Nitin Agrawal

Moneycontrol Research

Highlights:

- Robust volume growth led by domestic and export demand

- Operating profitability improved due to operating leverage

- Near-term outlook for domestic CV demand is weak

- Stock trades at a reasonable valuation

--------------------------------------------------

Despite weak demand in domestic and export markets, especially Class 8 trucks (15 tonne and above) in North America, Ramkrishna Forgings (RMKF) has posted a strong set of earnings. The company witnessed strong growth in net revenue and operating profit. Operating margin expanded due to benefits of operating leverage.

New plant and products, increase in content per vehicle, customer additions, increase in market share, strong financials and a reasonable valuation make the stock worthy of attention.

Quarter in a nutshell

Key highlights

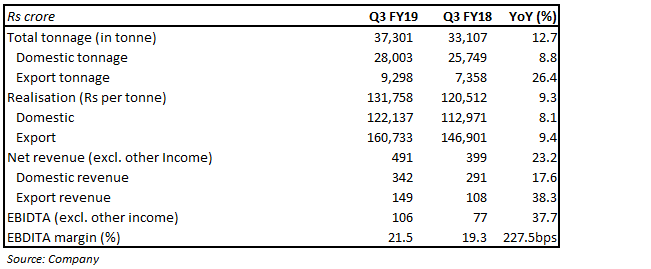

Volumes grew 12.7 percent year-on-year (YoY), driven by an 8.8 percent and 26.4 percent growth in domestic volumes and export tonnage, respectively. Despite weakness in the domestic market, volumes remain resilient due to increase in wallet share with its customers and content per vehicle. Growth in the export market came from both North America Class 8 trucks demand and new customer additions in Europe.

Continuous enrichment of the product mix, with leading original equipment manufacturers (OEM), led to an 8.1 percent and 9.4 percent rise in domestic and export realisations, respectively.

On the back of growth in volume and realisation, net operating revenue grew 23.2 percent in the quarter gone by.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin expanded 227.5 basis points (100 bps = 1 percentage point), led by favourable product mix and operating leverage, leading to a decline in operating and employee expenses.

Outlook

Industry outlook – weak in the near term

Over the last couple of months, the domestic market has been facing challenges on the back of weakening macro-economic environment, leading to muted sentiment for the automobile sector, including the commercial vehicle (CV) segment.

Subdued market sentiment is on account of liquidity problems, financing issues, rising interest rates and slowdown in economic activity. This was further aggravated by the lag impact of new axle load norms.

We expect demand to remain weak in the short term, but long-term growth outlook remains promising on the back of economic growth, rising income levels, lower penetration, government’s thrust on increasing rural income and focus towards infrastructure and construction.

A near-term growth driver for the company is the upcoming Bharat Stage-VI emission norms to be implemented from April 2020. This is expected to lead to pre-buying as new BS-VI compliant vehicles would be more expensive than current vehicles. Additionally, the government’s scrappage policy would potentially lead to replacement of 2-3 lakh trucks that are over 20 years old. This should bode well for the company.

Slowdown in demand for Class 8 trucks in North America

There has been a significant slowdown in Class 8 truck demand in North America over the last 2-3 months. The management, however, highlighted that the decline in demand was on the back of order cancellation from OEMs as they are running at full capacity and expects no slowdown in CY19.

Robust new product line-up

RMKF develops over 150 new products per year as is evident from its track record over the last five years. This has helped in increasing content per vehicle and increase in share from key OEMs. The management indicated it would continue to focus on developing new products.

New plant: A huge opportunity

In order to de-risk itself from the CV segment, the company has started focusing on passenger and light vehicles, bearings industry and railways. In light of this, the management, in Q2 FY19, had announced a capex of Rs 483 crore to set-up a 50,000 million tonne per annum (MTPA) capacity over the next two years starting Q1 FY20.

The company sees revenue contribution of Rs 200-250 crore in FY20 and Rs 550-600 crore in FY21 from this new capacity at a utilisation of 60 percent.

In its Q3 FY19 conference call, the management said in light of weak market conditions, the final call on postponing capex would be taken during Q4.

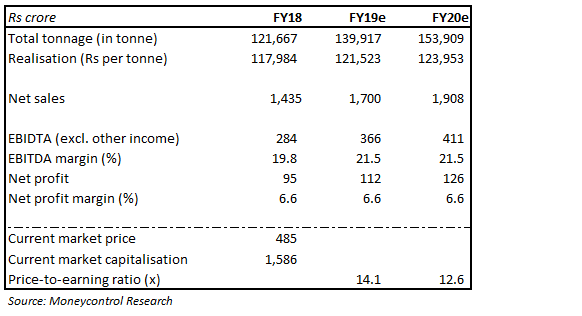

Valuations at reasonable levelsDue to overall weakness in the market and slowdown in demand, the stock has corrected 43 percent from its 52-week high. At the current market price, it trades at 14.1 times FY19 and 12.6 times FY20 estimated earnings, respectively, which is reasonable. We advise investors to buy this stock for the long term.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!