Nitin Agrawal

Moneycontrol Research

The recent volatility in the market is providing many opportunities to invest in quality businesses at reasonable prices. One such business is Minda Corp (Minda). We had initiated the coverage on it and find the current level attractive for long-term investors.

Minda Corp posted an excellent Q1 FY19 performance, led by strong growth in revenue and operating profit margin. The company has marquee clients, a strong focus on research and development, and a robust order book. Also, the recent correction in its stock price has left it an attractive valuation.

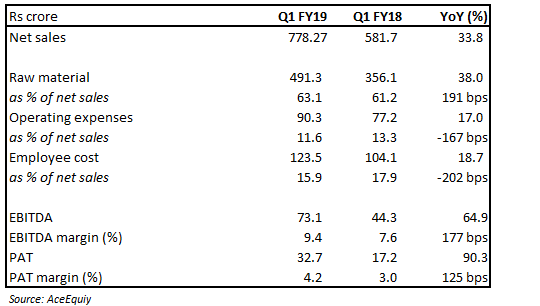

Quarter snapshot

In Q1 FY19, the company posted a 33.8 percent year-on-year (YoY) jump in its net revenue on the back of additional income from greenfield projects in Mexico and Pune, which are now operational, and growth across business verticals.

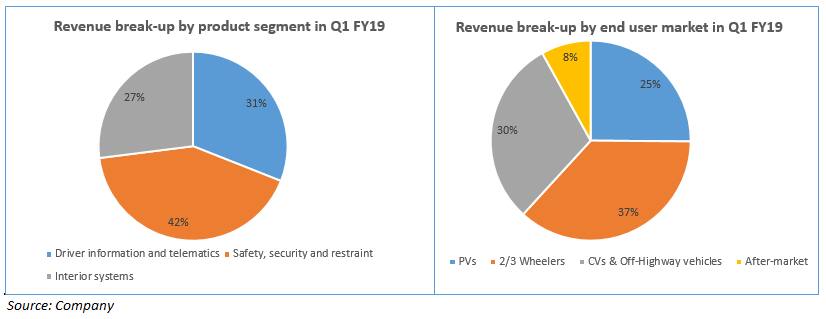

The highest growth (42 percent YoY) was seen in the interior system segment, led by the KTSN plant in Mexico. Other segments such as safety and security systems and driver information grew by 30 percent, and 32 percent, respectively.

In terms of operating profitability, despite the significant rise in raw material (RM) prices, the company posted a YoY expansion of 177 bps in its earnings before interest, tax, depreciation and amortisation (EBITDA) margin.

The margin expansion was predominantly due to a rich product mix, ramping up of greenfield projects and higher operating leverage. Its profit after tax (PAT) also grew by 90.3 percent on year and its PAT margin expanded 125 bps.

We continue to like the company for the following reasons:

Focus on export

The Ashok Minda Group has around 30 customers in more than 20 countries. The group continues to capitalize on its global footprint and has many initiatives underway to increase the share of exports in its overall business.

Minda Corp has secured business from a leading German tier-1 company for the supply of compressor housing, and from a German auto maker for the supply of seat latches. It has also made inroads in the European EV (electric vehicle) segment and has secured business from a Dutch EV company.

Strong order book

Minda Corp has a strong order book of around Rs 4,200 crore, which provides decent earnings visibility. During Q1 FY19, the company had received orders worth Rs 1,100 crore (lifetime value) across its domestic and export businesses.

Diversified across segments

The company has a well-diversified presence across business segments and products. This helps it de-risk itself from product or client concentration.

Focus on Research and Development (R&D) – results are visible

To develop technologically advanced products, Minda Corp has established a technical centre called the Spark Minda Technical Centre (SMIT) at Pune. The fruits of the exercise are visible now.

The company has secured orders for smart keys from Piaggio and Hero MotoCorp, and an order for both smart keys and locks from Honda Motorcycle & Scooters India (HMSI).

BS-VI implementation – growth trigger

The upcoming implementation of BS-VI norms is expected to augur well for Minda Corp as it is expected to increase content per vehicle. And the company is well placed to take advantage of this.

In fact, it has received new orders to supply BS-VI compliant instrument clusters and EFI wiring to a two-wheeler original equipment manufacturer (OEM) with a peak annual value of Rs 25 crore and Rs 30 crore, respectively.

The company has also secured business from a Japanese manufacturer for the supply of die-casted parts for its fuel injection pump in accordance with BS-VI requirements.

Acquisition of EI Labs – another pointer towards the focus on R&D

Minda Corp had acquired EI Labs for an enterprise value of Rs 6.5 crore, underscoring its focus on R&D and EVs. Apart from getting a prestigious order from EESL to supply mobility components for EVs in Q2 FY18, it also received an order from a Dutch EV manufacturer.

Enough resources for acquisition

Minda Corp has raised Rs 310 crore through a qualified institutional placement (QIP) of shares. The objective of this capital raising exercise is to go for acquisitions to further the company's growth. It may also use the amount raised to reduce some debt, and to manage working capital.

Significant expansion

Minda Corp has significant expansion plans for the future. It has set up a third die-casting plant in Pune, which has already started contributing to its revenue. The company has a total production capacity of 4,600 million tonne (MT) per year and aims to increase it to 9,600 MT per year by FY20.

Attractive valuation

Amid volatility in the overall market, Minda Corp's stock price has corrected 45 percent from its 52-week high, making it quite attractively valued. It is now trading at 16.6 and 13.6 times its projected earnings for FY19 and FY20, respectively.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!