Nitin AgrawalMoneycontrol Research

Tyre companies have, historically, been unable to pass on the full rise in the raw material (RM) prices to customers, leading to huge margin pressure. The brunt of the increase in RM prices was seen in the ugly set of first-quarter results. To make matters worse, the rollout of GST led to destocking. Under the circumstances, which tyre stock looks best placed to negotiate the decidedly bumpy terrain?

Raw material prices – a big worry is now easing

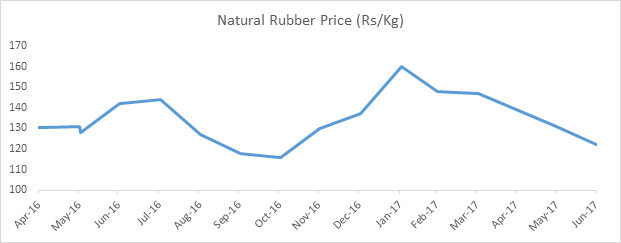

Prices of natural rubber, a key raw material, had been rising until recently, eating into margins for all players. To be specific, from a low in October last year, prices rose nearly 25 percent until March before easing off. The effect of the increase is being seen in this quarter due to companies having used raw material stocked in the January quarter.

Apart from this, crude derivatives also witnessed an uptick. Overall, raw material prices rose 16-18 percent. Due to competition, the companies could effect a price increase of only 5-6 percent. Things are, however, getting better, with the prices of natural rubber abating and crude moving in a range.

GST-led destocking

GST-led destocking impacted tyre companies’ performance in the quarter. It led to a decline in volumes, leading in turn to operating deleverage, impacting the margins. However, GST augurs well for the tyre companies as it would deter Chinese imports. This is because there will be fewer chances of evading indirect taxes, leading to increasing prices of imported products, thereby reducing the price advantage that the Chinese companies enjoy.

Hope for anti-dumping duty: A big respite

The tyre industry has been demanding this for long now and has put forward the proposal. If the proposal gets through then the anti-dumping duty of close to 10-15 percent would be implemented and that would give a big respite to the industry.

CEAT: A short-term blip but still high on valuations

CEAT has 12 percent revenue market share in India and is the fourth largest player. Over the years, it has become a strong domestic player on the back of its efforts to expand distribution network (4,500+ dealers) and increase in brand building activities. CEAT’s strategy is focused on high-margin consumer-oriented segments such as passenger vehicle and two-wheeler segments. It is now moving towards off-highway tyres, which is also a very high-margin category.

From the first quarter result perspective, the company’s top line witnessed a decline of 1.1 percent (y-o-y). The decline is attributed to 5 percent decline in the volume across all segments due to GST-led destocking, headwinds faced by foreign countries, and lower offtake across CVs on the back of BS-IV implementation.

EBITDA margin declined by 790bps (y-o-y) to 3.4 percent on the back of rising raw material prices, which witnessed, as a percentage of gross sales, an increase of 11.38 percentage points. However, the management expects the RM prices to soften from the second quarter.

MRF – hit by RM prices but deserves premium

MRF is the leader in the Indian tyre market with close to 28 percent market share in terms of revenue. The company has built a huge brand over the years and has a huge distribution network which helps it cater to a large number of customers.

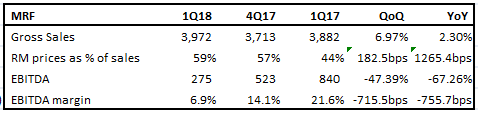

While MRF could save itself a little from de-stocking, it could not spare itself from rising RM prices. Topline grew marginally by 2.3 percent (y-o-y), whereas others posted a decline in the same. RM as a percentage of gross sales grew by 12.6 percentage points, leading to erosion of EBITDA margin from 21.6 percent a year ago to 6.9 percent.

Apollo Tyres – Due for a re-rating

With the capex cycle coming to an end, the company is due for re-rating relative to its peers. Apollo Tyres has invested heavily into the Hungary and Chennai TBR green field projects over FY16-18 and is now in the production ramp0up phase.

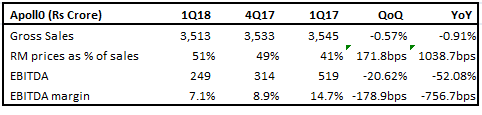

The company witnessed a marginal decline in top line on the back of fall in volume attributed to GST-led destocking. Apollo Tyres’ EBITDA margin was also hit badly by the increase in the RM prices and fell by 756bps (y-o-y) to 7.1 percent.

The management indicated that the gradual ramp-up in new additional capacity, higher depreciation, and finance cost would be a drag to the company’s performance over FY18. However, the management is confident that the earnings will pick up once the ramp-up period is over.

Valuations – Apollo at steep discount

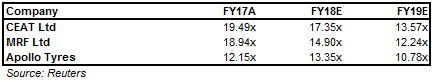

CEAT is currently trading at 19.49 times trailing earnings which seem quite expensive. In fact, forward valuations seem expensive for CEAT. We have comfort on CEAT’s strategy and business but the valuation leaves us cold.

MRF, the leader, deserves premium valuations on the back of its impeccable record and ability to weather headwinds. On the forward basis, it is trading at a reasonable valuation of 14.90 and 12.24 times FY18 and FY19 projected earnings. We would advise investors to accumulate the stock on any weakness.

Apollo Tyres is trading at a steep valuation discount compared to MRF and CEAT. On the forward basis, the company is trading at 13.35 and 10.78 times FY18 and FY19 projected earnings. With valuation and growth prospects in mind, we advise investors to go long in a staggered manner on the stock as the pressure from Hungarian plant would be there in FY18.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.