Madhuchanda DeyMoneycontrol Research

South Indian Bank’s (SIB) (CMP: Rs 32.90, M Cap: Rs 5,941 crore) December quarter profit growth was muted, as the erosion in bond prices all but wiped off treasury income. Core performance, however, was in line with expectations. Growth resumed, asset quality was stable and the bank is raising capital in anticipation of better days ahead. And finally, valuations appear reasonable.

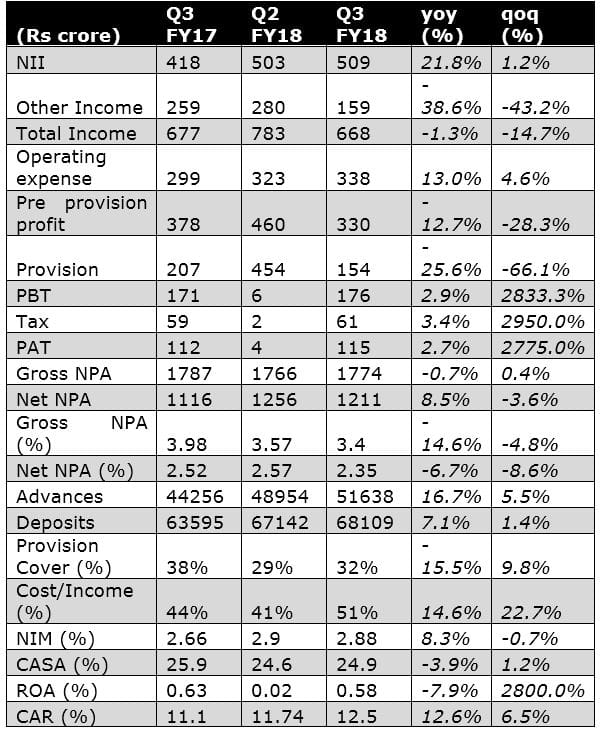

Quarter at a glance

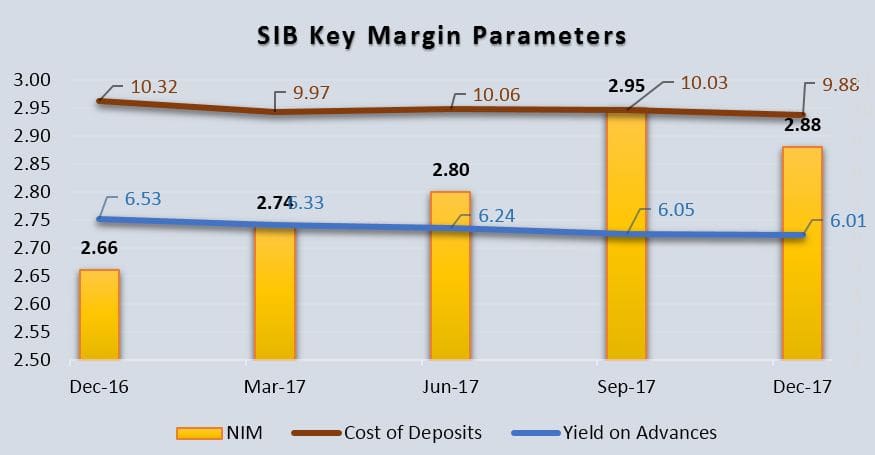

Net interest income (the difference between interest income and expenses) grew 21.8 percent aided by a 16.7 percent growth in loans and year-on-year improvement in net interest margin (up 22 basis points at 2.88 percent). While non-interest income (excluding treasury) grew 21 percent, treasury gains plunged from Rs 127 crore to Rs 11 crore, resulting in a decline in pre-provision profit. The uptick in cost to income ratio is on account of incremental wage provision and a decline in treasury gains.

Asset book getting diversified and granular – The loan growth of 16.7 percent was aided by 25 percent growth in retail, agriculture and SME (small and medium enterprises). On the positive side, the loan book is diversified and the bank has 0.9 percent share in incremental credit market.

CASA remains the need of the hour - While overall deposits grew 7 percent, NRI (non-resident Indian) deposits grew over 12 percent and constituted 27 percent of total deposits. The relatively muted (3 percent) growth in CASA (low cost current and savings account) resulted in marginal sequential improvement in CASA ratio. This is an area which would warrant greater attention as it would have a bearing on stability of interest margin.

Slippages well-contained - During the quarter, Rs 150 crore slippage was on account of a non-fund facility from the pharmaceutical sector that was recognised as NPA (non-performing asset) and has been fully provided for. The bank has close to Rs 248 crore as standard restructured account (two annuity based road project) and expect slippage to normalize to a quarterly run rate of Rs 100 crore.

In the outstanding corporate book, close to 74 percent is in the investment grade.

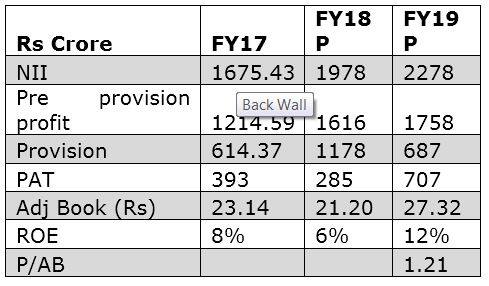

Provision to normalize in FY19 - The bank intends to step up the provision cover from the existing 32 percent (without technical write off) in FY19 and expects provision to normalize in FY19 once the additional provision for NCLT (national company law tribunal) referred cases are done in the fourth quarter of FY18.

Raising growth capital - The bank intends raising capital (could be upwards of Rs 600 crore) by issuing 20 crore shares. This would augment the capital base and prepare it for the growth journey ahead. The management expects advances to grow by at least 20 percent in the coming two years.

We feel, the worst for SIB may be behind and the additional capital should support a better quality of growth ahead. The valuation at 1.2x adjusted book, therefore, definitely beckons attention.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!