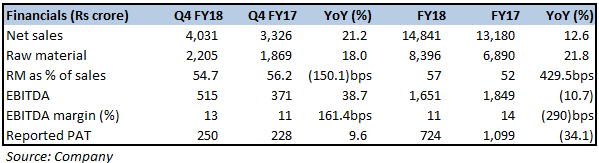

In Q4, its topline increased 21.2 percent (YoY) on a 22 percent and 19 percent YoY growth in the European and domestic businesses, respectively. The latter was driven by volume growth of 17 percent YoY. Appreciation in the Euro also aided performance. On the back of a decline in average RM price per kg, the company achieved a 161.4bps quarter-on-quarter expansion in its EBITDA margin. But on a full-year basis, the latter is down 290bps YoY.

In terms of overseas business performance, the management cited employee costs and higher scrap at its Hungary plant as reasons for the Q4 loss. Its Reifencom business posted negative EBITDA, impacting overall margin of the European business.

On the capacity expansion front, the management indicated that the company has started ramping up production at its Chennai plant to 12,000 tyres per day (TPD) from 10,000 TPD at present. New plant construction in Andhra Pradesh for commercial and passenger vehicles has also started. This is expected to be commissioned in H2 FY20. Hungary plant capacity is expected to be 13,000 TPD by FY19 end from the current 6,500 TPD.

MRF, the leader, deserves premium valuations on the back of its impeccable record and ability to weather headwinds. We advise investors to accumulate the stock on any weakness.

After the recent correction in the CEAT counter, valuations appear reasonable. Also, its capacity expansion plan is expected to drive growth.

Similarly, Apollo Tyres is trading at a reasonable valuation. We advise long-term investors to accumulate these two stocks on any weakness as these may witness some pressure due to a rise in RM prices in the upcoming quarter.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!